On 1 October, the Finance Ministry formally submitted to the European Commission an Economic Partnership Programme, together with a Report on Effective Action, which outline government’s plan to close 2013 with a general government deficit below 3%.

The Economic Partnership Programme is divided in two main chapters. The first chapter presents the government’s key policy planks, which represent the crux of the government’s fiscal, and economic strategy and which also correspond to the Country Specific Recommendations.

Furthermore, the fiscal framework underpinning the overall strategy is laid forward. This fiscal framework will ensure that Malta moves towards fiscal consolidation and achieves fiscal sustainability.

The second chapter lays forward the necessary measures and reforms taken by the Malta government in all sectors of the economy to ensure that Malta will exit the excessive deficit procedure permanently.

The main economic and fiscal measures proposed include the diversification of energy sources and the restructuring of the energy corporation (Enemalta); the restructuring of Air Malta; the pension reform process including the proposed introduction of the third pillar pensions; reforms underway in the health sector; further investment in education; as well as measures to reduce the poverty trap and therefore encourage people to get into employment rather than stay dependent on social benefits.

Other important measures included under the EPP are measures to increase competitiveness through diversification, through incentives and programmes aimed at SMEs and other businesses and through various other reforms, including the holistic Justice reform.

The Report on Effective Action focuses on providing a quantitative analysis on how the government will reduce the deficit-to-GDP ratio below the 3% threshold.

Economic Partnership Programme

It is now six months since the new Labour government came to office. During this period the government has made it its priority to stabilise and consolidate Malta’s fiscal position, while at the same time address the longstanding issues included in the country’s CSRs. The government has committed itself to reducing the deficit to 2.7% by year-end 2013 in contrast to an end of year 2012 deficit of 3.3%. It is further committing itself to further consolidation during 2014 ending the year with a deficit of 2.1%.

For 2014, the government is basing its projected revenues on an estimated real GDP growth rate of 1.7% per annum (refer to Table 1). The European Commission, the Central Bank of Malta and the IMF are estimating a marginally higher growth rate.

The growth rate for this year’s first two quarters stood at 1.8%. A strong labour market performance continued to underline economic developments in Malta. During the second quarter Eurostat reported that employment increased year-on-year by 3.6%, the highest rate in the EU and higher than Malta’s previous four quarters. Female activity in April 2013 increased by 2.7 percentage points compared to a year earlier. Unemployment still stands at a relatively low rate of 6.3%. Inflation has fallen below 1% year-on-year.

On its part, the European Commission projected a much higher deficit of 3.7% of GDP for 2013, despite very similar macroeconomic projections. The discrepancy between the two sets of forecasts was predominantly due to more conservative estimate of the impact of measures undertaken by the government to contain the public expenditure pressures and the active drive to collect more revenue, including past unpaid arrears.

As part of the drive to monitor closely the fiscal situation, the Ministry for Finance is now producing revenue and expenditure forecasts on a monthly basis for cash data and on a quarterly basis for accrual adjusted data. This enables a real time comparison of the actual outturn with the corresponding projections and identifies variances in time to allow government to take the necessary action. This method is being run in parallel with risk assessment methods used in the past.

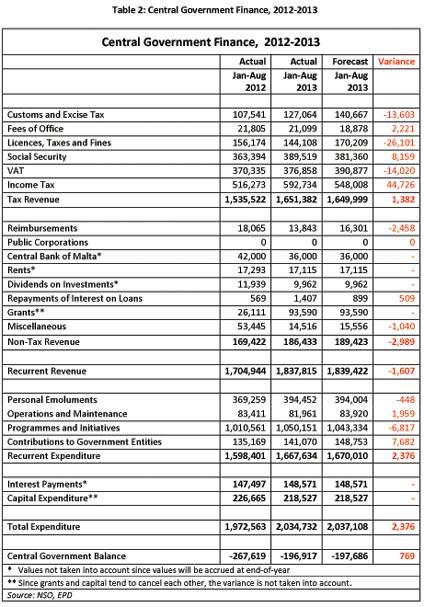

Recent cash data up till August 2013, which is presented in Table 2, suggests that while indirect tax revenue is slightly lower than projected, direct tax revenue is stronger than anticipated while expenditure is marginally less than that projected. Overall, there are no indications of any major deviations from the overall fiscal targets for 2013 suggesting that the target deficit of 2.7% of GDP remains attainable.

