Malta Developers Association president Sandro Chetcuti said there is no sign of a bubble in the housing market, let alone signs that the bubble could burst. This sentiment was echoed by a representative from KPMG, while Prime Minister Joseph Muscat expressed joy at the findings reaching the same conclusion as the government's own analysis.

Chetcuti was addressing a press conference at the OPM in the presence of Prime Minister Joseph Muscat, finance minister Edward Scicluna and other stakeholders following a study that was commissioned by the MDA to KPMG on the construction and property industry in Malta.

In the Prime Minister's remarks, he commended the MDA for commissioning such a study, stating there has been resistance to carry out one by the government due to problems that could be highlighted.

"We have not had many studies to base decisions on. This report is of extreme importance and will contribute to decisions taken by policy makers".

He said the report dispels certain myths, indirectly referring to concerns of a property bubble brewing, and highlights certain problems.

Muscat highlighted problems in the rental market, as the report does not delve into such issues. He revealed that the upcoming budget will create a framework to safeguard tenants and landlords from certain abuse, and will be a step in the right direction.

He acknowledged the MDA's resistance to rent caps, but said it is unacceptable that landlords increase their prices exorbitantly on a sudden basis.

Muscat said that uncertainty by both landlords and tenants, especially because court disputes take years to conclude, is resulting in landlords inflating prices to create a cushion for them in the eventuality that a tenant creates serious problems.

He reiterated his statement that the upcoming budget will see a framework put in place to curb abuse and ensure a certain level of regulation that will not allow landlords to act unprofessionally, while providing protection for both sides.

Findings of the report

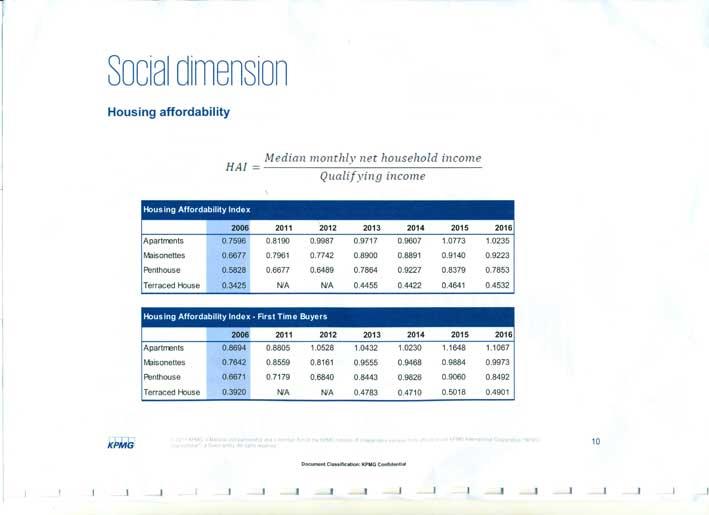

It was found that a single person earning an average income of €14,400 (after tax) qualify for a mortgage on a property with a maximum value of €95,300. When looking at a property database with roughly 13,000 listings, only 2.7 per cent fall within this category, mainly one or two bedroom apartments in the southern harbour region.

On the other hand, a couple with a minimum wage of €17,600 (after tax) qualify for a morgtage for a property with a maximum value of €117,000, representing 11 per cent of the aforementioned database.

This information highlights the plight of low income earners who wish to become home owners, especially within the context of rent prices skyrocketing.

A housing affordability scientific analysis however found that, especially with respect to apartments, the issue of affordability has improved significantly from 2006 to now. While the price of land and housing has gone up since 2012, the affordability could have improved through lower unemployment and other factors.

From an economic dimension, concern felt by those within the housing industry over a shortage of construction workers, more so with certain specialized construction skills, is causing the industry at large a headache. The report found that this shortfall of labourers is being addressed through an influx of foreign workers.

Onto the reports findings of a housing bubble, it noted that "price increases [are] matched by demand" and there appears to be "no sign of supply gut". It is this newsroom's understanding that this analysis does not take into consideration price increases stemming from the rental market.

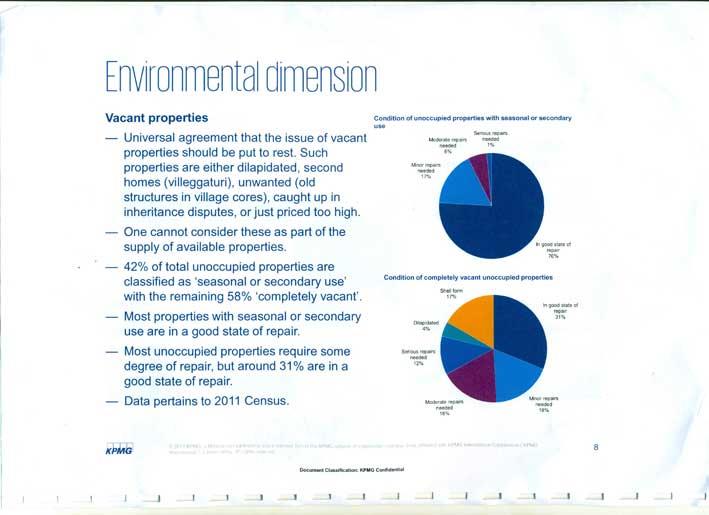

An analysis was carried out on vacant properties, where the report urged for the non-consideration of such dwellings to be "part of the supply of available properties". From 2011 figures, it found that vacant properties ten to either dilapidated, unwanted or caught up in inheritance disputes.

"42 per cent of total unoccupied properties are classified as seasonal or secondary use with the remaining 58 per cent completely vacant".

Onto the environmental aspect, a KPMG representative commented that both from the demand aspect (consumers) and the supply side (developers), an air of immaturity can be found, more so driven by the demand side. He remarked that consumers are largely unaware of the benefits, even monetary, from environmentally friendly materials such as double glazed windows and better insulation. The representative found an improvement in the way construction and demolition waste are disposed, adding that this does not mean the problem is solved. The report called for a strategy to address this problem.

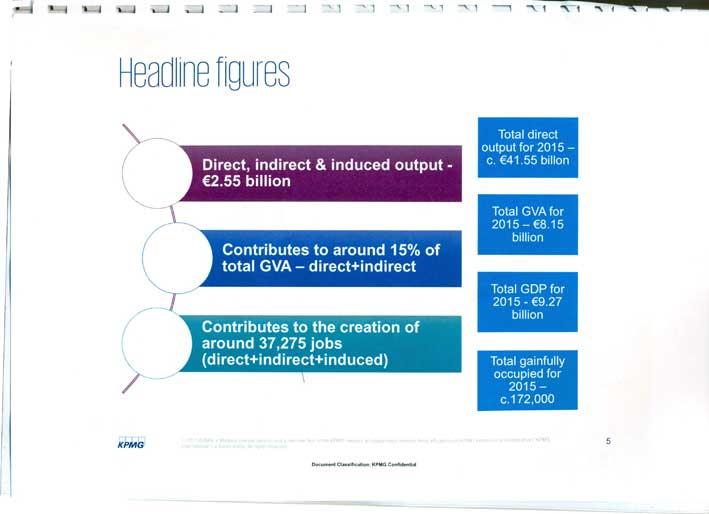

Turning to gross value added for the economy from the construction and property market, direct, indirectnanf induced output translate to €2.55 billion - translated into roughly 15 per cent value added as a proportion of the total value added produced by the Maltese economy.

This contributes to roughly 37,275 jobs created directly or indirectly within this sector. Chetcuti described how this translates into one in every seven workers being engaged with the construction and property market, directly or indirectly.