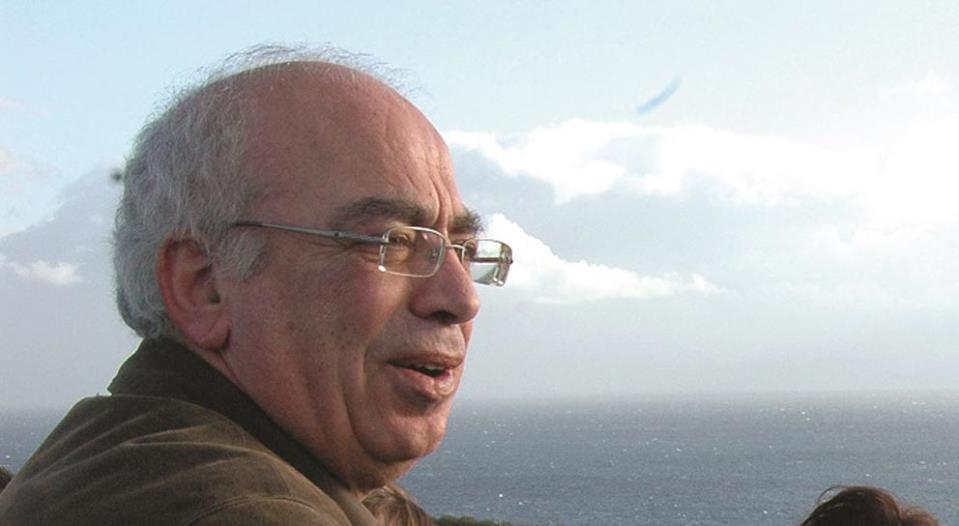

Former PN minister Ninu Zammit hid US$3.2 million in a Swiss HSBC bank account, which he maintained through annual visits to Switzerland while he was still a Cabinet member.

The Swiss Leaks files have been made available to The Malta Independent on Sunday through an investigative partnership with the International Consortium of Investigative Journalists (ICIJ) and French newspaper Le Monde.

The banker's notes - candid comments made by HSBC staff about their clients - show the blatant extent of the former minister's tax evasion as well as the bank's willingness to aid in the avoidance of tax.

During a visit to Geneva in September 2005, Mr Zammit discussed with his banker how best to avoid the European Union's (EU) withholding tax, a year after Malta joined the EU.

The directive required all EU member states to exchange information on interest payments received on savings and investments so that they can be taxed in their home country, with Switzerland agreeing to implement a similar measure.

Had Mr Zammit not taken action at this point, the government he formed part of would have potentially been made aware of the millions he was hiding by never declaring them in his tax returns as he should have by law, or to Parliament in his declarations of assets.

To put this into context, in 2004, then Minister Zammit declared a local HSBC bank deposit of Lm4,671, which is equivalent to US$12,000, as well as investments in the region of US$70,000.

Back in Switzerland, Mr Zammit and his banker came up with a scheme to transfer his US$3.2 million (€3,010,808.59) - held under the name Dingli 17 - to a corporate account in the British Virgin Islands under the name Nester Trading Inc.

According to the banker's note on the transaction, "We went through all the portfolio. They received the mail of the closed account - Dingli and the new corporate account - Nester Trade. The corporate account was opened to avoid falling into the ESD [European Savings Directive] - withholding tax."

The banker's notes reveal the close relationship HSBC Geneva staff had with their clients.

"Met the three children again," the banker handling Mr Zammit's US$3.2 million account said, while noting Mr Zammit's satisfaction at the way his financial affairs were being looked after.

During that same visit, Mr Zammit, who at the time was declaring income of €37,000, gave instructions to his banker to invest US$100,000 and €100,000 in two different financial products.

Former minister never revealed amount held

The Malta Independent on Sunday contacted the former minister several times last month, asking him if he ever made use of a Swiss bank account.

An agitated Mr Zammit did not give much away at the time, simply saying that all his affairs are in order and warning this newspaper not to chase after him.