Government’s Strategy and the Fiscal Framework

Key Policy Planks

The government’s economic and fiscal strategy rests on a number of key policy planks, which are vital for the development of the economy and are included in the country’s CSRs:

1. Ensuring public finance sustainability in the short to medium term, while also addressing the long-term;

2. Raising potential output, in particular through productive capital investment, raising skill and education levels, promoting lifelong learning and increasing labour force participation;

3. Enhancing the competitiveness and transparency of the products and services markets while strengthening consumer protection;

4. Ensuring that the public service is not only efficient and cost-effective, but delivers a quality service;

5. Safeguarding the successes achieved by the Maltese financial sector as based on sound regulation and ensuring it continues to follow rigorous practices; and

6. Prioritising the promotion of a diversified and balanced economy.

Fiscal Framework

To achieve the policy aims the government has outlined a fiscal framework that ensures transparency in policy making for the future years. These reforms are outlined below and presented in more detail in Annex 1:

Fiscal Rules that provide a medium term economic strategy. A Fiscal Responsibility Act will be presented to Parliament.

The functions of an Independent Fiscal Council are envisaged to be undertaken by the Audit Office in Malta, which is already backed by a legal framework to ensure its independence and adequacy of resources.

Planning total for Public spending to be presented and endorsed by Cabinet and the setting up of a Star Chamber to adjudicate on public spending priorities,

Multi-year budgets so that ministries have pathways for public spending as opposed to a stop start model of one-year budgets. In addition proposals for the setting up of a contingency reserve fund and the regulation of supplementary estimates are being proposed

A comprehensive spending review with zero budgets ad policy outputs to ensure that ministry spending reflects changing priorities.

For the period 2013 to 2016, the gradual losses from the revision in the income tax regime affecting direct taxation will be offset by similar gradual revisions in indirect taxation planned in the context of the budgetary exercise for the upcoming year. Moreover, revisions to the VAT legislation are before Parliament. These will empower the minister responsible for finance to revise as necessary the penalties and interest payable on taxation due in order to increase tax compliance and ease the recovery of amounts due.

Tackling tax evasion, avoidance and enhancing efficiency in revenue collection: The various government revenue departments are being consolidated into one authority. Through this restructuring, government is aspiring to utilise the resources available in the Inland Revenue Department, the VAT Department and the Tax Compliance Unit with maximum efficiency. Once the different departments are merged the new entity will be able to use the information at its disposal more effectively and will be in a more favourable position to prevent tax evasion. Other legal and administrative measures being undertaken will update and simplify tax legislation, improve tax audits, enhance risk analysis, raise penalties and sanctions on non-compliance, increase human resource complement and improve its quality through training, strengthen the link with foreign tax authorities, maintain double-tax agreements, strengthen the power of the Commissioner for Inland Revenue, strengthen the provision on transfer of shares, and strengthen the legal framework to combat tax evasion. Further details are provided in the table of measures in Annex 2.

Fiscal and economic reforms under the Economic Partnership Programme

In addition to the rule-based approach on policy making, the government can report major progress on specific policy initiatives. Taken together these initiatives confirm the government’s commitment to sustainable public finances. These economic and fiscal reform initiatives include:

Diversifying energy source and restructuring the energy corporation

Government recently announced that it had signed a Memorandum of Understanding with the China Power Investments Corporation, one of the five largest state-owned electricity producers in China. As part of the agreement, Shanghai Electric Power, a subsidiary of CPIC will become a minority shareholder in Enemalta, providing the Maltese utility company with a cash injection of about €200m and provide an AAA strategic partner that will improve its financial position and therefore reduce the risks to government public finances.

In 2012, Enemalta’s total debt reached more than €830m (12% of GDP), of which 85% is guaranteed by the government. As of end-2012, guarantees to Enemalta represented about 50% of the government’s total guarantees.

