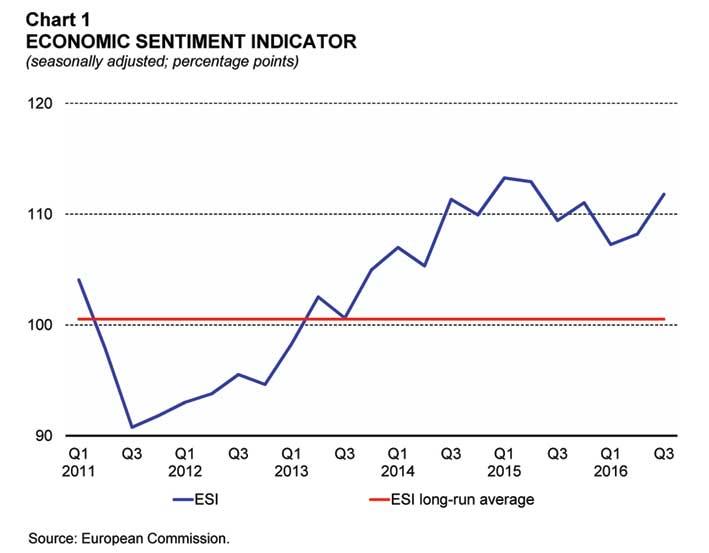

During the third quarter of 2016, the economic sentiment indicator rose further, increasing to 112, from 108 in the second quarter, the Central Bank of Malta said in its Quarterly Review.

Therefore, economic sentiment remained above its long-term average of 101. Sentiment improved among firms in industry and construction, while it deteriorated in the retail and services sectors.

Confidence was broadly unchanged among consumers.

Industrial confidence turns positive

Confidence in the industrial sector swung to 4 in the third quarter, from -6 in the preceding quarter, thereby increasing above its long-term average.

Positive sentiment in the third quarter of 2016 was entirely due to a favourable assessment of production expectations. This was partly offset by persistently weak order books and above-normal stocks of finished goods.

The increase in sentiment in industry during the quarter under review was driven by all subcomponents of the indicator. Production expectations rose and order book levels improved significantly compared with the second quarter, while stocks of finished goods were perceived to be smaller.

The largest gains in confidence were registered among manufacturers of computer, electronic and optical products and within the repair and installation of machinery and equipment sub-sector.

Additional survey data suggest that, compared to the previous quarter, in the third quarter more respondents expected to increase their labour complement in the subsequent three months. Meanwhile, fewer respondents expected to decrease their selling prices.

Confidence in the construction sector less negative

Sentiment in the construction sector improved significantly during the third quarter of 2016. Indeed, the construction confidence indicator stood at -4, compared with -12 in the preceding quarter.

While well above its long-term average of -24, the overall construction confidence indicator has been negative for three consecutive quarters, with firms' assessment of order books being the main contributor to this result.

The rise in confidence during the third quarter of 2016 was largely driven by an increase in firms' employment expectations for the subsequent three months, as the assessment of order book levels improved only marginally.

Additional survey data indicate that in the third quarter, on balance, respondents reported positive building activity developments during the preceding three months. Firms also expected selling prices to rise in the subsequent three months.

Confidence in the retail sector declines

Sentiment in the retail sector extended its downward trend, while remaining positive. The retail confidence indicator fell from 10 in the second quarter to 6 in the quarter reviewed, though it still exceeded its long-term average.

Firms in this sector continued to express a favourable assessment regarding past and expected business activity. However, both of these assessments were less positive in the third quarter of 2016.

The fall in confidence this quarter was also driven by a small increase in the share of respondents reporting higher stock levels. Additional survey data indicate that selling price expectations were unchanged compared to the second quarter.

On the other hand, a significantly smaller share of respondents expected employment and orders to increase in the following three months.

Confidence in the services sector falls marginally

Confidence among firms in the services sector remained high, though it deteriorated marginally over the previous quarter.

The services confidence indicator edged down to 24 in the third quarter, from 26. This still compares favourably with a long-term average of 21.

The fall in confidence in the third quarter within the services sector was mainly driven by a decrease in both past and expected demand. In contrast, firms' assessment of their business situation was unchanged between the two quarters.

Additional survey data indicate that, overall, in the third quarter a smaller share of firms reported past and expected employment growth. Moreover, a larger net share of respondents expected to charge higher prices in the following three months.

Consumer confidence unchanged in the third quarter

The consumer confidence indicator averaged 2 in the third quarter, unchanged from the preceding three-month period. The indicator thus remained well above its long-term average of -21.

Consumer sentiment continued to benefit from a favourable economic situation and buoyant labour market conditions. Indeed, on balance, the share of respondents expecting an improved general economic situation and lower unemployment in the subsequent 12 months increased during the quarter under the review.

These were offset by slightly less favourable expectations of consumers' financial situation as well as lower savings expectations.

Additional survey data suggest that, compared to the previous quarter, the share of consumers intending to reduce major purchases over the subsequent 12 months fell slightly.

The survey also indicates that, on balance, consumers' inflation expectations for the following year decreased marginally.