A considerable number of motorists have been evading road and registration tax, and the cost of insurance and VRT, by failing to declare vehicles imported from abroad.

Sources speaking to this newspaper have pointed out that a considerable number of UK-registered cars in Malta (which are still bearing UK licence plates) are registered as ‘garaged’ in the United Kingdom and as such pay no road tax or MoT charges and are exempt from paying insurance. Moreover, these vehicles are virtually invisible to the Maltese authorities.

A source said that most of the people resorting to this tactic are Maltese but there are also some expats in on the act.

EU citizens are allowed to drive their cars in Malta for a period of seven out of every 12 months if they do not live here. However, if they relocate their residency to Malta they are required to exchange their licence plates to Maltese and pay , road tax and insurance. EU citizens owning a car for a minimum of 24 months in their former home country have the option to apply to Transport Malta for an exemption on Maltese registration tax. Similarly, Maltese people who import cars from the UK have 30 days to register their vehicles and switch over to Maltese plates.

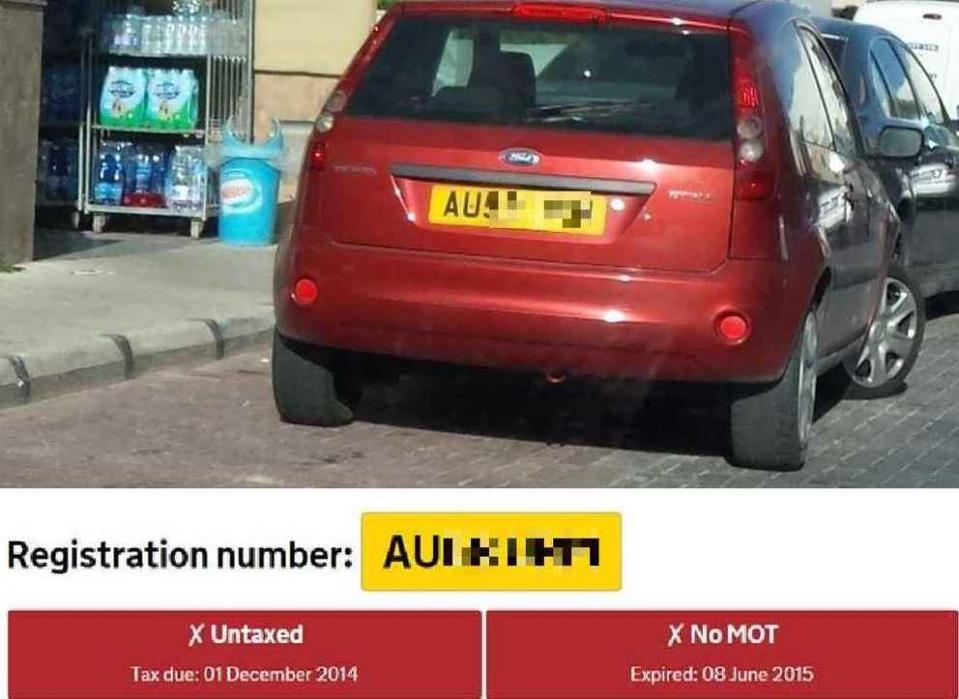

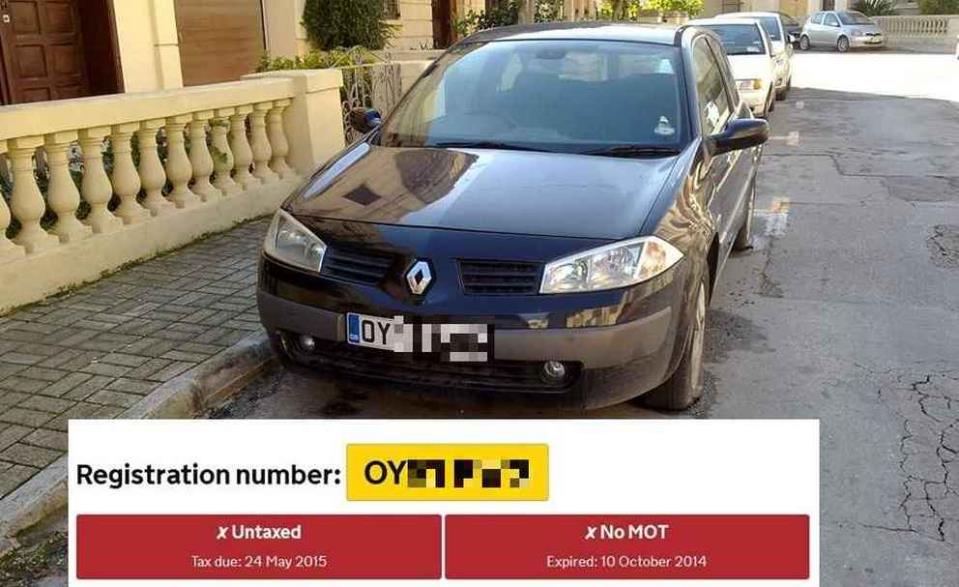

But registration number checks on the UK’s Driver and Vehicle Licensing Agency (DVLA) show that many UK cars being driven on our roads are listed as SORN, or Statutory Off Road Notification, a term which means that they are exempt from tax and MOT but which also precludes them from being used on the roads or being exported. Despite the clear rules, however, an unknown number of SORN category cars have ended up in Malta.

“People are going to the UK to buy second-hand cars, because they are cheaper there than in Malta. They ship or drive their cars to Malta and leave their UK number plates on, and no questions are asked. These cars look as if they belong to UK citizens staying in Malta for a few months or have been imported and are in the process of being registered here, but this is not the case. In doing this these people are avoiding paying registration tax. Obviously they do not bother renewing their English road tax and MOT and are also evading tax in Malta,” said the source.

He said the situation is made more complicated by the fact that the British transport authorities did away with the old tax discs late in 2014. The system was changed after the UK installed road cameras that read and check number plates to ascertain whether a vehicle is taxed. Malta obviously has no such system in place, making it difficult for the police to check whether the road tax has expired.

