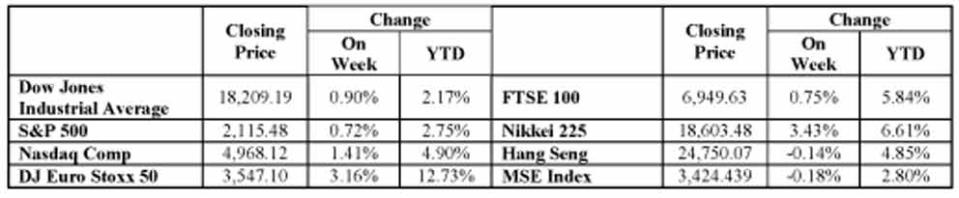

Equity Indices

The Dow Jones and S&P 500 hit records high while the Nasdaq also ended the week higher following the US Federal Reserve's Chair Janet Yellen's testimony which fuelled expectations that the Bank will not hurry to raise interest rates. The UK's FTSE100 hit a new record high of 6954.79 this week, surpassing the previous life-time high set at the end of 1999. Japan's Nikkei also rose, hitting a 15-year high.

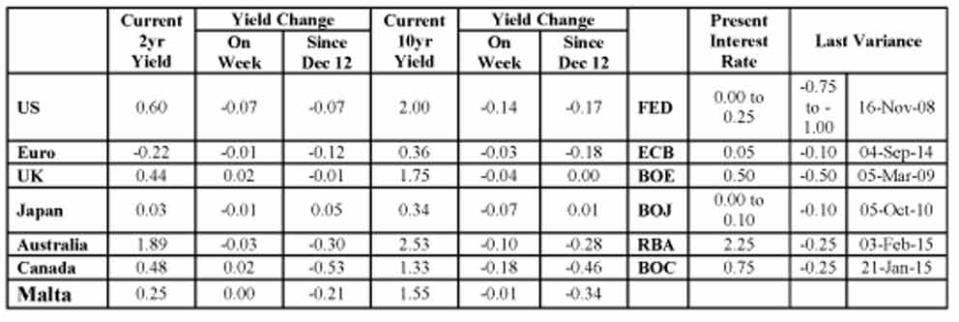

Interest Rates

Benchmark Bond Yields

The Treasury on Tuesday accepted 0.5 million in 91-day Treasury bills at an average yield of 0.020% and 6 million in 182-day Treasury bills at an average yield of 0.030%. Outstanding Treasury Bills now amount to Euro 210,440,000 - an increase of Euro 0.5 million from the previous week.

The Eurogroup met for the third time in ten days and saw Greece agree with other eurozone finance ministers on a four-month extension of its bailout. Greece submitted a list of economic reform plans to European institutions and the International Monetary Fund. The euro zone partners approved the reform plan which promises to stop privatisations, boost welfare spending and raise the minimum wage. Greek Prime Minister Alexis Tsipras is trying to balance satisfying the demands of creditors with meeting his pre-election pledges. Together with his government he wants to clamp down on tax evasion, corruption and inefficiency in order to fund social spending and alleviate what is being called Greece's "humanitarian crisis".

US home re-sales fell to the lowest level in nine months in January as potential buyers were deterred by a shortage of properties on the market. The National Association of Realtors reported existing homes sales fell by 4.9% to an annual rate of 4.82 million. Prices were kept higher due to lower levels of properties listed for sale, preventing many first-time buyers from entering the market.

In the UK, supermarkets and department stores reported much lower sales volumes as retailers cut orders with suppliers at the fastest pace since May 2013. In addition retailers reported they expected to reduce staff numbers at the fastest pace in more than five years. Expectation for sales next month also fell sharply, despite the boost to household incomes from falling inflation.

China's factory sector edged up to a four-month high in February but export orders shrank at their fastest rate in 20 months, according to the flash HSBC/Markit Purchasing Managers' Index. This registered the 50.1 mark in February, just above the 50-point level that separates growth in activity from a contraction on a monthly basis. Factory activity grew, albeit marginally, but manufacturers still face considerable risks from weak foreign demand and deepening deflationary pressures. Input and output prices also fell, though not as sharply as they did in January, the trend points to further pressure on companies' profitability. Employment in factories shrank for the 16th straight month as firms dismissed workers to adjust to slower business.

In her semi-annual testimony to the Senate Banking Committee, Federal Reserve Chair, Janet Yellen, indicated that monetary policy is likely to remain accommodative for some time. The current guidance that the FOMC can be patient in beginning to raise the federal funds rate means that it is unlikely that the FOMC will raise rates for at least the next two meetings. At some point, Ms. Yellen said, the FOMC will start to consider raising the federal funds rate on a "meeting-by-meeting basis." But before then, the Committee will first change its forward guidance.

Forex

Expectations that the US Federal Reserve will not hurry to raise interest rates coupled with a high in British stocks, caused sterling to rebound against the US dollar. The euro rose, hitting a high of 1.1358, helped by the euro zone's approval of Greece's reform plan, a requirement for Athens to receive a four-month loan extension

HSBC Bank Malta p.l.c. has based this document on information obtained from sources it believes to be reliable but which it has not independently verified and is for your personal, non-commercial use only. The contents do not constitute a solicitation of the purchase or sale of any investment. Although HSBC makes every reasonable effort to do so, it makes no representations that the information presented is accurate, complete or timely. Expressions of opinion herein are subject to change without notice. Accordingly, HSBC shall not be liable for any decisions made or actions taken in reliance on such information. Past performance is not necessarily a guide to future performance and the value of investments may go down as well as up. Issued by HSBC Bank Malta p.l.c., which is regulated by the Malta Financial Services Authori