The 2018/2019 evaluation

MONEYVAL, a Council of Europe body tasked with assessing compliance with the principal international standards to counter money laundering and the financing of terrorism, published an evaluation report on Malta in September 2019. This evaluation exercise was not specific to Malta: in fact, regular evaluations on countries around the world are carried out. These evaluations are carried out either by the FATF itself or, as in Malta's case, by other FATF-style regional bodies such as MONEYVAL.

The FATF is the international standard-setter for Anti Money Laundering/Counter Funding of Terrorism (AML/CFT). MONEYVAL is a regional player that falls under the Council of Europe. Its full name is: Committee of Experts on the Evaluation of Anti-Money Laundering Measures and the Financing of Terrorism. While different assessment bodies may carry out these evaluations, the same international standards and assessment methodology are always used. The standards and common methodology are adopted by the FATF.

A new methodology

In the 2018/19 evaluation of Malta - the country's fifth evaluation since 1998 - MONEYVAL used a new methodology that was adopted by the FATF in 2013. Unlike the previous methodologies used, the new methodology did not only look at AML/CFT laws and policies, but also at the country's ability to effectively implement them. To put it more simply, pre-2013 evaluations focused mainly on the technical element, whilst post-2013 evaluations put more focus on effectiveness. The technical component of the assessment is based on 40 technical Recommendations. The effectiveness component, on the other hand, is based on 11 Immediate Outcomes.

