A battle has been raging for the past year in the EU, one that seeks to make multi-billion multinational corporations pay taxes in the countries where they are earning their profits, and stop them from legally avoiding millions in tax each year.

Malta is in an awkward position in this battle. Being a small economy with limited resources, policy makers had to play on the islands’ strengths and many services-based industries began to flourish. Preferential tax rates and other financial incentives have been provided to cross-border corporations for years – Malta offers them preferential tax rates, better ones than the country where most of the financial activity and profits are being made.

As a result, these multi-billion dollar companies open luxurious offices in Malta and channel profits to the island, paying a fraction of the taxes of what they would, some argue should, be paying elsewhere. This represents a large sum of taxation revenue for the Maltese government.

Big multinational corporations such as BMW, Lufthansa and Volkswagen all have offices here; it’s a win-win situation.

Promoting fairness

This seems like a good situation for both Malta and the multinationals; however various MEPs, members from civil society, SMEs and stakeholders have questioned the fairness of such practices.

This is especially true when you consider that SMEs do not have access to such cost-cutting strategies, since they do not have the resources or the growth to operate across borders, therefore essentially paying a proportionately higher tax rate than a multibillion cross-border company.

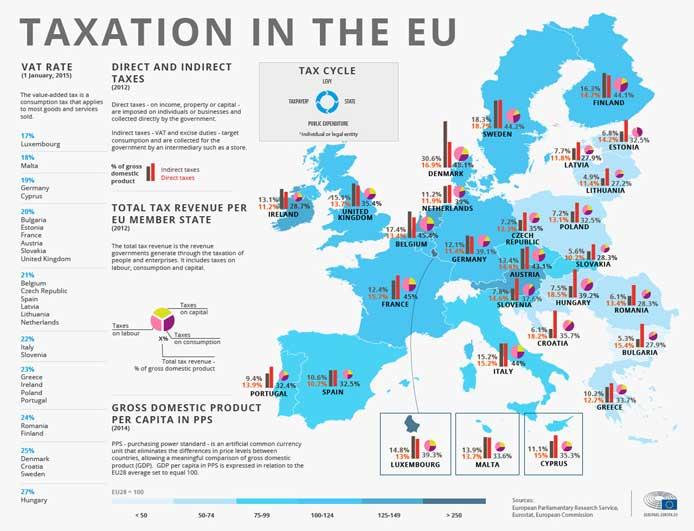

Austerity – another reason why secret preferential tax deals are so especially hard to accept. Many economically turbulent countries in the EU such as Greece and Spain have had austerity measures pushed down their throats, meaning cuts in social benefits and public investment. Citizens are suffering while the EU is allowing some member states to siphon off millions in government revenue.

On the other hand, cross-border countries such as Apple and Microsoft, instead of paying taxes in Ireland might choose to pay their taxes in the United States without preferential tax rates, so one could argue that it works both ways.

The assertion is not that these companies would be paying taxes in the economically turbulent countries, but that millions and possibly billions are being lost in the EU at a time when the euro is losing its value and the economy is stalling.

European Parliament

A resolution drafted by MEP Elisa Ferreira (S&D, PT) and MEP Michael Theurer (ALDEDE) was approved in the European Parliament last Wednesday. The resolution contains measures on how to make corporate taxes fairer across Europe.

MEPs called for member states to “agree on mandatory country-by-country reporting by multinationals of profits and taxes, a common consolidated corporate tax base (CCCTB), common definitions for tax terms and more transparency and accountability with regard to their national tax rulings for companies”. a press release issued by the EP said.

All six Maltese MEPs voted against the resolution and the findings of the report published by the Parliament’s Special Committee on Tax Rulings relating to a common tax base. All six also rebelled against their respective European political party, by voting against the resolution. The fact that all Maltese MEPs voted together on the matter and against their party lines begs the question what Malta stands to lose from a common tax base. The majority of other MEPs voted in favour of both the report and the recommendations.

What is the Common Consolidated Tax Base?