Mr Zammit released a statement on the day the story was published, in which he admitted to having a Swiss bank account.

He explained that he benefitted from a government amnesty in 2014 for tax evaders such as himself.

What Mr Zammit did not say in his statement is how much he held in his Swiss account and how much of that money has not been repatriated.

Mr Zammit said he started depositing money abroad in the late 1970s. The money came from his profession and property business. He opted to deposit some funds abroad in order to diversify, for financial security, and because of attractive interest rates.

The funds were eventually transferred to HSBC Geneva. No more deposits were made since that time, he said.

The Swiss Leaks seen by The Malta Independenton Sunday show that Mr Zammit opened the HSBC Geneva account in 2004.

This being said, the mention of the client's "annual visit" as well as the banker's saying he met Mr Zammit's three children "again" suggest a longer-standing relationship with the Swiss bank.

Asset repatriation based on 'good faith'

Commissioner for Revenue Marvin Gaerty will not divulge the amount repatriated by former Minister Ninu Zammit, as this will be in conflict with Data Protection Laws he said when asked by this newsroom.

However, he told The Malta Independent on Sunday that the tax amnesty scheme precludes the registration of assets that are the proceeds of certain crimes, although this is based on the "good faith" of the beneficiary.

"Assets could only be registered under the scheme by their beneficial owner and the appointed registration agent was obliged to carry out an enhanced due diligence with regards to the person seeking registration of assets and with regards to the origin of the assets.

"It was not permissible to register any assets representing the proceeds of crime, except for crimes against the Income Tax Act, the Succession and Donation Duties Ordinance, the Death and Donation Duty Act, the Duty on Documents and Transfers Act and the Exchange Control Act.

"Every person registering assets is required to subscribe to a declaration confirming that the assets are not the proceeds of crime as described above and confirming, amongst other matters, that he or she has acted in good faith," Mr Gaerty said.

Mr Gaerty explained that appointed registration agents are obliged to carry out a due diligence process on the person applying for the amnesty and collect information on the source of the funds.

The first tax amnesty was launched in 2002, with subsequent amnesties in 2003, 2005, 2007 and 2014.

In July 2014, the due diligence process was tightened up due to an EU directive aiming to crack down on the use of the financial system for the purpose of money laundering and terrorist financing.

"All registration agents were obliged to exercise enhanced customer due diligence measures for the prevention of money laundering or financing of terrorism with regards to persons wishing to register assets under the scheme.

"They were also obliged to collect information on the source of funds regarding the assets being registered. This involved the collection of documentary evidence such as invoices, receipts, bank statements, contracts of employment, pay-slips, wills, contracts, audited financial statements and other documents that could attest to the source of the funds," Mr Gaerty said.

Asked what happens if a person is unable to prove where the income came from, Mr Gaerty said the registration agent is obliged to refuse the asset registration.

"It was not permissible to register assets of unknown origin under the scheme. As explained above, the process was subject to enhanced due diligence, which implies knowledge of the origin and owner of the assets.

"In the event that a person applying to register assets under the scheme was unable to prove where his income came from, the registration agent was obliged to refuse to complete the registration.

"If during the registration process, a client failed the registration agent's due diligence and anti-money laundering tests, that agent was duty bound to report the client to the Financial Intelligence Analysis Unit in the event that there were sufficient grounds to give rise to a suspicion of money laundering."

This newsroom is not yet privy to information on how much Ninu Zammit actually repatriated in the 2014 amnesty scheme, applications for which closed in September. It would, however, be pertinent - now that this newsroom has revealed the amount of funds held in Switzerland by Mr Zammit - to expect the Commissioner of Police, aided by the Commissioner for Tax, to investigate the repatriated funds.

This should be done to determine whether the amounts brought back to Malta under the scheme match the amounts listed in the Swiss Leaks data revealed today, as well as to determine whether the proper channels and protocols were followed when the funds were repatriated.