In the short run Enemalta is expected to generate €36m in savings from the recently installed diesel-run power plant. This has cut the cost of electricity generation to 11 cents/unit, from 17-18 cents. Management sees further revenue boosting potential through an ongoing cost-reduction exercise, settling and resolving a number of locked and past-due accounts, greater billing efficiency, and the benefits derived from the PPPs, savings from the new generation engines, the interconnector and potential sale of non-strategic assets which could generate nearly €75m.

The 200MW 230kV HVAC sub-sea interconnector between Malta and Sicily is expected to be completed before the end of next year, when, Enemalta is expected to break even.

Furthermore, government is committed to switch Malta’s energy generation facilities from Liquid Fuel Oils to Natural Gas through the construction of a new highly efficient generating plant and Liquefied Natural Gas (LNG) infrastructure. The gas plant is expected to be an LNG storage and regasification facility which will meet the total gas supply requirements of the new (circa 200MW) gas-fired baseload generating plant; and Enemalta’s gas requirements to operate its 149MW Diesel Engine plant which will be converted to operate on gas. The new gas-fired CCGT generating plant shall be based on a proven, advanced CCGT design with a rating of approximately 200MW.

The gas plant project is currently on track, in fact three consortia out of 19 bidders were recently short-listed including ElectroGas Malta Consortium, Yildrim Tecnicas Power and Gas Consortium and Endeavor Energy, Exodus Crussing and BB Energy Consortium. The investment in a new gas-fired generating plant will lead to considerable improvements in respect of efficiencies in the generation of electricity leading to reduction in overall costs. It will also achieve significant reductions in air pollution in the country.

In the meantime, a comprehensive study that includes a cost-benefit analysis to determine the commercial viability of gas interconnection as well as its effect on the Maltese economy is being prepared. The study will also look into other externalities of the project such as security of supply, competitiveness, sustainability, and shall identify those aspects that make it a potential Project of Common Interest as defined by the proposed Regulation on guidelines for trans-European energy infrastructure (which repeals Decision 1364/2006/EC on TEN-E). The study may be used to support an application to the European Commission for financial assistance from the Connecting Europe Facility funding instrument under the Commission’s energy infrastructure package.

Malta is continuing to pursue the development of its internal electricity distribution network, both to meet increased consumer demand and to enable the connection of increased renewable energy installations. A new 132kV primary distribution centre (sub-station) in Kappara has been constructed and is intended to receive the electricity imported from the Interconnector and to distribute it to the network for distribution throughout Malta.

Restructuring of Air Malta

The Air Malta restructuring programme is focused on cost cutting measures and initiatives to boost revenue. In 2013, the company received an EU approved injection of €40m. Measures to cut costs include in-flight catering costs, better fuel efficiency and improved deployment of resources. Contract negotiations with third parties should also result in a reduction in ground handling and landing costs.

Furthermore, a number of ongoing measures are being implemented to optimise revenue potential. These include, among others, the Network planning and fleet deployment optimisation together with an effective pricing strategy supported by marketing tactics. The signing of new charter flight contracts will also contribute to increase Air Malta's revenue. Moreover, a better process control particularly in Outstations together with Initiatives to increase on-flight sales (meals and other products) shall also contribute to raise revenue. New contracts were also signed in relation to Handling and Engineering Services offered to third parties.

The new Pension reform process

Following the election of the new administration in March, government has expressed its commitment for the continuation of the pension reform process in Malta. A Joint Pensions Working Group – the Pensions Strategy Group – between the Ministry for Finance and the Ministry for the Family and Social Solidarity was set up to review the work carried out by the Pensions Working Group, in particular the recommendations outlined in the Post-Consultation Report submitted to government in August 2012.

Furthermore, it has been tasked to draw up a holistic strategy aimed at addressing the adequacy and sustainability of pensions in Malta and develop a communications strategy directed towards raising the level of public awareness on pensions’ issues. It will also emphasise the need to ensure that future pension incomes are adequate in order to sustain a high standard of living in retirement.

Third Pillar pensions

An Advisory Group on Third Pillar Pensions has been set up and has made a number of recommendations relative to the introduction of such voluntary schemes in Malta. The group also recommended the introduction of tax-favoured accounts, where interest earned on these accounts would be tax-free, with the option of converting such accounts into personal retirement schemes.

