From Pilatus Bank to Nexia BT venture BT International, Henley & Partners sought to set up introduction agreements across Malta in the hopes of raking in as many clients as possible, documents and correspondence seen by the Malta Independent on Sunday and MaltaToday shows.

Data which emerged as a result of the Passport Papers collaboration shows that Henley & Partners made use of so-called introducers to help attract clients and promote Malta’s Individual Investor Programme.

For every introduced client, Henley & Partners would pay an Introduction Fee as a percentage of the gross amount of professional fees paid by the introduced client. For the Malta Individual Investor Program, this commission often stood at 30% of the Henley Professional Fee.

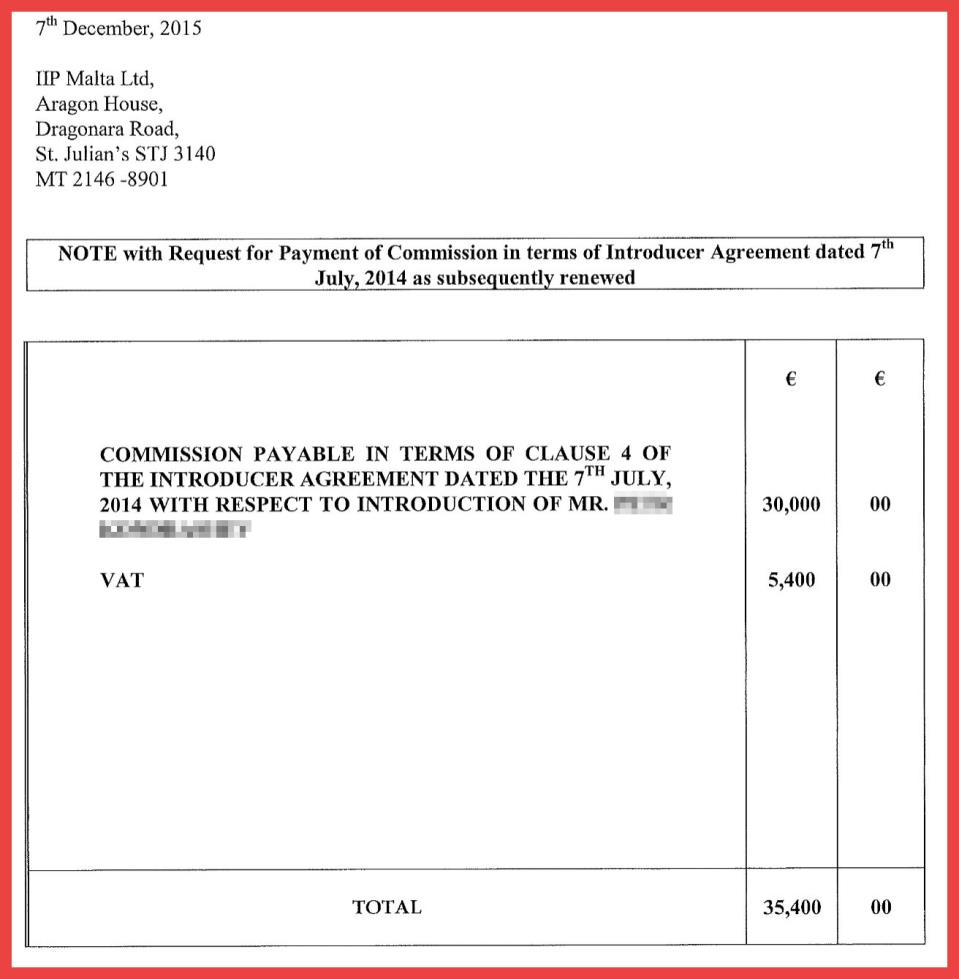

One Introducer, a Maltese lawyer, earned a €35,400 commission by introducing a Russian billionaire to Henley & Partners and the IIP. However, the passport application was eventually declined.

Another immigration advisory company from Hong Kong applied to become an Introducer for the IIP. Having introduced nine applicants to the programme, the company earned €108,500 in commission fees.

