Data published earlier this week confirmed Malta's strong economic performance. Real GDP grew by 7.5 per cent, further confirming that Malta is going through an economic boom. Last week's analysis looked at various sectors which have contributed to such growth, most notably service sectors. JP Fabri says that, being an island with no natural resources other than human capital and jurisdictional power, Malta's growth has largely been influenced by the island's ability to create and sustain ecosystems around innovative legislation establishing regulation-based economic sectors. The gaming sector is a case in point; not only has it contributed to the country's growth, but has been a magnet for foreign workers, leading to an increased demand for properties, especially rental ones.

The human demand for property

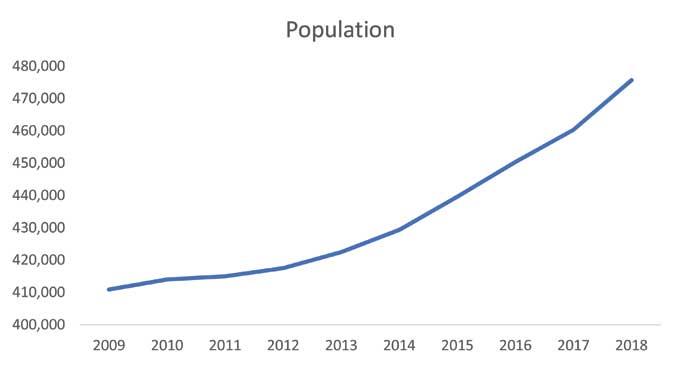

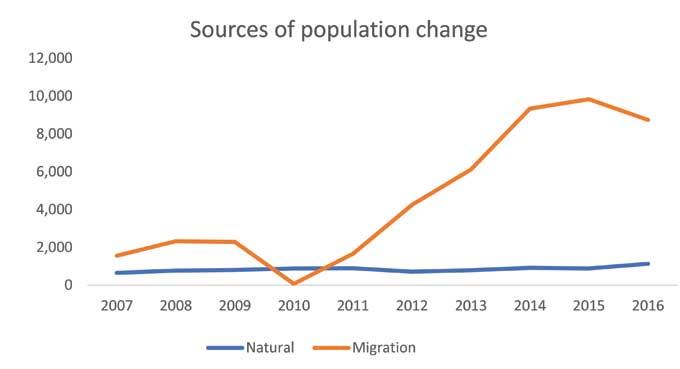

Last week, we described a number of demand and supply factors that have been contributing to the increase in the rental prices Malta is currently experiencing. This week, we focus on the most basic demand factor: population growth. Malta's population has been increasing at a fast pace, and when assessing whether this increase stems from natural population growth or migratory flows, it becomes clear that, in Malta's case, migration is the sole driver of such an increase in its population.

Fabri notes that Malta's economic growth has not only lowered Malta's unemployment rate, but has also brought increased migratory flows which have led to the expansion in the labour supply. This has led to an increase in the demand for rental properties. Migration, Fabri says, is the natural consequence of a fast-growing economy like Malta's, which is on a convergence track to EU averages. Understanding such migratory flows and composition is also important for policy and planning purposes, he says.

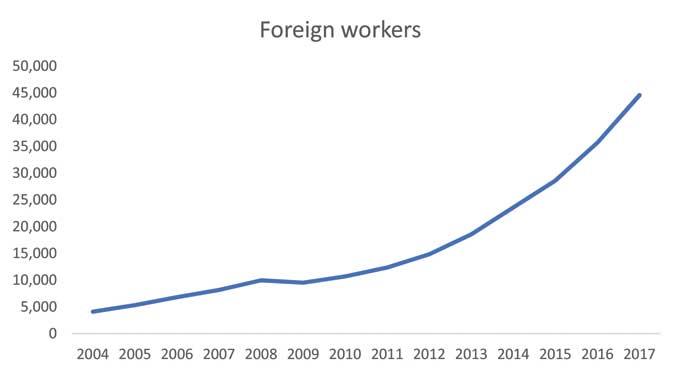

Fabri says that data published by Jobsplus shows that 78 per cent of foreign employment in Malta is European, followed by Asians who account for 14 per cent. Italians make up the largest share, with their presence increasing very rapidly since 2011. The depressed Italian economy has been a major factor in making Malta a more attractive location for employment and economic independence. Most positions such employees hold are in the service-based sectors too.