Such tax-favoured accounts would supplement the introduction of voluntary third pillar pensions in Malta. Under a cautious scenario where take-up is partial and in line with current saving behaviour, the cost of tax relief could be in the range of €3.3 - €9.9m, depending on the type of tax relief to be adopted by the authorities.

Making work pay

Government aims to reduce the current poverty trap by introducing incentives to ensure that being in work is always better than being dependent on social benefits. To achieve this objective, government is studying ways of introducing a tapering system so that those who are long-term unemployed and join the labour market do not lose their benefits at the rate of 100%. Government is also seeking to introduce tax incentives so that households do not lose income if a second breadwinner joins the labour market.

Health reforms

Government is introducing a series of health reforms that ensure better use of community care facilities to release pressure on the national public hospital including the continuation of the health reform of moving patients from social beds to residential homes utilising capacities in both the private and public sectors, reforming the medicine procurement process and centralising the storage of medicines.

At Mater Dei Hospital there are approximately 70 “social” beds occupied by elderly persons needing long-term care. These beds are costing the Ministry for Health approximately €200 per day. The aim is to move some of these occupants into community nursing homes to transfer the cost of long-term care in hospitals to a lower-cost community care.

Raising economic growth potential through investment in human capital

A series of policy initiatives have been introduced by the Ministry of Education to ensure high levels of education attainments of our student population and these include improving literacy, providing better community access in deprived areas and providing incentives for students to stay in school longer.

Furthermore, government is introducing and widening childcare facilities to allow working mothers to enter the labour market. There are also initiatives to open schools earlier and provide support for longer hours to help working parents with childcare.

There are also programmes being launched aimed at continuing to retrain the existing workforce, updating their skills and increasing labour force participation.

For Malta to catch-up with its European peers in relation to the skill level of its working-age population and the number of persons in the working-age population that opt to enter the labour force, reforms are underway with respect to the National Curriculum Framework, Early School Leaving Strategy and the National Literacy Strategy.

In addition, government remains committed towards raising the number of persons in tertiary education through the development of new scholarship schemes that complement ongoing programmes. Government will also be launching a Lifelong Learning Strategy, which coupled with the ongoing and new training programmes, shall contribute to raise the skills and competences in the labour market.

With regards to raising the labour force participation rate, especially among females, government is planning to complement its support to working parents through the introduction of free childcare centres. Government is also introducing changes in the tax-benefit system intended to make work pay, alongside labour activation programmes, notably through the launch of the Active Ageing Strategy.

Enterprise and competitiveness

Government has introduced a series of legislative frameworks to improve competitiveness, cut red tape and reduce the costs of regulation on enterprise. The reforms in the judicial system are aimed at increasing transparency and reducing the invisible costs of bureaucracy.

Transport policy also plays a key role in raising competitiveness in Malta. In this regard, government is presenting initiatives focused on raising energy efficiency alongside the ongoing public transport reform.

Some of the energy efficiency measures in the transport sector include the tax reform to further incentivise a newer, smaller and less polluting fleet of vehicles; an increase in the share of sustainable biofuel as a percentage of the total energy content of petrol and diesel imposed on importers/wholesalers of fuel for the transport sector and a scrapping scheme with the aim of encouraging owners of old passenger cars and old light commercial vehicles to scrap their old vehicles and buy new vehicles in the same category as their scrapped vehicles.

With regards to the ongoing public transport reform, further improvements to the system are being proposed aimed at increasing passengers and hence increase the use of public transport.

In fact, government has entered into discussions with the operator in order to try and find areas where the service can be improved.

Justice reform

Finally, the holistic justice reform is also expected to contribute to competitiveness in Malta by enhancing the quality of the business environment by containing administrative burdens and hence reduce administrative costs. It will also help to reduce pending cases and the average time it takes for Judiciary personnel to decide on the court case.

This will lead to significant cost-savings as currently the system is imposing on the citizens to spend a cumulative 3.5 million hours each year to attend Court sittings.

The justice reform will involve, among other measures, the investment in ICT

Technology and capacity building including training of personnel, the refurbishment of the Malta Courts building and the building of a new court in Gozo, will have to be financed through national funds.

Government is also keen to reduce bureaucracy in an effective manner. In this regard, government has appointed a junior minister tasked with the simplification of administrative processes that set the objective of a reduction of 25% in existing bureaucratic procedures. Initiatives are at present underway to reduce the length of public procurement procedures. A report was commissioned and an inter-ministerial committee is formulating recommendations.