The CCCTB, originally proposed in 2011 by the European Commission, offers a single set of criteria that multinational companies could use to calculate their taxable profits. It allows for multinationals to file a single tax return for all their activities within the EU through one central authority. As it stands, multinationals must file tax returns for every country in which they operate, which adds to administrative burden, compliance costs and legal uncertainties.

The consolidation element of CCCTB allows multinationals to offset losses in one member state against profits in another. It would also eliminate the need for complex transfer pricing within the multinational. Transfer pricing is a way in which cross-border companies can allocate more of the international profits to a country in which they operate with lower tax rates, resulting in the company reducing the overall taxes to be paid. Part of the scope for CCCTB is to re-establish the link between where a company earns profits and where it is paying taxes, with the hope of recuperating the millions lost in taxation revenue through such schemes.

This is where it starts to get clear why Malta is against CCCTB. Multinational companies tend to make big profits in larger member states but choose to base themselves on the island, filling Malta’s coffers because of our lower tax rates, as opposed to the larger country.

“Transfer prices are significant for both taxpayers and tax administrations because they determine in large part the income and expenses, and therefore the taxable profits, of associated enterprises [multinational companies] in different tax jurisdictions,” a publication of the Organisation for Economic Co-operation and Development said.

The main focus of the version that has been re-launched is to eliminate many of the weaknesses in country-by-country corporate taxation which allows for tax avoidance and aggressive tax planning, and provides for increased transparency in the area.

A common tax base means that multinationals must adhere to the same rules for calculating taxable profits in whichever EU country they are operating. The way in which multinationals can exploit differing national corporate tax systems is through loopholes and mismatches found in each national system.

The Commission believes it can make a strong contribution to economic growth, competitiveness and fairness in the Single Market. During the debate at the EP on Wednesday, a number of MEPs argued in favour of the report, inclusive of the CCCTB measure by saying that the internal market is incomplete without a consolidated tax base.

Eight countries – Ireland, Britain, The Netherlands, Bulgaria, Sweden, Poland, Malta and Romania – had come out against the CCCTB when it was originally proposed in 2011. Malta has not changed its position since then, advocating tax transparency and fighting tax avoidance it is firmly against the re-launch of the CCCTB.

The revelations brought about by the LuxLeaks scandal sparked a debate on the fairness of preferential tax rates being agreed on between EU member states and multinational corporations last year, which was the catalyst for the re-launch of the CCCTB.

What else are the MEPs pushing for?

“MEPs believe that multinational companies should pay their taxes where they make their profits. They feel that today’s corporate tax competition – prompting aggressive tax planning and evasion, without any agreed framework – is harmful. Apart from the loss of public income, they consider it unfair that big companies pay hardly any taxes on their profits, whereas citizens and small and medium-sized firms have to pay their full share,” a press release said following the EP session where the resolution was approved.

Parliament has recommended introducing mandatory country-by-country reporting of financial information, including profits made, taxes paid and subsidies received by multinational companies. Another important element of this recommendation is agreement on the definitions of factors determining corporate tax bills, so that companies with large legal budgets do not exploit ambiguities in the legislation.

Transparency is an area where Maltese MEPs are in agreement with and support. The resolution pushes transparency by insisting that all member states share their national rulings and other tax information that has an impact on other EU countries, such as in the case of tax rulings on multinational companies.

Better protection for whistleblowers is also called for, a measure stemming from the court charges faced in Luxembourg by former PriceWaterhouseCoopers employee Antoine Deltour, for exposing the LuxLeaks scandal to investigative journalists.

Maltese MEPs voting against the TAXE committee report

The Malta Independent on Sunday spoke to the Maltese MEPs to find out exactly why they voted against a report that essentially wants multinational companies to pay their taxes where they are making their profits.

Former Prime Minister Alfred Sant (S&D party), who is a member of the Committee on Economic and Monetary Affairs, and a substitute member of the special TAXE committee said: “Nobody likes to vote against the political line adopted by the parliamentary grouping to which one belongs. However, ultimately, we were elected to the EP by national constituencies and are duty bound to first and foremost defend their interests.