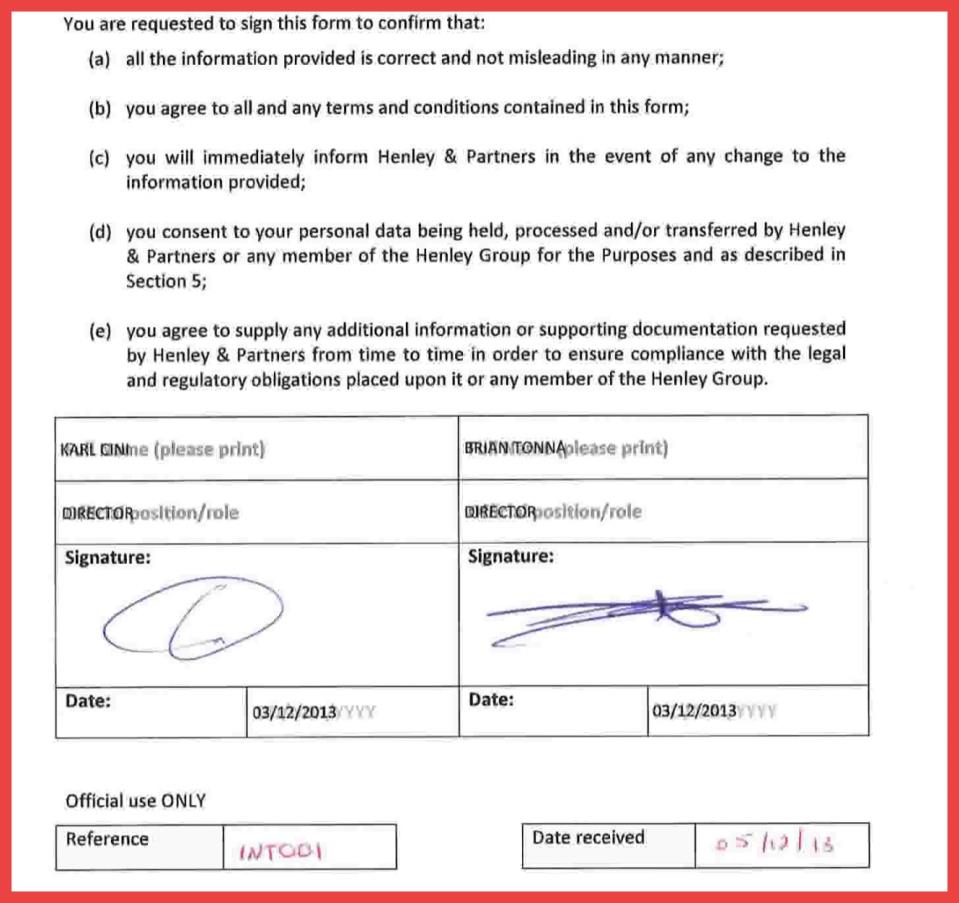

At the start of the IIP, only law and audit firms were authorised to act as Introducers to the firm. In fact, Brian Tonna and Karl Cini were the first authorised Introducers for Henley & Partners through their financial services company BT International, with reference number INT001 in a Henley & Partners database.

However, BT International saw their passport-selling license suspended in September 2020 after Tonna and Cini were placed under an asset freezing order.

Both Tonna and Cini have since been charged with money-laundering, with police providing evidence in court that Keith Schembri received kickbacks from the sale of Maltese passports by BT International to Russian nationals.

An internal position paper by Henley & Partners dated 8 January 2014 indicates that there had been some bad blood between the concessionaire and the local financial community, likely derived from the exclusivity clause in Henley & Partners’ concession agreement.

When the IIP was initially set up, what we now know as approved agents were considered as Introducers by the concessionaire, insofar as they would introduce clients to the IIP and process applications on behalf of Henley & Partners.

But to reconcile tensions, it was later decided that these introducers-turned-agents would be able to process applications directly with Identity Malta, eliminating Henley & Partners as the middle-man in the transaction.

The more informal introducer agreements, involving a commission fee, were set up for the IIP after this position paper was drafted.

Stefan Zrinzo Azzopardi, Karl Stagno Navarra submitted interest in becoming IIP agents

Among the approved agents applications was Karl Stagno Navarra. The Labour TV presenter explained that a personal friend of his from abroad had enquired over how to obtain Maltese citizenship, and so Stagno Navarra applied to see if he could assist his friend personally.

“I simply put forward an application, but I wasn’t qualified.”

He confirmed having an exploratory meeting with a Henley & Partners representative over his application, but said that things stopped there.