“In the case of garaged cars, the UK does not require drivers to surrender their plates as is the case in Malta. So anyone can ‘garage’ their car and then bring it to Malta.”

It is believed that some UK second-hand car sellers actually use SORN for their slow sellers to avoid paying tax.

It is not clear why UK sellers do not always have their name removed from a vehicle’s registration document once they sell it – thus removing all responsibility for that vehicle – although they are supposed to advise the DVLA if a vehicle is sold and/or exported.

People supposed to notify us of car exports – DVLA

This was confirmed in comments by the UK transport watchdog which said, however, that the irregularities flagged down by this newspaper were “a matter for the Maltese authorities and we cannot comment on what action they would take against vehicles that don’t comply with their rules.”

The DVLA spokesman confirmed that foreign registered vehicles temporarily used abroad are exempt from the receiving country’s tax and registration rules for up to six months in any 12 month period, provided they are correctly taxed and registered in their home state. After six months the vehicle must be taxed and registered under the rules of the receiving country.

The spokesman also confirmed that if a vehicle is being exported, the vehicle user should tell the authority and the vehicle should not be used on UK roads. “We update the vehicle register accordingly to show that the vehicle has been recorded as exported. The registered user of a UK-registered vehicle remains legally responsible for taxing it until it has been recorded as exported. If we have not been notified of the export, enforcement action may be taken against the vehicle user.”

‘I have been doing it for two years’

Our source showed us many pictures of UK-registered cars that have been driven on Malta’s roads for many months. One was a BMW which, according to the DVLA database, should be parked in a garage somewhere in the UK. The car was finally registered in Malta after “numerous” police complaints.

“Transport Malta and the police rarely bat an eyelid when it’s a foreign-registered car and wardens have no way of handing out fines. They have a problem since they have no access to foreign vehicle records through their PDAs. If they try to issue a fine in respect of a foreign-registered car it will be added automatically to the previous offender because of a technical glitch. This is completely unfair. These people are not only avoiding paying taxes like the rest of us but because the authorities cannot touch them they abuse the system, park badly and occupy parking spaces for months on end,” a source said.