Fabri says that data published by Jobsplus shows that 78 per cent of foreign employment in Malta is European, followed by Asians who account for 14 per cent. Italians make up the largest share, with their presence increasing very rapidly since 2011. The depressed Italian economy has been a major factor in making Malta a more attractive location for employment and economic independence. Most positions such employees hold are in the service-based sectors too.

Malta's ability to attract foreign talent is also important for our competitiveness as a country. Our economic survival depends on our ability as a country to continue attracting foreign and local investment. Being a knowledge-intensive economy with a large number of infrastructural and construction projects underway - both public and private - the demand for foreign labour is going to continue increasing. Related to this are the nascent and fast-evolving industries that continue to attract foreign talent such as financial services, gaming and aviation.

In terms of competitiveness, foreign workers have also dampened wage growth in Malta, particularly in the median income range, which would otherwise have had to grow much faster given the fast pace of growth. This has had an adverse effect on the median wage.

Fabri highlights that foreign talent can support the economy not only through this short-term economic boom by providing their productivity, but even more so in the long term, through knowledge transfer, especially in high-value-added sectors. Foreign talent has been instrumental in building Malta's financial services sector, especially in specific areas, and even more so in the remote gaming world. This will also happen in the blockchain industry should the ecosystem truly develop to start attracting investment and entities at the fast pace gaming did. Therefore, Fabri highlights that having inward migratory flows in essential if Malta aspires to continue climbing the value ladder.

Temporary or permanent?

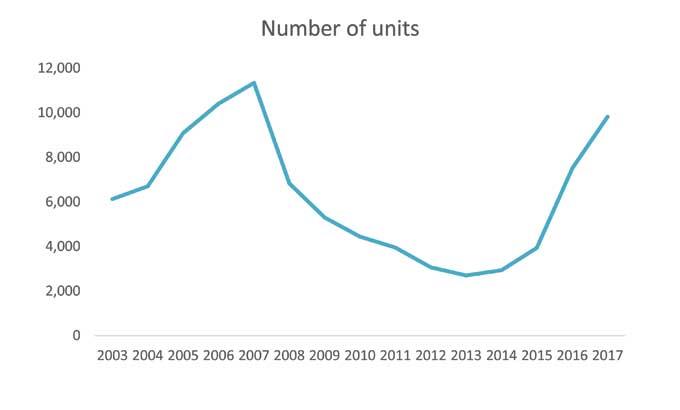

It is true that such inflows of workers have increased the demand for rental properties; however, Fabri argues that in the long term, it is imperative that policy-makers to look at the composition of these migratory flows and, more importantly, trace their stay in Malta. Their length of stay has important consequences on the rental market. Should their be a cyclical decline in the growth pattern and in the migratory inflow of workers, the demand side of the rental market will slow down, given that most workers do not become permanent residents in Malta. This needs to be taken in the context of the growing number of property units.

Fabri says that in light of the numerous infrastructural projects set to commence in 2019, temporary accommodation should be considered for foreign workers. This would help minimise the risk of over-supply in the housing market.

Social and affordable housing

Fabri says that aggregate growth figures should not distract us from the cohort of people that are not benefitting from this period. Figures show that profits are growing faster than wages, indicating an uneven distribution of growth, with serious social ramifications. The affordability of property has become a challenge for a growing segment of the population. It is crucial, therefore, that the government not only continues investing in housing units, but, more importantly, reforms the way social assistance is given. Fabri believes that Malta needs a supply of temporary housing shelters to accommodate those facing homelessness, perhaps more importantly, another social housing tier which will allow people to have a decent home. Fabri adds that many of those facing economic difficulties often suffer from social and health issues. Support and intervention, therefore, needs to be multifaceted. It is also encouraging to see that the government is actively considering public-private partnerships in this field.

Looking ahead

In conclusion, Fabri says that this phase of strong economic growth and fiscal surpluses should serve as a catalyst to truly cater for particular societal cohorts. The property market, especially the rental sector, will remain an important competitiveness determinant, and it is crucial the strains we are currently seeing are addressed. The government's response, through its White Paper, is a step in the right direction. He also believes that this discussion on rent and the challenges that some cohorts are facing should also lead us to a broader discussion that focuses on the quality, rather than the quantity, of economic growth.