Maritime strategy

Work on a maritime strategy is underway, supported by a number of capital projects, notably the development of a maritime hub. An expression of interest, which was recently launched, has had a very good response.

International business in Malta is also being supported through the launching of Global Residence Programme designed to attract high net-worth individuals to Malta.

Further details on government’s economic and financial reforms are outlined in the Annex 2.

Report on effective action

In 2012, an unexpected worsening of economic conditions caused by the protracted electoral uncertainty led to weaker domestic demand and postponed private consumption. This impinged negatively on public finances. As a result the actual fiscal imbalance recorded in 2012 increased by 1.0 percentage points over the Budget estimate to 3.3% per cent of GDP, thus exceeding the 3% of GDP reference value of the Treaty.

In addition, in 2012 the debt ratio was above the 60% of GDP reference value, and Malta did not make sufficient progress towards compliance with the debt reduction benchmark, in line with the requirements of the transition period.

Against this background, on 21 June 2013, the ECOFIN Council decided that an excessive deficit existed in Malta and recommended that Malta takes action to reduce the excessive deficit by 2014.

Furthermore, the Council set headline deficit targets of 3.4% of GDP for 2013 and 2.7% of GDP for 2014, consistent with an improvement of the structural balance of 0.7% of GDP in both years while also setting a deadline of 1 October 2013 for taking effective action. The Council called on Malta to continue progress towards its medium-term objective of a balanced budget in structural terms following the correction of its deficit.

Meanwhile in the revised Budget for 2013 and also in the Stability Programme submitted in April 2013 Malta committed to reach a deficit target of 2.7% of GDP in 2013 supported by a number of structural reforms and on the assumption of a recovery in revenue due to the expected improvement in economic sentiment following the election.

It is also the result of further positive fiscal outcomes arising from the 2006 pension reform, which included, among other things, the gradual rise in retirement age from 61 to 65 (0.4% of GDP).

Past measures aimed at enhancing revenue efficiency (including tax arrears collection schemes and administrative measures aimed at improving tax audit and tax compliance) were also expected to contribute further to fiscal consolidation to the tune of 0.2% of GDP.

Administrative measures to control expenditure (particularly intermediate consumption) were also expected to contribute 0.3% of GDP towards fiscal consolidation.

These structural measures (in total 0.9% of GDP) coupled by the recovery in deferred indirect tax revenue (estimated 0.5% of GDP) were expected to mitigate the impact of expansionary measures (estimated at 0.9% of GDP).

The revision in income tax bands (€12m) and the restructuring of Air Malta (€40m) were expected to contribute about 0.7% of GDP to general government expenditure.

On its part, the European Commission projected a much higher deficit of 3.7% of GDP despite very similar macroeconomic projections.

The discrepancy between the two sets of forecasts was predominantly on the revenue side and was mainly due to the European Commission’s conservative approach to the estimation of the impact of structural measures on the revenue side compared to those submitted by Malta in the Stability Programme.

Enhanced monitoring

As part of the strengthening of the fiscal frameworks the Ministry for Finance is now producing revenue and expenditure forecasts on a monthly basis based on seasonal patterns for cash data and on a quarterly basis for accrual adjusted data in order to compare in real time actual versus projections and identify variances in time to allow government to take the necessary action. This is being run in parallel with risk assessment methods used in the past, which also evaluated monthly revenue and expenditure trends against end-of-year estimates and previous year outturn. These are supplemented by the daily reports from the main revenue departments evaluating the trends in revenue collection together with a regular risk assessment.

Government Revenue and Expenditure in 2013

The following section contains the comparison of actual revenue and expenditure compared to monthly budgetary projections included in the Budget 2013 estimates presented last April.

Recent cash data up till August 2013 suggests that indirect tax revenue is lower than projected mainly due to a €66m shortfall in excise duty from Enemalta which is expected to materialise before year-end.

Direct tax revenue is however stronger and compensates for the mentioned shortfall in indirect taxation. Total expenditure has been contained within the estimated values.

Overall there are no indications of any major deviations from the overall fiscal targets for 2013.