“CCCTB together with other measures being contemplated, like the Financial Transaction Tax, would in reality constrain Malta’s flexibility in setting tax rates that would allow it as a country to be competitive, especially in the financial services sector which at present accounts in one way or another for close to a quarter of our GDP. I do not like this dependence on financial services at all but it is there and our ability to set policy in and for the sector should be safeguarded.

“It has been said that the measures being contemplated by the TAXE report would only apply to the bigger multinationals, but inevitably this would eventually be extended across the board in the EU.

“The application of EU rules especially for eurozone countries, basically on a one-size-fits-all model, has constrained the economic flexibility of the smaller economies, which is why disparities between the north and south regions have been growing (Malta for the present being an exception – precisely because of the growth of financial services plus the rebound in tourism).

“Bigger countries, because of their political clout, can in a way avoid the resulting rigidities (vide the examples in the past two years of France, Germany and Spain over their budgetary policies), while smaller economies are being obligated to follow the rules and punished severely when they fail in this (vide Cyprus). So it would be folly to accept further rigidity in our policy-making apparatus by agreeing to any form of EU wide tax convergence/harmonisation, without the prior establishment of effective mechanisms that would compensate for the structural imbalances that are being generated between national and even regional economies.

“This does not at all mean that Malta should operate as a tax haven to allow tax evasion or aggressive tax avoidance by multinational and other companies. We should go for full transparency in all tax matters at both EU and OECD levels. On those parts of the TAXE report which deal uniquely with transparency, I voted for when separate clauses were being tabled.

“I will also be voting against another report that will shortly be coming up to the plenary, originating too from the Economic and Financial Affairs committee, which again deals with the subject of tax convergence.”

Pressed why all local MEPs voted against the report, Dr Sant said that it was because they were acting in Malta’s national interests.

Miriam Dalli (S&D party) had this to say: “The Report makes recommendations regarding an improvement in transparency related to the taxation measures applying in EU member states. I agree with these recommendations and fully support measures designed to promote full transparency in national tax treatments.

“However, the report also proposes measures that implicitly or explicitly would introduce tax convergence and harmonisation on an EU-wide basis. This goes against the interests of smaller economies of the EU, which lack the endowments of the larger economies.

“Their flexibility in policy-making is already constrained among others by the convergence in VAT rates, state aid rules, the single currency and the six pack/two pack rules applied to their budgets. Reducing tax flexibility of such economies would further increase these disparities, which is unfair, dysfunctional and unacceptable.

“Tax competition should remain part of the limited array of decision tools available to national economies. For these reasons, I voted against the Report.”

Marlene Mizzi (S&D party) focused on the need for an economic impact assessment of what CCCTB would translate into in practice:

“As far as taxation at EU level is concerned, I have always been in favour of transparency, coordination and exchange of information including that on an automatic basis. I will always agree with recommendations and fully support measures targeting abuse, enhancing transparency and addressing instances of harmful tax competition in the area of corporate taxation as promulgated by international standards.

“At the same time, I am not in favour of a move towards an EU-wide basis to introduce tax convergence and harmonisation in direct tax matters. It is important to keep in mind that small economies do not face the same economic realities and domestic market size, geographical proximity or resources as big ones; therefore they need a certain latitude in tax policy otherwise a one-size-fits all approach can put them into a disadvantaged position. I also have reservations on the mandatory CCCTB provisions and a Financial Transaction Tax. In this context, I have voted against this Report.

“I have strong reservations with the suggestion of having mandatory CCCTB provisions before conducting a full economic impact assessment. The CCCTB could potentially lead to an increase in compliance costs, loss of fiscal autonomy and last but not least increased costs for SMEs. In fact, there is logic behind the fact that mainly larger member states are pushing for the CCCTB proposals and the reason is that smaller member states will lose their competitive advantage over bigger economies by not being able to keep a lower effective corporate tax rate.

