Equity Indices

UK stocks fell as at Tuesday, snapping an eight-day winning streak after having rallied over 7 percent in the past week to close at the highest level since the beginning of September. Japanese stocks rose over the week on expectations of strong corporate earnings and a weaker yen which boosted investor sentiment. Stocks in the US ended the week lower following disappointing results from a number of large companies which pointed to weakening conditions, while an unexpected decline in durable goods orders also weighed on sentiment.

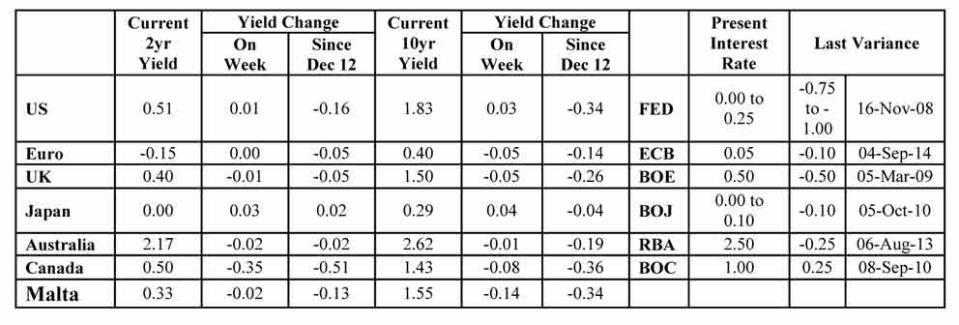

Interest Rates

Benchmark Bond Yields

The Treasury on Tuesday accepted 1 million 28-day Treasury bills at an average yield of 0.02% and 9 million 90-day Treasury bills at an average yield of 0.037% . Outstanding Treasury Bills now amount to Euro 208,540,000 - an increase of Euro 10 million from the previous week.

This week elections in Greece saw the anti-bailout Syriza party elected, falling just short of an overall majority. Leader Alexis Tsipras said that the country left behind catastrophic austerity and five years of humiliation and suffering. He went on to add that he would cooperate with fellow euro zone leaders to find a fair and mutually beneficial solution but stressed the Greek people were his priority. This result paves the way for the first euro zone government committed to overturning the austerity measures implemented as part of the EU and IMF bailout.

In the US durable goods orders tumbled by 3.4% month-on-month in December, dragged lower by a sharp fall in demand for commercial aircraft and following a 2.1% decline in the previous month. Orders for goods excluding non-defence goods, a closely watched proxy for business spending plans, fell by 0.6% month-on-month following a similar decline in the previous month. Analysts anticipate this slowdown in capital expenditure will hamper growth in the coming months. On the other hand, US consumer confidence strengthened to the highest level in seven years, boosted by optimism regarding the labour market.

UK retail sales exceeded expectations in December as falling prices lured shoppers. Retail sales volumes (excluding fuel) rose by 0.2% month-on-month in December, far exceeding the 0.7% decline expected as a hang-over from the Black Friday discounts in November. This resulted in year-on-year sales growth of 4.2%. Prices, including fuel, fell by 2.2% year-on-year, the steepest annual decline since June 2002 and no doubt helped boost sales volumes.

In the euro zone, German business sentiment rose for the third consecutive month as the Ifo business climate index increased by 1.2pts to 106.7 in January, the highest level since July 2014. The main driver was the current business climate component which rose 1.9pts to 111.7, while the business expectations component rose by 0.7pts to 102.0, lifted by the weaker euro and continued lower oil prices. This release, together with the stronger ZEW and PMI surveys, point to a favourable start to the year for the German economy.

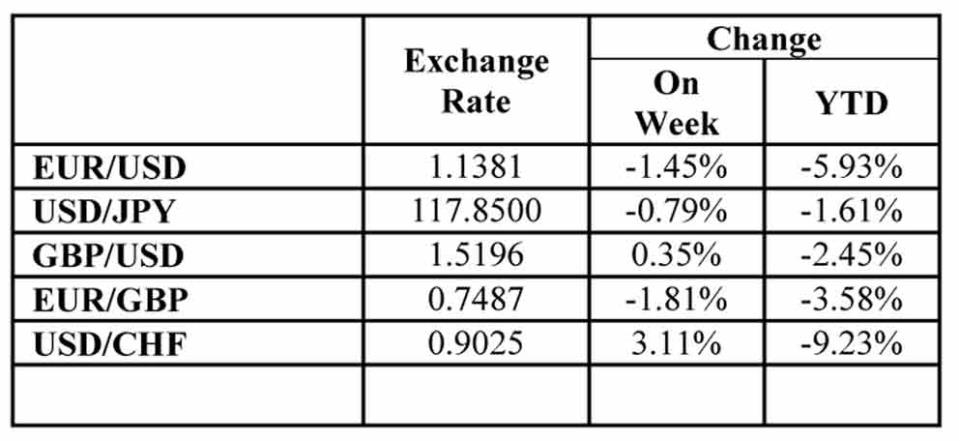

Forex

US dollar retreated from an 11-year high against a basket of currencies following disappointing earnings and soft spending data. Investors are looking ahead to a meeting of the US Federal Reserve Bank this week which could give future guidance on future rate rises. The Swiss franc fell past low levels seen when the Swiss authorities removed a cap against the euro earlier in the month. Speculation was rife that the Swiss National Bank was intervening to weaken the currency after the bank's vice-chairman said in an interview the bank was ready to intervene in the foreign currency market to ease monetary policy after the turmoil following its removal of the cap of 15 January.

HSBC Bank Malta p.l.c. has based this document on information obtained from sources it believes to be reliable but which it has not independently verified and is for your personal, non-commercial use only. The contents do not constitute a solicitation of the purchase or sale of any investment. Although HSBC makes every reasonable effort to do so, it makes no representations that the information presented is accurate, complete or timely. Expressions of opinion herein are subject to change without notice. Accordingly, HSBC shall not be liable for any decisions made or actions taken in reliance on such information. Past performance is not necessarily a guide to future performance and the value of investments may go down as well as up. Issued by HSBC Bank Malta p.l.c., which is regulated by the Malta Financial Services Authority.