Table 1.A gives a clear indication of the main upside and downside risks towards achieving the fiscal targets. The table shows that the target deficit of 2.7% of GDP remains attainable.

In-Year Budgetary Execution

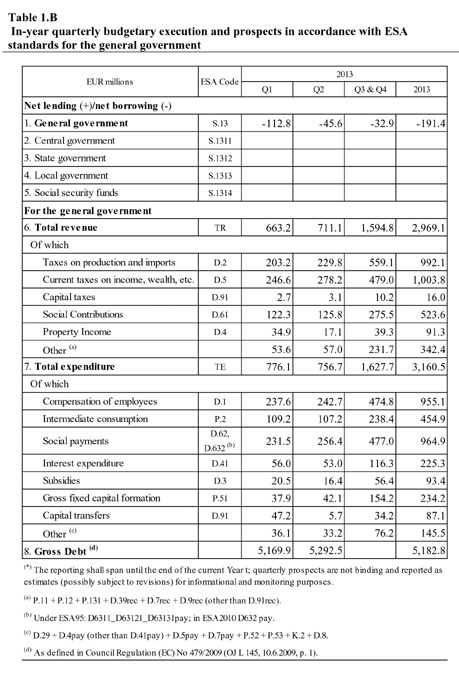

Table 1.B, which utilises accrual data in ESA 95 with time-adjustment, shows the estimated revenue and expenditure components for the first half of 2013 together with the projections for the second half of the year. Data for the first half of the year is still provisional while data for 2013 has been revised after taking into account the risk factors identified in section 3 above. When evaluating these estimates it is also important to keep in mind that macroeconomic forecasts project a recovery in domestic demand conditions in the second half of the year.

Moreover, seasonal factors based on past experience indicate that a larger proportion of revenue and expenditure materialises in the last quarter of the year. As a result the in-year budget performance will not be symmetrical between the first half of the year and the second half of the year.

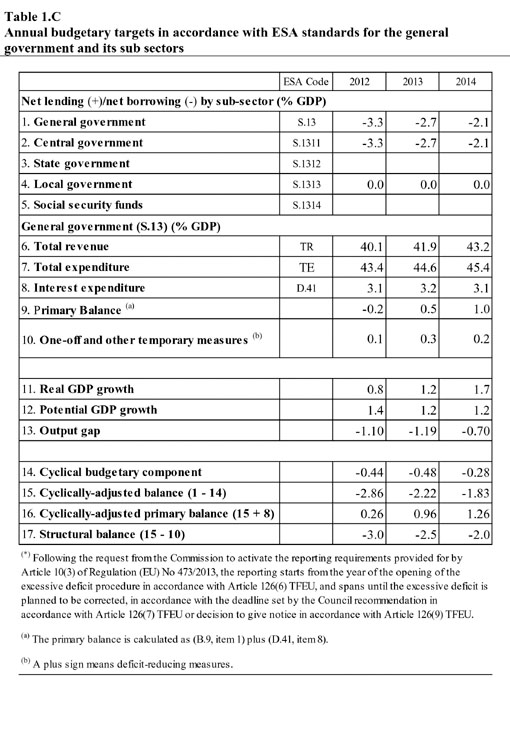

Table 1.C shows the annual budgetary targets expected for 2013 and 2014 consistent with the planned reduction in the general government deficit, which will underline the budget for 2014. Table 2 presents these targets in more detail.