Technical vs Effectiveness

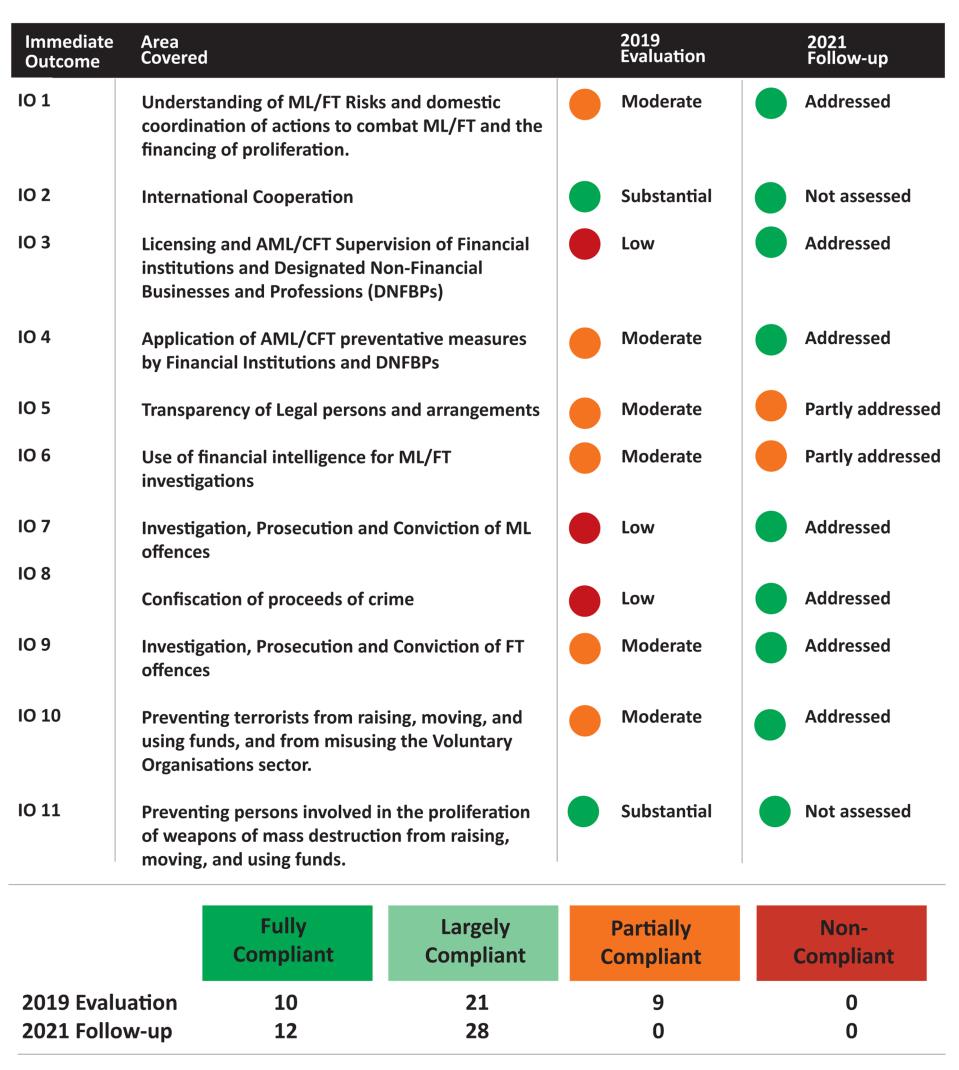

In the 2019 evaluation, Malta received a positive assessment on the technical component, obtaining a positive rating for 31 out of the 40 Recommendations. In fact, it was rated as being 'fully compliant' with 10 Recommendations, 'largely compliant' with another 21, and 'partially compliant' with a further 9 Recommendations. No Recommendations were rated as being 'non-compliant.'

In the Effectiveness Component, Malta was given a 'Substantial Effectiveness' rating in two Immediate Outcomes, a 'Moderate Effectiveness' rating in six Immediate Outcomes, and a 'Low Effectiveness' rating in another three. Effectiveness ratings range from High and Substantial (which are the highest and considered to be positive ratings) to Moderate and Low (considered to be the lowest and negative ratings). The Immediate Outcomes in which Malta got a low score were: Licensing and AML/CFT Supervision of Financial institutions and Designated Non-Financial Businesses and Professions (DNFBPs); Investigation, Prosecution and Conviction of Money Laundering offences; and Confiscation of proceeds of crime. Malta was given 58 Recommended Actions by MONEYVAL to address the shortcomings identified across all the Immediate Outcomes. (SeeTable)

In view of the results obtained in relation to the effectiveness component assessment Malta was placed under the scrutiny of an FATF working group called International Cooperation Review Group (ICRG), meaning that the country's progress would be monitored by both MONEYVAL and the FATF. The scope of the follow-up conducted by the two bodies is different. While MONEYVAL focuses on the progress made by the country on its technical shortcomings, the FATF monitors the country's ability to improve its effectiveness in implementing the laws and procedures.

MONEYVAL follow-up

In April 2021, Malta passed the MONEYVAL follow-up assessment. MONEYVAL concluded that Malta had passed all necessary reforms and that the 9 technical Recommendations that had been rated as 'Partly Compliant' in the 2019 evaluation were now rated as 'Largely Compliant' or 'Compliant.'

This means that Malta is one of very few countries that have a positive rating for all 40 technical Recommendations.

FATF follow-up

In June 2021, the FATF delivered its verdict, on whether Malta had addressed all the 58 Recommended Actions given by MONEYVAL in relation to the 11 Immediate Outcomes on effectiveness. Its assessors concluded that Malta had made satisfactory progress on 7 out of the 9 Immediate Outcomes which had been rated low or moderate in the 2019 assessment. These included the three Immediate Outcomes previously rated as Low (Supervision, ML Investigation and Prosecution and Confiscation).

On the other hand, however, it found that two Recommended Actions linked to Immediate Outcome 5 (related to the sanctioning of companies and company gatekeepers for beneficial ownership-related failures) and one Recommended Action linked to Immediate Outcome 6 (related to the generation and use of financial intelligence to investigate and prosecute Money Laundering emanating from tax evasion) had been partially addressed, and more progress needed to be registered.

The grey listing

In view of these three (out of 58) outstanding Recommended Actions, the FATF agreed with Malta to implement an Action Plan to address these remaining three shortcomings. Malta was consequently placed on a list of countries under increased monitoring - also referred to as the grey list. The country is being monitored by the FATF until the agreed Action Plan is fully implemented. Once the FATF is of the opinion that the Action Plan is satisfactorily implemented, the FATF follow-up procedure envisages the carrying out of an on-site visit, which would take place between one FATF Plenary and another. The purpose of this on-site mission would be to verify on the ground the progress achieved and to confirm or otherwise that the Action Plan has been fully implemented. A positive outcome from the on-site visit would lead to Malta's removal from the grey list.

The efforts being made to remove Malta from the grey list will be discussed during an Indepth interview with FIAU Deputy Director Alfred Zammit, which will be published on 5 December.