The EU has recently just enacted an anti-money directive, in which Ultimate Beneficiary Owners (UBO) can be accessed through a list by certain authorities etc; will such legislation put off foreign investment coming to Malta?

The only ones that will be put off are those solely interested in hiding who the ultimate beneficiary owners are. I believe Malta is a good jurisdiction, where all EU regulations are adopted. In terms of financial services, we want Malta to have the best reputation thus all directives are adopted to transpire good governance and transparency.

This law will continue in pursuing further transparency. We already have a good degree of transparency in place in terms of the exchange in information between Malta and tax jurisdictions. Here of course it is not just investors but the media and the public who intend to know who are the ultimate beneficiaries of various holding companies are etc. And yes, currently it is very difficult to identify each UBO. I don’t believe this will have any negative effects despite the many incidents which have occurred in the last year. Most investors are choosing Malta because we are an EU state with a good reputation. The companies investing here do not want to be associated with a country that has a bad jurisdiction otherwise they would have gone there.

Malta’s tax system is clearly attractive however it is not the only reason investors come here. There are other factors involved in their decisions including: a steady macro-economic environment; a country that is stable politically, economically and socially; how much does it cost to do business; are courts independent etc.

There has been much talk of tax harmonisation in the European Union, what could this mean for Malta?

Malta is not against tax harmonisation in fact we’re in favour of it. Now, the EU is proposing to stop multinationals from massaging accounts to make more profits in some jurisdictions then others, we agree with this. What we are opposed to is tax rate harmonisation. Malta needs to have flexibility in its tax rates as to attract to invest. It is not only Malta. Cyprus and Ireland are also against this, most member states do not want harmonisation of tax rates.

How are PPE’s regulated and monitored when they decide to invest?

There are some misconceptions surrounding the MFSA. As the regulator it is often accused of not performing due diligence. It is responsibility of the practioners if the Politically Exposed Persons (PEP) wants to open a bank account its up to the bank to do this due diligence. They can then report any issues to the MFSA or FIAU were further investigations and information is gathered which if necessary is taken to the police.

In your personal view, how ethical do you believe it is for UBO’s and PEP’s to pay their taxes in small jurisdictions such as Malta?

What might be unethical is not necessarily illegal. Each company has the right to organise its own business and its own tax affairs; I don’t subscribe to the notion that companies should be stopped from shopping for the best tax jurisdiction. Alas I believe politicians themselves should hold themselves to higher standards because being seen to be doing the right thing is as important as doing the right thing.

However, there is this perception that shopping for better tax jurisdictions is part in parcel with money laundering which most of the time is not the case. Money laundering is not getting the best tax deal, its about hiding illicit gains.

In the last year, with the Panama papers allegations against Maltese politicians; and the Malta files in the Paradise Papers. Malta has been criticised as a ‘tax haven’ and a ‘mafia state’, is this fair judgement or are these unfounded allegations?

It’s easy to make allegations but harder to prove them. Recently there was an article speaking of certain people in Europe feeling envious of us. Now I wouldn’t go as far as to say that but there definitely is an element of that because many of allegations put forward are unproven. If someone has legitimate concerns of money laundering they should stick to that and not start labelling the whole state as a tax haven and a mafia state.

In the long-term, will such mudsling effect financial services? Did we miss out on opportunities from Brexit because of it?

I don’t believe that there will be prominent long-term effects. Luxembourg has won much of the financial services over because it offers many attractive factors. If the big British banks were to come here they would create a huge problem since we don’t have close to enough the man power needed to supply such banks thus it would not make sense for them to come here. Therefore, we are being modest, making it clear that we are available to the right client and right size of client.

Clearly what has happened in the last year has a painted a negative light for Malta and both the government and opposition need to create consensus legislation since improvement is still needed in good governance and transparency.

Regarding the economy, and the influx of Igaming companies in our services? Is this a fickle service, how sound is the economy?

Services are fickle in themselves. At the moment, Igaming is a big chunk of the economy and diversification is needed: including in banking, insurance, and Igaming etc. However, those who are opposed to Igaming companies, it doesn’t make sense. You are simply not going to find a policy maker who will say no to good business.

The government has a diversification programme and if the nature of the business changes we will have to adapt accordingly.

The economy has also risen due to a construction boom, what are your thoughts on this?

There has not been a boom. The studies are showing in fact that construction is still a small part of the economy. Construction is increasing because the economy is increasing but it has not even shown above average gross rate.

Do believe there is a possibility that a housing bubble is occurring?

No there is no housing bubble. I would even go as far as saying there isn’t even enough construction taking place; why are prices going up because there is more demand then there is supply. In other countries there was a lot of construction going on, but the future demand did not materialise. In Malta there is demand, it’s the reverse.

With Crypto-currencies such Bitcoin becoming more and more popular. Is this the future?

Crypto-currencies have a future I believe. In the EU there is still a lot scepticism and the authorities are still grappling with the idea of how regulate it. The problem is no one really knows what it is. So far it is not a reason for concern because its peripheral however if it grows then EU needs to regulate it. Crypto-currencies will not be the prominent currency in Malta however we want to make sure that people who invest in crypto currencies know what the risks are. Education is needed. There is big hype currently over it, but the MFSA needs to regulate it and educate people along with the media.

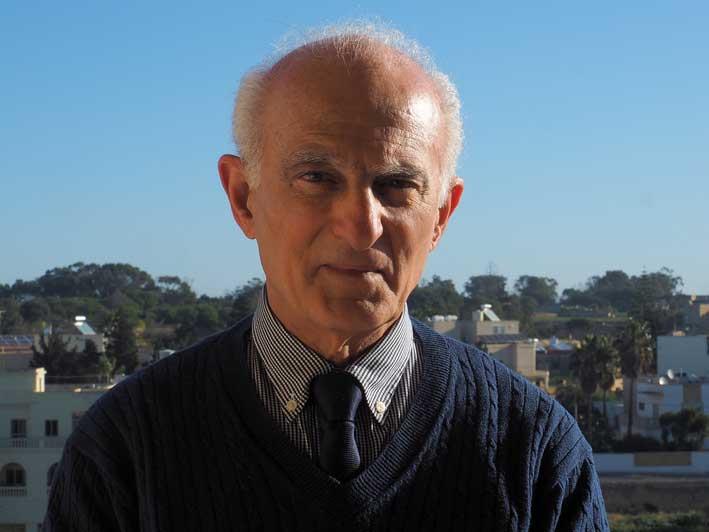

In March, MFSA Chairman John Bannister will be resigning, who is set to be the new chairman?

Prof John Mamo is set to be the new MFSA non-executive chairman. Everybody has expressed confidence in him and he’s level headed enough for the job. Additionally, for the first time the board will be deciding on a new CEO who will be employed by March also.