Fiscal stance in 2014

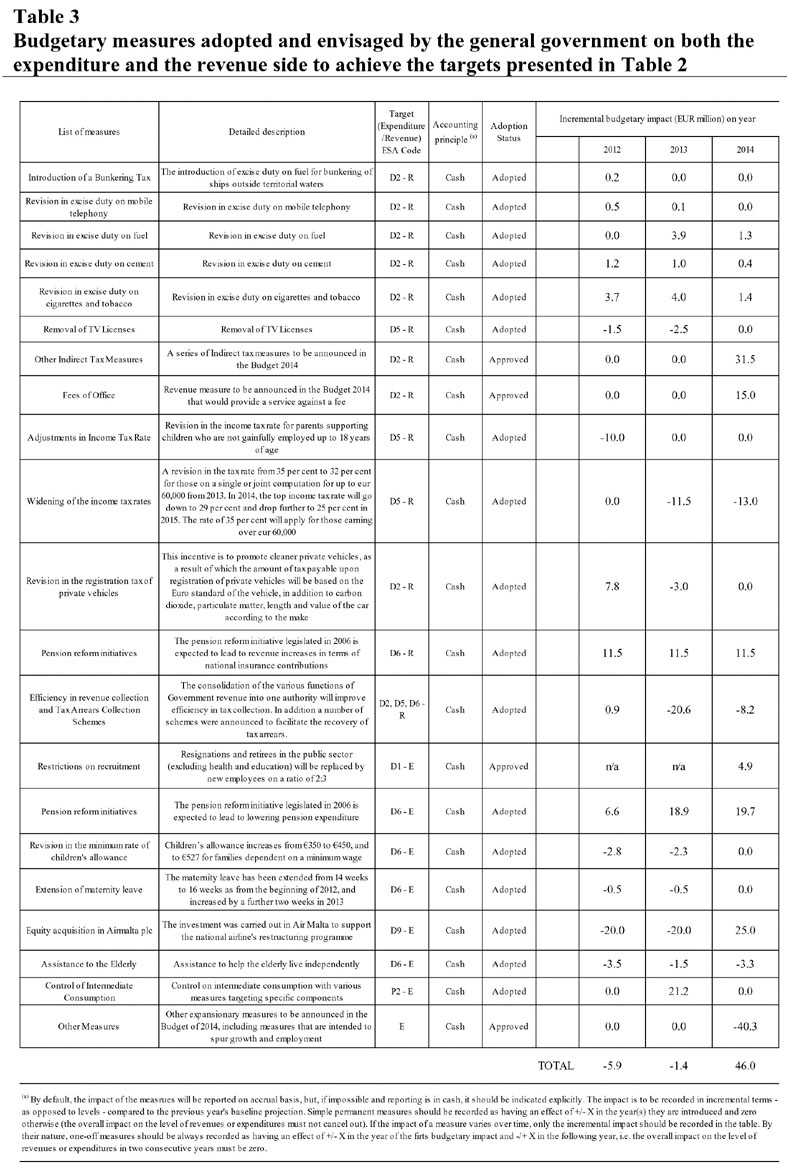

A number of structural fiscal consolidation measures underline the structural effort envisaged for 2014, which will support the budget for that year. Some of these measures were included in the Stability Programme presented last April but were not specified. These measures are presented in Table 3.

Shift from Direct to Indirect taxation

Government’s policy to shift taxation from direct to indirect will be sustained over the medium-term.

Indeed, further to the revisions in the income tax regime in recent years, the 2013 Budget provided for the widening of the income tax bands for single and joint tax computations, and for parents supporting minors who are not gainfully employed. However, this will be implemented gradually in a manner that will limit the expansionary impact on public finances, which will amount to 0.17% of GDP in 2014.

For the period 2013 to 2016, the gradual losses from the revision in the income tax regime affecting direct taxation will be offset by similar gradual revisions in indirect taxation planned in the context of the budgetary exercise for the upcoming year. Moreover, revisions to the VAT legislation are currently ongoing. These will empower the minister responsible for finance to revise as necessary the penalties and interest payable on taxation due in order to increase tax compliance and ease the recovery of amounts due.

Pension reform measures

In December 2006, the House of Representatives adopted a series of parametric reforms (Act No. XIX of 2006) to the definition of pension age, retirement before pension age, the full rate of two-thirds pension, calculation formula, the maximum pensionable income and the crediting of contributions as provided for under the preceding legislative framework. The reform law adopted by the Maltese Parliament was aimed at enhancing the sustainability of the pension system while improving the adequacy of the pension enjoyed by retirees in the future. The 2006 reform constitutes one of the main policies supporting the structural effort as conceived in the Stability Programme and in this Report.

The increase in the pension age, the increase in the contribution period for full pension eligibility and the changes to the bene?t formula contribute to lower the projected increase in pension expenditure. The pension reform initiative legislated in 2006 is expected to contribute positively in terms of revenue from social security, equivalent to 0.16% of GDP in 2013 and 0.15% of GDP in 2014. In addition, pension reform initiatives are expected to reduce public expenditure by 0.27% of GDP in 2013 and 0.26% of GDP in 2014.

