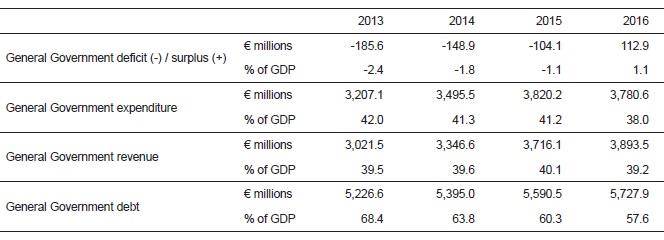

In 2016, the general government registered a surplus of €112.9 million, equivalent to 1.1 per cent of GDP. The gross consolidated debt amounted to €5,727.9 million or 57.6 per cent of GDP, the NSO said today.

General Government balance and debt position

Net lending (or surplus) of general government for 2016 amounted to around €112.9 million, shifting from a deficit of €104.1 million recorded in the previous year. This is calculated as the difference between total revenue (€3,893.5 million) and expenditure (€3,780.6 million) of general government.

When measured as a percentage of GDP, the general government balance was equivalent to a surplus of 1.1 per cent, showing a significant improvement from a deficit of 1.1 per cent in 2015.

On the back of stock flow adjustments, the general government nominal gross consolidated debt increased by €137.4 million to €5,727.9 over 2015. Nonetheless, given a higher level of GDP, the debt-to-GDP ratio fell below the Maastricht debt criteria to 57.6 per cent.

2016 data

In order to arrive at the General Government Sector’s positive balance for 2016 of €112.9 million, adjustments are made to the balance of the Government’s consolidated fund, which registered a surplus of €8.9 million.

The major positive adjustment is the net lending (or surplus) recorded by Extra Budgetary Units of €183.4 million, particularly by the setting up of the National Development and Social Fund (NDSF), registering a surplus of €163.5 million. The NDSF, which receives 70 per cent of the contributions under the Individual Investor Programme (IIP), was set up by the Government in July 2016. Prior to 2016, such proceeds accumulated temporarily in a Treasury Clearance Fund (TCF) account and were recorded as revenue since 2014. Upon the setting up of the NDSF in 2016, IIP contributions started featuring in the Fund. A transfer between the TCF account and the NDSF was necessary, resulting in an equal expenditure and revenue transaction of €43.5 million, with no impact on the fiscal balance for 2016.

Another positive adjustment to the Government’s consolidated fund includes the time-adjusted cash transactions (€4.8 million), while, the main negative adjustments included the ‘other accounts receivable and payable’ (€27.1 million), the treasury clearance fund (€24.4 million) and the equity injection to the national air carrier (€12.0 million).

Reporting and Updates

On 29 September, Malta submitted its report on government deficit and debt levels for the years 2013-2016. This was done in accordance with Council Regulation (EC) No. 479/2009, as amended by Commission Regulation (EU) No. 220/2014, as well as in accordance with the Code of Best Practice adopted by the Ecofin council on 18 February 2003.

When compared to the previous submission of 30 March 2017, the balance of the General Government was revised for all the years under review with an improvement in the deficit for 2013, 2014 and 2015. In addition, the General Government surplus for 2016 was revised upwards by €11.9 million.

The major controbitors to these significant revisions is attributable to the reclassification of the financial protection schemes, namely depositor, investor and insurance, within the General Government sector, as Extra Budgetary Units, from 2003 onwards, in compliance with Eurostat methodological guidance on the recording of protection schemes.

In addition, for 2016, the availability of audited accounts for the other Extra Budgetary Units resulted in a downward revision of €11.9 million. Conversely, the ‘other accounts receivable/payable’ was revised upwards by €6.3 million.

As regards General Government debt, data was revised downwards for all years under review. Most of the revisions were due to the consolidation of government debt securities held by the fi nancial protection schemes.

Stock Flow Adjustment (SFA)

A stock flow adjustment of 2.5 per cent of GDP was recorded in 2016. This suggests that the debt increased despite the recorded surplus of 1.1 per cent of GDP and thus, changes in government debt are attributable to other elements. The rise in debt was mainly due to the result of an increase in the ‘holdings of currency and deposits’. Conversely, this increase was partially offset by lower ‘other accounts receivable and payable’