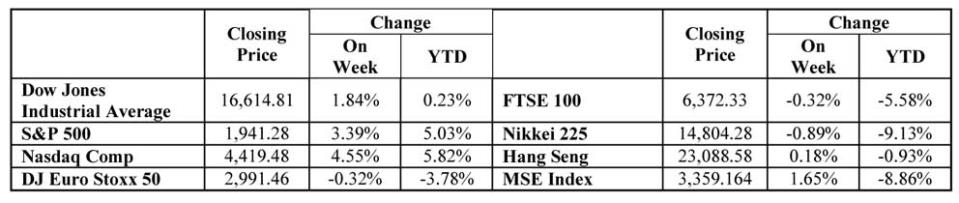

Equity Indices

U.S. stocks rallied on Tuesday, with the S&P 500 notching a fourth straight session of gains boosted by strong corporate results, including Apple's. The S&P 500 posted its biggest daily percentage gain since 10 October 2013 whilst the Nasdaq registered the biggest percentage increase since 2 January 2013, thanks to better-than-expected results from several major tech companies.

Interest Rates

Benchmark Bond Yields

The European Central Bank is considering buying corporate bonds on the secondary market and may decide on the matter as soon as December with a view to begin purchases early next year. The ECB has already carried out work on corporate bond buying, which would widen out the private-sector asset-buying programme it began on Monday. It is hoping these measures will foster lending to businesses and thereby support the euro zone economy.

U.S. consumer sentiment rose in October to the highest in more than seven years, boosted by views on personal finances and the national economy. The survey's gauge of consumer expectations also rose to hit 78.4, the highest since October 2012, from 75.4 and beating a forecast for 74.4. The survey's barometer of current economic conditions was unchanged at 98.9 and also beat its forecast of 98.0.

China grew at its slowest pace since the global financial crisis in the September quarter and risks missing its official target for the first time in 15 years, adding to concerns the world's second-largest economy is becoming a drag on global growth. Official data showed China's gross domestic product (GDP) grew 7.3 percent in the third quarter from a year earlier, the weakest rate since the first quarter of 2009.

Japan's government cut its overall economic assessment for the second straight month as weak consumption after a sales tax hike in April is causing companies to reduce production. The government also cut its view on industrial output for the first time in five months as companies produced fewer goods and as inventories piled up due to weak demand. The BOJ is preparing to roughly halve its 1 percent economic growth forecast for this fiscal year at a meeting on 31 October but stand by its prediction that inflation will hit its 2 percent target in the year that begins April 2015.

Forex

Sterling hit its highest in over a week against the euro and most emerging Asian currencies edged up after sources said the European Central Bank was considering buying corporate bonds, pumping more euros into the financial system. Sources said the purchases, which would be the latest in a string of measures designed to boost the flailing euro zone economy, could start early next year.