“Our stand as a delegation, both on the Nationalist side and the Labour side, is ‘yes’ to tax transparency: we should say exactly what we are doing, but ‘no’ to giving up the way we do it,” Socialists and Democrats MEP Alfred Sant said.

Speaking to The Malta Independent on Sunday, Dr Sant explained the reasons why he voted against a resolution put forward by the Committee of Economic and Monetary Affairs at the European Parliament.

The resolution included a number of measures relating to multi-national corporate taxation. Many of these measures relate to tax transparency which, he explained, is something by which all Maltese MEPs firmly stand. The problem lies with tax convergence and the infamous Corporate Common Consolidated Tax Base (CCCTB) which, as Dr Sant put it, “Is not in Malta’s best interests.”

The revelations of the ‘LuxLeaks’ scandal sparked public outrage, leaving the EU no choice but to evaluate the current taxation practices of each member state.

“At the moment, taxation is under the sole jurisdiction of member states. It is not in Malta’s interest to lose that sovereignty. The whole thing was sparked off by the ‘LuxLeaks’ scandal, where tax rulings published showed that many multi-national companies were given quite liberal treatment on tax. This caused them to save a tremendous amount of money which could, of course, have gone to other member states.”

This liberal treatment effectively made it profitable for multi-nationals to move taxable profits from nearby countries – to Luxembourg in this case, and pay a far lower tax rate than in the countries in which they were actually operating and earning profits.

A number of countries, Malta included, have been offering preferential tax rates in order to incentivise multi-national companies to set up shop, move profits and pay taxes. This is synonymous with the governments of smaller economies, since companies do not have the opportunity to earn similarly large profits as is the case with larger countries and larger economies.

“As a socialist I agree to the ethical arguments of what is being proposed. In fact, there was an MEP from Holland sitting next to me, questioning why I voted against the resolution and if I was really a socialist.”

Dr Sant explained that he was voting in line with Malta’s best interests, like any MEP ultimately votes in favour of his or her national interests when this is not in accordance with what their EP party group believes.

“When the French are doing something in their national interest they bulldoze through EU rules. Flexibility was introduced in the eurozone rules recently because the French needed it. When Malta needed it, no flexibility was introduced.”

Dr Sant said that, ultimately, each MEP is going to fight for what their country needs, which is why all local MEPs have come together with one voice on this issue.

“So there were two committees set up by the EP, after the European Commission had promised to do something about the current situation. One of them went into this business of tax rulings, which are statements handed down by various Finance Ministries telling multi-national corporations how they are going to be taxed. This was discussed through negotiations that were held in secret. This was the Tax Rulings and Other Measures Similar in Nature or Effect Committee (TAXE), and its scope was how to regularise tax.

“The committee was established on the basis of regularising tax and tax transparency, which is what it was all about initially. They discussed how to introduce tax transparency, but beyond that they also started discussing matters relating to tax convergence and tax harmonisation.”

Asked for clarification about the precise difference between convergence and harmonisation, Dr Sant explained that harmonisation refers to tax systems that are extremely similar, robbing countries of their ability to alter tax rates in a way that makes the most sense for their country. Tax convergence is “half-way” to tax harmonisation he said, and allows governments slightly more flexibility.

“The second committee also looked into issues relating to tax rulings, but mostly on the basis of tax convergence within the EU. This is outside the EU’s remit but relates to issues surrounding tax evasion, tax avoidance and aggressive tax planning.”

Turning to why tax convergence is being offered as a solution to the current situation, he said: “The argument here is that if you have convergence of taxation systems, evasion would be under control.” By forcing member states to calculate tax rates on a similar basis, he said, multi-nationals would not gain anything by shifting taxable profits around member states.

“The point of view of those against tax rulings is that if you have multi-national companies recording the operations of each branch in a specific way, you can measure their profits in the same way, and produce country-by-country reporting. So multi-nationals will have a common way of recording operations, they would have to do this in each country in which they operate and transparency is able to be reached.”

A CCCTB, which has been proposed by both committees, offers a single set of criteria that multi-national companies could use to calculate their taxable profits. It allows multi-nationals to file a single tax return for all their activities within the EU through one central authority. As it stands, multi-nationals must file tax returns for every country in which they operate, which adds to the administrative burden, compliance costs and legal uncertainties.

“The point is this, when you start applying CCCTB rules themselves, they imply certain changes to your tax rules. This is an intrusion into the flexibility by which you set taxes.”

Dr Sant added that the CCCTB is a step towards tax harmonisation: “The real objective is to move towards tax harmonisation. When they [the EU] start saying this is just for multi-national corporations one cannot – or does not – trust them. It starts with multi-national corporations and goes across the board.

“We have already had to harmonise VAT in a certain way, we have had to harmonise a lot of excise taxes, we have accepted state aid rules and, under the eurozone, strict rules were accepted as to how to budget. When you are a big country, you have big endowments and large internal markets that still leave you in a somewhat strong position. When you have small endowments, and are losing your flexibility all the time, tax flexibility is what you have left. If you give that up as well you will be operating completely in line with the French and German economies. They have clout, we [Malta] do not, so we end up in a position that is not in our best interest.”

There has been much debate within the EU about matters relating to tax convergence, but the question is whether or not this will amount to concrete measures.

“Within the EP there is a big majority in favour of tax convergence. For the leftist parties this is not a problem, they agree with the proposals. The right increasingly think it should be done because the big parties from Germany and France are concerned that their national treasuries are losing a lot of money in the current situation. So they agree with what is being discussed: if not tax harmonisation, definitely tax convergence.