“CCCTB might prove to be useful for larger member states, big economies and multinationals companies operating cross-border on the internal market, but one should keep in mind that most businesses established in Malta are SMEs that would have to pay the costs and administration fees of the CCCTB without deriving any benefits from it. Therefore, before making up my mind on the CCCTB, I need to be well aware of what the proposal will entail and the implications that might have on the economy and on local businesses.”

David Casa (EPP) spoke about the future possibility of multinationals moving outside the EU because of the effects of implementing the CCCTB:

“We are in favour of tax transparency and against tax fraud. However, fighting tax fraud does not mean that the EU should legally oblige Malta to introduce CCCTB. Tax-related issues are and will remain national competences, and no matter how much the European Parliament insists on this, Malta can always block this in the European Council because like all other member states, Malta has a veto on this subject.

“Procedure is this way for a reason; different member states have different economies and the EU recognises this. The EU is not a homogenous area and not all regions in the EU face the same economic realities, be it for their domestic market size, geographical realities or resources. The introduction of an EU CCCTB system would be particularly damaging to the Maltese economy.

“It would significantly harm our competitiveness and could also harm the competitiveness of the EU as a whole. We are convinced that a one-size-fits all approach is not the right way forward for Europe as inevitably it would be the EU's smaller economies, such as Malta, that would bear the disproportionate brunt of such policies. Companies would be more inclined not only to move out of Malta but also move out of Europe. This is a misguided policy.”

According to MEP Therese Comodini Cachia, “The report is the outcome of wrongful use of tax rulings by a few member states. However, other member states have taken this opportunity to go further than address tax transparency and tax fraud, and saw this abuse by a few member states as a catapult to obtain support for convergence of tax systems, harmonisation of tax aspects and to strongly and quickly proceed towards the introduction of a mandatory CCCTB.

“I am entirely in favour of tax transparency and against tax fraud. I disagree with using tax rulings for any other purpose than to provide the taxpayer with an interpretation of the law.

“I am completely against the mandatory introduction of the CCCTB. The Treaties leave tax regulation within the competence of member states and there is no other manner in which tax regulation can be done.

“In the case of Malta, an investor faces challenges which are naturally ascribed to Malta being an island. Even our own geographical and environmental limitations are challenges for our economy: it increases costs of bringing here raw materials, the fact itself that Malta does not have much raw material or natural resources to start with, the challenge that we are a small population and an ageing one, the challenge that an investor has a small market, the structure of our investors setting up in small and medium enterprises, as well as the sustainability of Malta's infrastructure. These are our challenges as a small economy.

“The introduction of a mandatory CCCTB would not allow Malta to consider aspects of the economy which are obviously challenges, but would ask of Malta to bury its head in the sand and think that there are no challenges which need to be addressed. The mandatory introduction of CCCTB would affect every service that is provided by the government, but what is of great concern to me is that it would affect those people who need government services most. Although the CCCTB refers only to company tax and not to individual tax, we cannot hide from the fact that it is that industry that provides us with jobs, that provides us with the possibility of earning a living to support ourselves and our families.

“Consequently, having a tax system which does not take into consideration the challenges posed to our industry would in the end harm not only the investor but more so the employee and our families. To state it simply, SMEs and industry of whatever nature provide us with employment opportunities but also provide the government with taxes which are put at the service of those who need them.”

Roberta Metsola said that "We do need better tax transparency tools and better progress in our fight against tax fraud, but that does not mean the mandatory introduction of a Common Consolidated Corporate Tax Base (CCCTB). There are some issues that are best tackled at EU level and other that are best tackled at national level. This is a principle point of how the EU functions.

Not every State in the EU face the same economic realities, be it for their domestic market size, geographical realities or resources.

While the report in question did contain some useful points on transparency, which I supported, questions of tax of the nature of CCCTB must remain an issue of national competence since they reflect the different economies of Member States.

A one-size-fits all approach and the CCCTB is not the right way forward for Europe as inevitably it would be the EU's smaller economies, such as Malta, that would bear the disproportionate brunt of such policies. I therefore could not support the report."