In March 2013, the incoming administration found itself faced with the largest deficit and debt in the nation’s history. The European Commission placed Malta yet again in the EU’s Excessive Deficit Procedure, and recommended austerity measures. The IMF warned that if Labour tried to deliver its manifesto, debt would explode, while rating agencies were downgrading the country’s sovereign rating.

In this environment, Dr Joseph Muscat could have chosen the route taken by previous administrations to ignore manifesto promises and adopt austerity measures. Instead, he adopted a radical plan to reduce taxes, raise social spending and boost public investment; bolstered by structural reforms to boost the supply of labour, reform the energy sector and turn around public corporations.

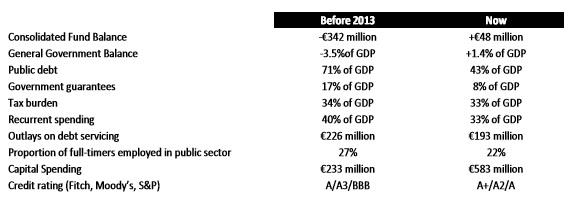

This plan completely transformed the state of the public finances. From the largest deficit in the Consolidated Fund, Government now has a surplus of nearly €50 million, an improvement of nearly €400 million. Looking at the General Government Balance – the measure adopted by the EU to assess public finances – one notes that from having one of the worst deficits, Malta now has the third highest surplus in the EU. From a record high deficit of 3.5% of GDP, the Maltese Government has been registering surpluses higher than 1% of GDP for four consecutive years.

In March 2013, the burden of public debt had risen to 71% of GDP, and IMF experts were projecting it would exceed 75% unless fiscal austerity measures were imposed. Instead by the end of this legislature experts now forecast the debt burden will have fallen to 35%, or half the burden in 2013. In recent years Government has started to repay its debt. Its deposits with banks now exceed €1.5 billion, nearly a billion more than in 2013. Besides this, the Government has set up a Malta Development Bank and has accumulated nearly €600 million in the National Development and Social Fund. The Government has also improved the finances of public entities, to the extent that the burden of state guarantees on their debts has fallen from 17% of GDP to 8%.

The transformation in public finances occurred despite several budgets where no new taxes were introduced. Dr Joseph Muscat’s administration is the only one in our nation’s history to have lowered the burden of income tax in every budget. As a result, the tax burden has fallen from 34% of GDP to 33%. According to the EU Commission, Malta has the lowest rate of tax on those on low incomes among all EU countries.

Despite lowering the tax burden, Government finances still improved as outlays did not rise in line with economic growth. Consequently, recurrent expenditure as a share of GDP declined from 40% of GDP to 33%. One of the key causes for this was the decline in dependence on social benefits, though spending reviews which increased cost efficiencies of Government departments also contributed.

Another important element was the reduction in spending on debt servicing. Whereas in previous years, debt servicing was one of the fastest growing expenditure items, in recent years it has been falling, not just as a proportion of GDP but also in absolute terms. Today the Maltese government pays 15% less in debt servicing than it paid in 2012.

A further boost to fiscal sustainability was the reduction in the proportion of those working in the public sector. While in 2012 27% of the full-time workforce was employed in the public sector, by 2019 the proportion had fallen to 22%. However, Government still boosted employment in a number of essential sectors. For instance, in public health and education there are two thousand more full-time workers than in 2012.

One of the most enduring legacies of Dr Joseph Muscat will be the large increase in public investment conducted under his watch. This year Government capital spending will reach €583 million, €350 million higher than 2012. The doubling of public investment will increase the nation’s productive capacity and lay the foundations for future economic growth.

The improvement in Government finances was a key factor behind the decisions of all rating agencies to upgrade Malta’s sovereign rating in recent years, with ratings standing above A. These upgrades, in turn, are a major reason for the increase in foreign direct investment since 2013.

Clayton Bartolo is a PL MP