“I’ve never had any further business with Henley & Partners,” he said.

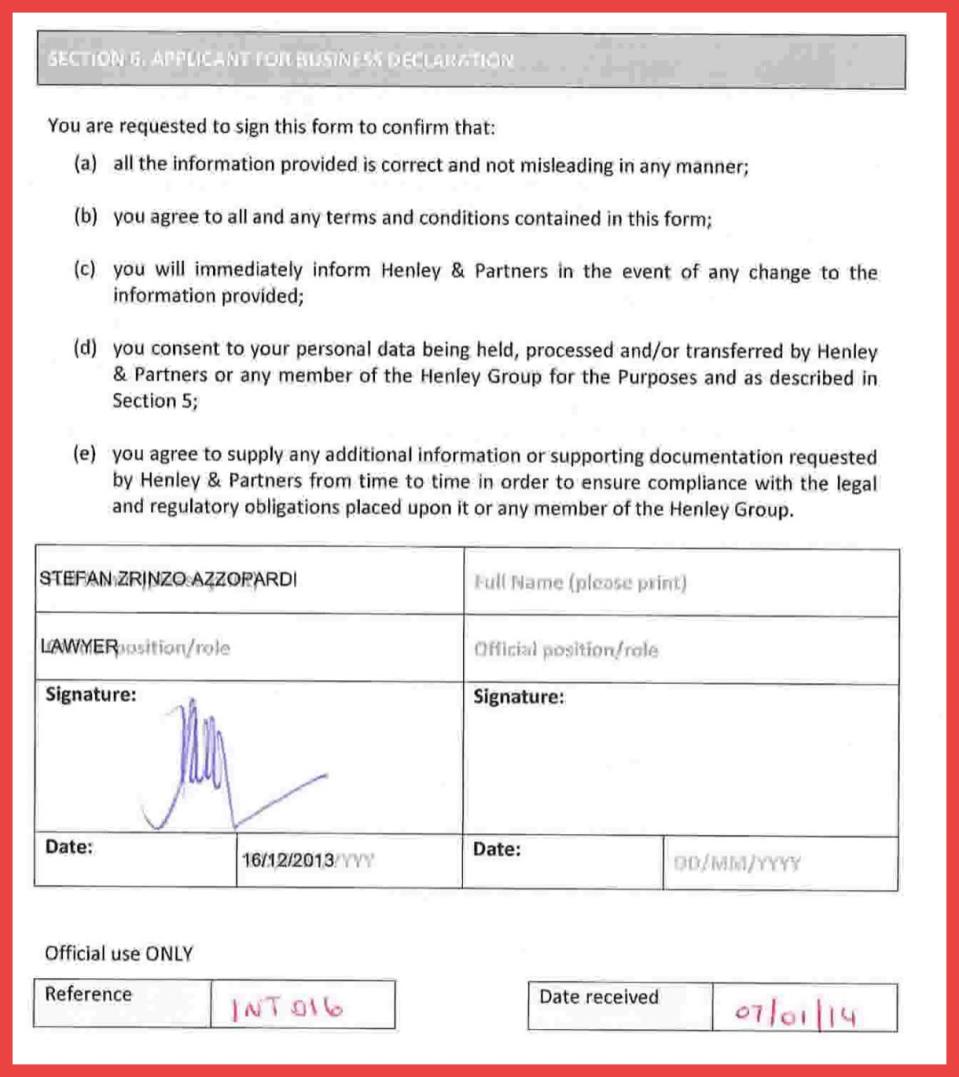

Stefan Zrinzo Azzopardi had also pursued an Introducer agreement with the concessionaire, sending an application form to Henley & Partners to explore the idea of acting as an agent.

When contacted, he said that he and his law firm never ended up working in the sector.

Pilatus Bank offered financing option for IIP applicants

Pilatus Bank offered a financing option for applicants of the Individual Investor Programme, a cache of documents from Henley & Partners shows.

The financing option, approved by Identity Malta, involved a one-time €280,000 payment by the main application and a monthly €10,000 payment over five years, in order to finance the government contributions necessary for citizenship.

The loan was offered against collateral, generally a piece of real estate valued at not less than €750,000, or publicly traded securities of a similar value.

One of the advertised advantages of the financing option was that an in-principle approval from Pilatus Bank could replace the account statement and source of funding requirements necessitated for the IIP applications.