“However, without looking at the EP, in practise many member states are not so keen on tax convergence. There are big lobbies, in the Netherlands for example, who are against it. The UK has a strong interest, but the UK tends to strike deals for themselves and abandon the rest of the member states. Even other countries that say they want tax convergence are constrained by other issues, such as owning multi-national corporations themselves. While state multi-nationals did come to TAXE committee hearings, other French state multi-nationals tried to get out of it.

“The problem now is that Commission President Jean-Claude Junker is committed to doing something. He was Prime Minister of Luxembourg during many of the tax rulings that were uncovered by the LuxLeaks scandal so he wants to clear his name. On the other hand, you can bet your bottom dollar that he will do his best to water down some elements of what is being proposed. He has a number of commissioners, however, who are committed to doing something about the current situation. Whether the Economic Committee of the European Council will stop it is another matter entirely.

“Up to this point there has been a lot of back-tracking. CCCTB is not such an easy operation, because one of the problems would be transfer pricing [selling goods and services between various entities of the same multi-national corporation, which allows them to allocate profit before tax to the country with the lowest tax rate]. Most of the committee meetings I attended just discussed how transfer-pricing would be solved by CCCTB. It is not going to be solved, it is too complex. When you talk about services, which is where the cookie crumbles, it is too difficult to track. Look at the publicity services that are given across Europe, for example Google, which is the eye of the storm. What sort of services are given where? Where is the value added? It is not so transparent or easy to track. Manufacturing is easier.

“The problem will be for smaller countries if they continue on this path. Bigger countries have much more hinterland within which to operate and allow people to operate in.”

Asked about whether Malta should start developing some sort of contingency plan for losing its competitiveness and millions of euro in taxation revenue, Dr Sant said: “We are too dependent on financial services. Directly and indirectly, it makes up about 25 per cent of our GDP. Services such as shipping and the gaming industry feed into the financial services industry, so we are over dependent. It is in our best interests to diversify, but since we joined the EU our economy has become increasingly services-oriented. Manufacturing has shrunk, farming has never really been a viable option but has also gone down, so we are left with tourism, services and financial services in particular. Services is the option that makes the most sense for Malta, but with a wider basket of activities, if you suffer in one area it is possible to compensate in another.

“We have lost about 40 per cent of our manufacturing industry since joining the EU, which is not so good, and agriculture has gone down 50 per cent. Financial services have gone up but, to be fair, it would have gone up whether we joined the EU or not since it is an option that suits Malta very well. Once outside the EU, you fashion the financial services industry within that context, and when you join this must change. This is why Malta’s financial services sector did not do so well in the first three or four years of EU membership: it needed time to adapt to new circumstances. The point is this, once a country is reliant on financial services, it needs to try and diversify but you can’t let it go out of the window, it still needs to be propped up.”

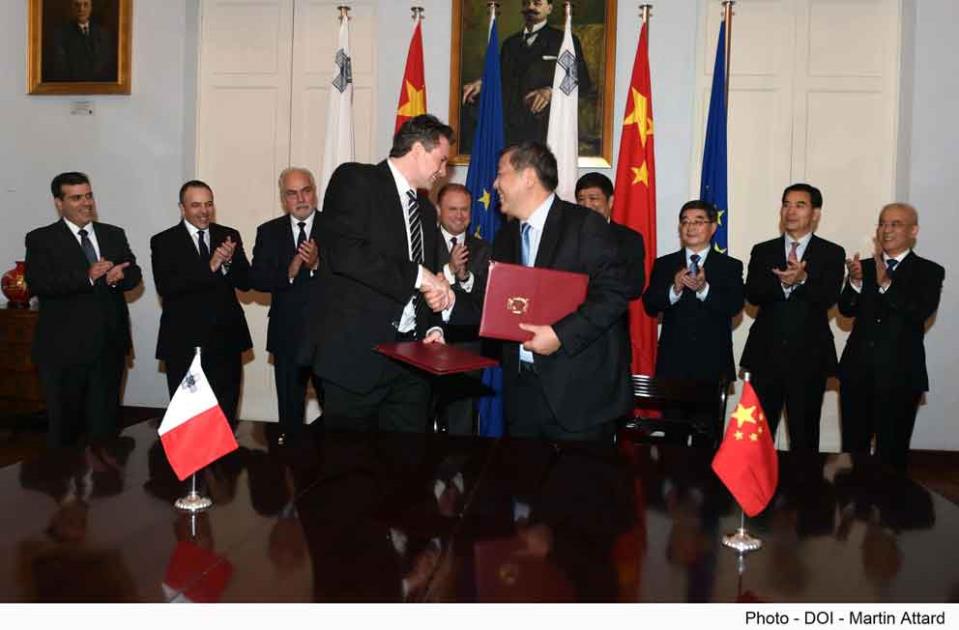

China-EU-Malta relations

There has been extensive investment by China in the EU: both regions have an interest in healthy economic growth from both sides.

“Chinese investment in the EU has been growing a lot, so China wasn’t too thrilled about the eurozone stalling because it was losing on its investment. On the other hand, the EU has been very dependent on China booming, which hasn’t been the case and so is not in the EU’s best interests.

“China is investing heavily in the EU and Africa. With regard to Africa, it invests through agricultural land and minerals. In the EU, it goes for more sophisticated facilities because the USA does not allow China to do as much as Europeans allow. So in effect, the EU is the largest developed market for China. Chinese investment has two goals, to make a profit and to create new opportunities. Investing in Malta gives access to the eurozone. It could be argued that China can do this by investing in another eurozone country, but because of the trillions of cash they have piled up over the years, it can afford to invest in many countries at once, which is what they are doing. Malta also provides China with access to North Africa, should the need arise. China thinks strategically, it might be of interest to them to have a foothold across the Mediterranean. That said, what they have invested in Malta is peanuts compared to their overall investment in Europe.”