The Malta Financial Services Authority has detailed a set of measures it has taken in order to combat money laundering and terrorism financing in its 2019 Annual Report which was tabled in Parliament on Monday.

The report states that combatting financial crime, money laundering and the financing of terrorism are a "key strategic priority", this especially after Malta's most recent National Risk Assessment in 2018 highlighted threats in this regard, and after Moneyval - the Council of Europe's Evaluation of Anti-Money Laundering Measures - recommended that Malta strengthen its financial supervision.

The report comes four months before Malta faces its final Moneyval test which, if failed, would see the country face being grey listed - which would be a mortal blow for the financial services sector.

This being said, the MFSA's plans have drawn praise in the regulatory sector with the President of Germany's regulator BaFin Felix Hufeld telling The Malta Independent last October that it could, if implemented fully, serve as a benchmark for Germany's regulator and those of other countries.

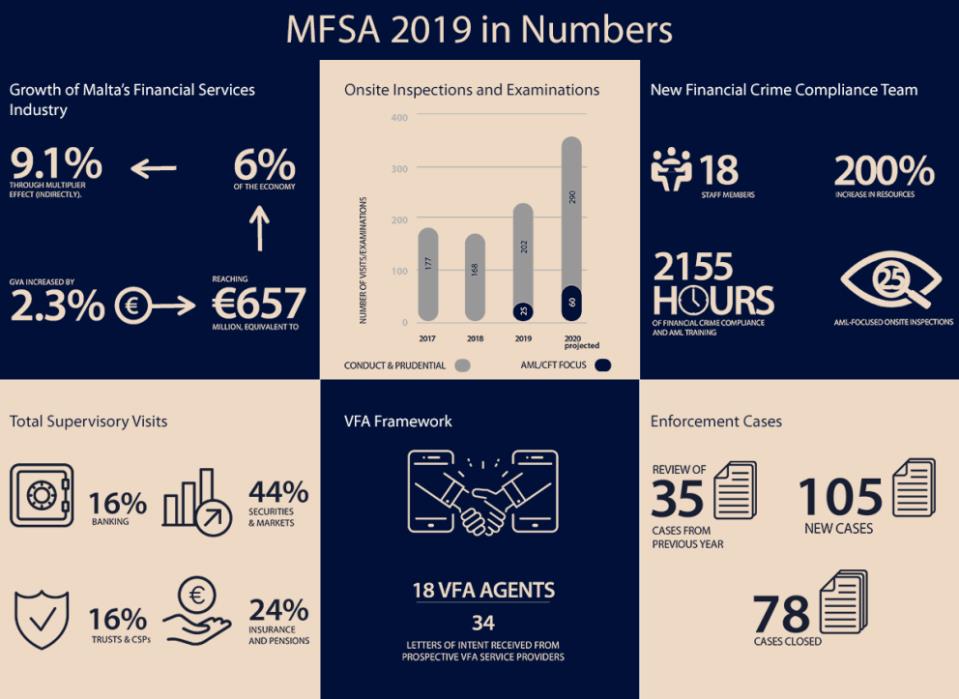

The report indicates that the financial services sector grew by 2.3% year on year in terms of direct Gross Value Added (GVA) reaching a total of €657m, generating 430 new jobs reaching a total of 12,230 jobs - representing almost 5% of total employment in Malta. The indirect effect of financial services in the Maltese economy is estimated to be between 9-10% of GVA, the report found.

The report lists various measures taken by the MFSA in this regard, namely first the launch of an AML/CFT Strategy, which sets out the role of the Authority in relation to fighting money laundering and terrorism financing, and details the principles of its supervisory approach in this regard.

A dedicated Financial Crime Compliance Team (FCC), led by Anthony Eddington, was also set up in order to accelerate the Authority's effectiveness in detecting and responding to risks, or instances of misconduct, by supervised firms.

"The team has been supported by experts from a world-class consultancy firm, who provided training and shadowing during onsite visits and reviews", the report reads.

The team is now made up of a total of 18 members excluding Eddington, who brought with him 20 years of experience of work in this field abroad.

Enforcement plays a key part of the strategy, and the report shows how the MFSA carried out an "unprecedented" total of 25 anti-money laundering specific site inspections throughout 2019, as part of the 275-total number of inspections they carried out in across the board.

Another measure emphasized in the report is further investment in developing a risk-based model to be used in managing supervisory efforts, which will eventually form part of a wider risk-based ranking framework for regulatory supervision which is being developed with the help of external consultants.

"In this context, the MFSA studied potential financial crime and money laundering risks arising from business models adopted by licensed entities. Prudential supervisors are being involved in discussions at Euro area level aimed at including, to the extent possible, AML/CFT oversight in prudential supervision. The prudential supervisors have further increased their interaction with the Authority's FCC team and with the Financial Intelligence Analysis Unit (FIAU)", the report reads.

Training is another point where the MFSA said it had increased its efforts during 2019. In fact, MFSA attended 27 AML/CFT specific events in 2019 - 10 more than in 2018 - along with another 110 regulatory and compliance events and six workshops.

The report notes that the need for sectoral supervisors to continue enhancing their knowledge of AML/CFT risks was a Moneyval recommendation.

All in all, MFSA staff members participated in almost 2,000 training hours in 2019, provided by specialists in the field of financial crime and money laundering. In addition, FCC team members delivered 255 hours of training on the same topic to internal regulatory functions, with the intent of achieving a holistic approach towards supervision.

The opening of an Academy for Financial Supervisors is also in the pipeline for the upcoming year, and will serve as a key part of the MFSA's supervision strategy when it comes to interaction with other financial supervisors and effective training of staff.

Three new departments were also established within the MFSA: a Due Diligence function, an Enforcement function, and a Cyber Security function. The former would make sure that diligence checks are carried out on an ongoing basis, the middle will be concentrating on efficient enforcement processes, while the latter looks into the IT-related risks faced by companies registered with the MFSA.

The report also emphasizes the use of data driven supervision, an approach based on data analysis to extract emerging or underlying trends, to identify the risks in a more timely and effective manner.

The technology team was restructured in such a manner which saw the setting up a separate Data Management & Business Intelligence function. That function will establish data governance processes and policies, automate the orchestration of all supervisory-related processes, as well as providing advanced supervisory insights for effective supervision and enforcement.

"The MFSA's technology strategy places formal data governance and centralised data management at its core to support a data driven supervisory approach", the report reads before noting that over the next two years the Authority will seek to use machine learning technique to take data management technique to the next level.