This suggests that Pilatus Bank had an agreement with Identity Malta involving the processing of IIP applicants.

Pilatus Bank CEO Hamidreza Ghanbari spoke at several Identity Malta IIP seminars, advertising the bank’s products and its due diligence processes.

In its lender profile, Pilatus Bank is described as “the only provider of private banking services in Malta”, with a high credit quality rating and stable outlook.

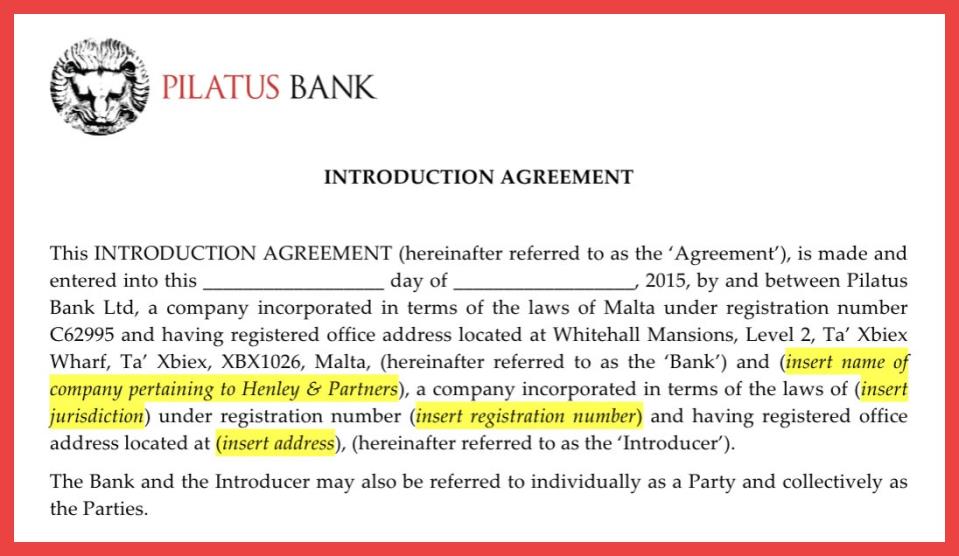

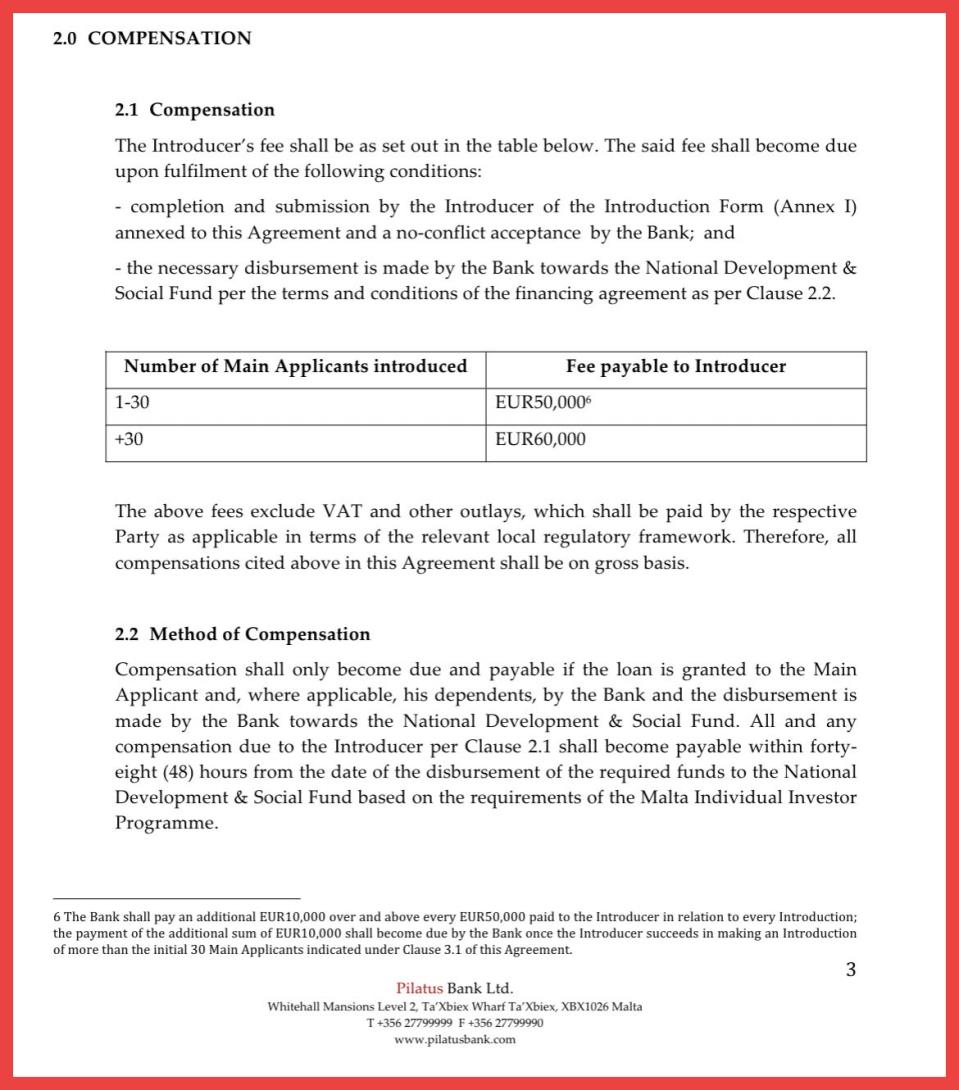

Pilatus Bank went on to draft an introduction agreement with Henley & Partners, whereby the former would introduce potential clients to Pilatus Bank and its financing option.

In return Pilatus Bank would pay out €50,000 to Henley & Partners for every introduction.

Henley & Partners sought advice from multinational law firm Baker & McKenzie (B&M) on the legality of this financing option under Swiss law. During a directorial meeting held on 14 July 2015, the chairman of the meeting tabled a draft engagement letter from the company, under which B&M would review the legality of the option proposed by Pilatus Bank.

The advice issued by the law firm on 6 July 2013 confirmed that Henley & Partners Switzerland AG did not require approval under the Swiss Banking Act to draw attention of suitable applicants to the finance option, and it may receive an introducer fee.

Draft agreement found between Cambridge Analytica and Henley & Partners

Among the material in the Passport Papers cache, three separate introduction agreements were found between Strategic Communication Laboratories (SCL) and Henley & Partners.

A first agreement, dated 25 February 2010, stated that Henley & Partners would act as an introducer for SCL, and would refer potential political client parties to SCL in exchange for a percentage of any resulting revenue from that client.

On 22 March that year, Henley & Partners approved the referral agreement with SCL.