Air Malta restructuring

In view of the important function of Malta’s national airline in supporting the local tourism industry, the ongoing restructuring of Air Malta will be sustained by a government equity injection. To date, €20m and €40m have been disbursed in 2012 and 2013 respectively. A further €15m in equity injection is planned for 2014. Cost-cutting measures and initiatives to boost revenue in Air Malta as part of the restructuring programme are detailed in the Economic Partnership Programme.

Expenditure consolidation measures

Government is committed to continue reviewing its expenditure programme through a comprehensive spending review. The CSR is assisting each ministry to identify cost savings through the elimination of waste and other inefficiencies, as well as facilitating the exchange of good practices and incentives to ensure that the country's finances are improved.

The review provides a framework for the ministries to explore their line items to introduce zero budgets and outputs for lines of expenditure to ensure that spending is continually being reviewed according to changing needs and priorities. These reviews are to serve as a platform for medium-term public finance forecasts.

On 28 June 2013, a series of budgetary reductions were decided upon, communicated to the respective ministries and incorporated into the government accounting system (DAS).

Furthermore, government is committed to restart the practice of restricting recruitment and reducing public sector employment through attrition. In particular, government is committed to restrict the replacement of retirees and resignations by a ratio of 2:3. Health and education will be excluded from this exercise. It is to be noted that every year there are roughly 1,500 public sector employees who retire or resign from their posts. This policy would effectively reduce public sector employment by around 500 per annum. This policy will be reviewed every year. Potential savings from this policy could amount to around €4.9m in 2014 and additional savings in subsequent years.

Other expenditure restraint measures are planned by government and support the expenditure targets presented in this report.

Debt dynamics

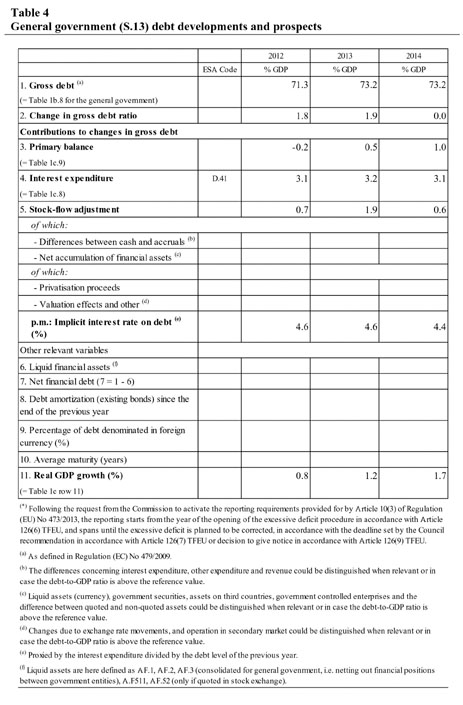

As a result of the fiscal consolidation measures and the overall fiscal stance the rise in the debt ratio is expected to stabilise to 73.2% of GDP in 2014. The primary balance is expected to lead to a contraction of 0.5 percentage point in the debt-to-GDP ratio during 2013. On the other hand, interest expenditure and the stock-flow adjustment are expected to have an expansionary impact of 3.1 and 1.9 percentage point respectively on the debt ratio during the aforementioned period. Debt dynamics are shown in Table 4.

Conclusion

Government is committed to achieve the targets presented in the Stability Programme with a view to correct the excessive deficit by the end of 2013 as planned and further carry out structural fiscal consolidation measures in 2014 to ensure a permanent correction in the deficit and embark on the trajectory of reducing the structural deficit and reach the medium-term objective of a balanced budget in structural terms. The fiscal consolidation strategy is built primarily on the pension reform initiatives and a shift from direct to indirect taxation coupled with restraints on discretionary expenditure and an increase in expenditure efficiency.

This Report on Effective Action has highlighted in more detail the specific measures being envisaged. Further details will however be presented in the forthcoming budget.

This report is complemented by the Economic Partnership Programme, which details the structural economic reforms, which will support a durable correction in fiscal imbalances in the medium- to long-term. Both reports are being published as testimony to government’s commitment to these reforms.