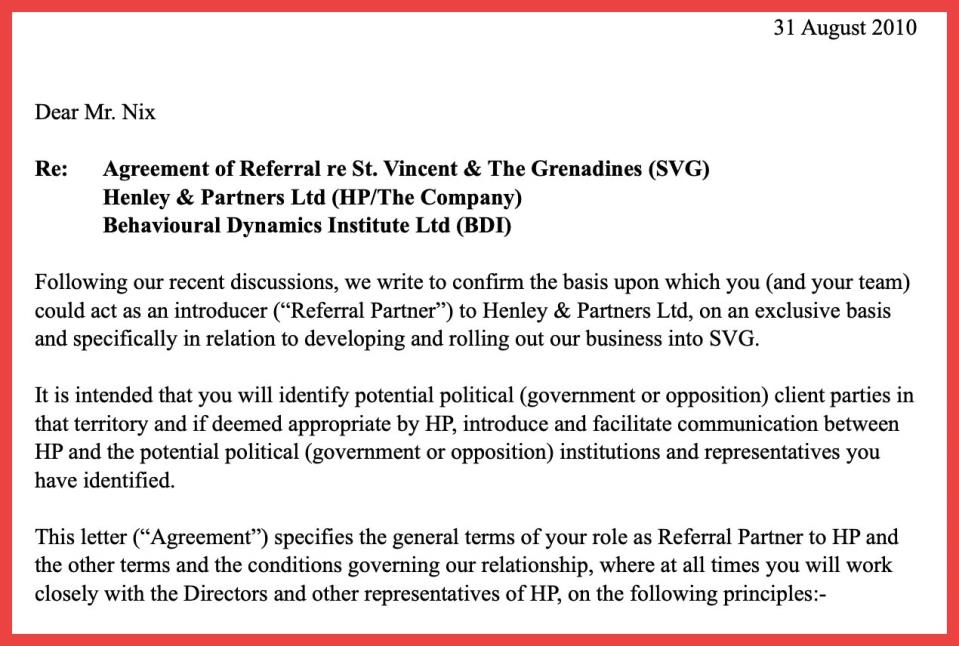

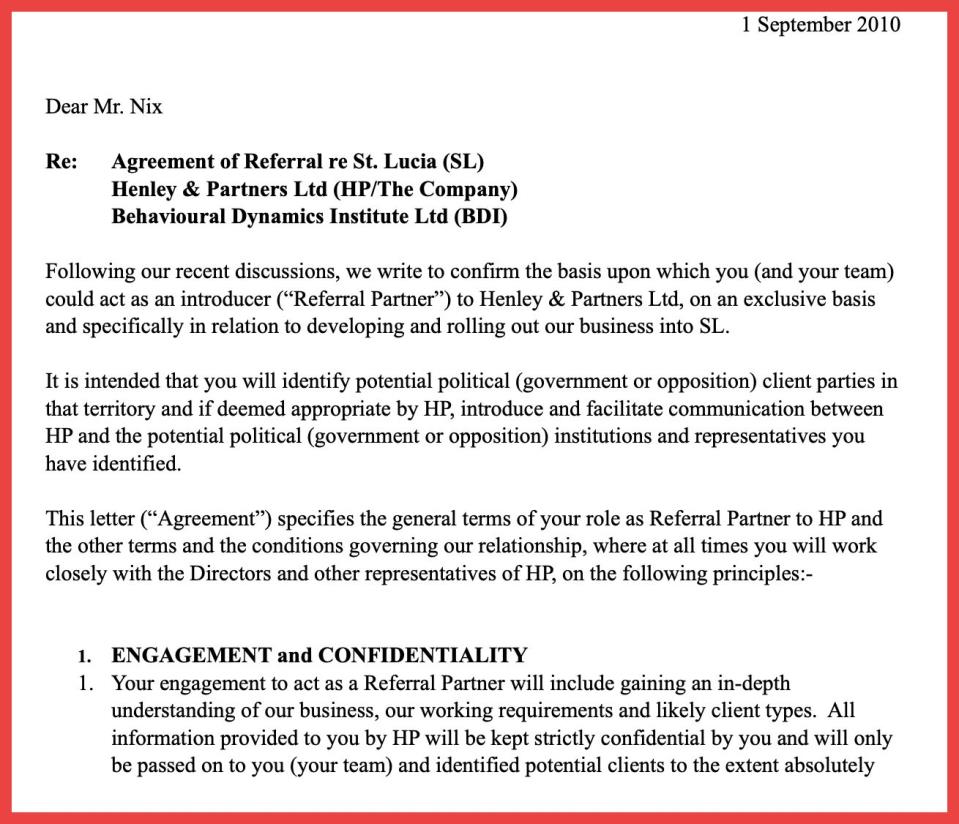

Another two unsigned agreements, dated August and September 2010, were also found among the cache between Henley & Partners and Alexander Nix on behalf of Behavioural Dynamics Institute (BDI), which falls under SCL.

The agreements state that BDI would introduce Henley & Partners to potential client parties in St Lucia and St Vincent and the Grenadines, while Nix would receive an introductory success fee upon completion of a transaction between Henley & Partners and the political client.

SCL, the parent company of now-infamous Cambridge Analytica, had come under fire in 2018 for using Facebook data and micro-targeting to influence election outcomes.

British political magazine The Spectator published a feature article in 2018, claiming that Cambridge Analytica and Christian Kalin had worked together on general elections in the Caribbean where citizenship-by-investment programmes were in place.

Emails seen by The Spectator show Kalin speaking with the leader of the opposition in St Vincent and the Grenadines, describing "what we could do with you once you are in government".

These allegations were quickly rebuked by Henley & Partners, insisting that it has never had any formal working relationship with Cambridge Analytica in the Caribbean or elsewhere.

This is a joint investigation by The Malta Independent, MaltaToday, and other partners, coordinated by the Daphne Caruana Galizia Foundation. The production of this investigation was supported by a grant from the Investigative Journalism for Europe (IJ4EU) fund.