“Following previous exposure in the printed and social media, last summer the police seized a record number of foreign cars, but the rate of enforcement has since dwindled considerably, despite the abuse continuing and getting worse.”

The Malta Independent on Sunday spoke to one individual – on condition of anonymity – who has been using a UK-registered car in Malta for almost two years. “I imported a car with the intention of registering it as soon as it arrived but I never got round to doing it. I said to myself that I would register the vehicle as soon as I was stopped by the police but, two years later, I have never been approached or questioned about it.”

The motorist explained that his car is still listed as being garaged in the UK and its tax and MOT have long expired. The vehicle is neither registered nor insured in Malta.

No insurance

A source from the insurance field said insurance companies could technically insure foreign registered cars “but this is usually done with the presumption that the owner would then head to TM’s offices to register the car locally.”

The source said that, in all probability, people who have been abusing the system in this way are probably not insured. “We would likely catch these people out when the time came to renew their policy so, no, they are probably driving around uninsured.”

It was explained to this newspaper that if two cars collided and one was uninsured, the other driver would have to sue in court, both for damages and injury compensation. The process, as we all know, could take years and years.

A source pointed out that one could be even unluckier. “In December 2013 a woman was hit by a foreign-registered car in front of the St Julian’s police station. The driver sped off and, although the car was caught on CCTV, the driver was never identified. The woman will spend the rest of her life in a wheelchair and she cannot sue the driver.”

TM measure should curb abuse

Transport Malta official Pierre Vella recently confirmed during a TV show that imported second-hand vehicles must be registered in Malta within 30 days. It recently announced the introduction of a 30-day permit allowing use of an imported car on Malta’s roads until the registration process has been completed.

Mr Vella said on TVM show Realtà that the permit has to be affixed to the windscreen. “If a police officer or TM official sees a car with foreign plates and without the special 30-day permit, they will know that things are not in order.” Mr Vella also flagged the apparent absence of monitoring incoming vehicles. “Up until a few years ago, there would be a police officer jotting down registration plate numbers at the Gozo ferry. Now cars are coming in from Sicily as if it was nothing.”

He said that the number of unregistered cars in Malta was neither good for enforcement nor for the economy. “Those who live here, work here or have a residence permit have to regularise their position.”

The TM official said that the new 30-day permit should reduce abuse, but it was still too early to talk about results. He insisted that the police were doing what they could and were towing away unregistered cars, but also pointed out that Transport Malta’s compounds were practically full.

However, another source insisted that the 30-day permit would not do much to reduce abuse. “Those who were going to break the law will still do so. If they want to enforce this, they actually need someone at the port checking all incoming cars.”

The source also insisted that existing enforcement measures are ineffective. “Sometimes the police place yellow stickers on the windscreens of abandoned or unregistered cars – giving them eight days to regularise their position, but this does not always work.

“This is being too soft on defaulters. Furthermore, many a time these yellow stickers are ignored and, due to a lack of follow-up enforcement by the police, these illegal cars remain on our roads.”

Libyan, Italian and Bulgarian plates

The problem is not limited to UK-registered cars. In the past couple of years the number of Libyan, Italian and Bulgarian-registered cars has exploded. In the Sliema/Swieqi/St Julian’s area, the drivers of Libya-registered cars are notorious for their bad parking habits, which include blocking access to ramps and driveways. Many of these cars are flashy and expensive vehicles. “The police have been towing away a number of cars for obstruction offences but the owners simply pay the €105 fine, get their cars back from the pound and resort to their usual habits. In such cases, the authorities appear to focus on the obstruction offence, and do not bother to check if the vehicle is on the road legally in respect of insurance, tax and VRT. ”

In the case of Libyan cars, the source added that since there is no direct ferry between Malta and Libya, the cars must be from elsewhere in mainland southern Europe and then on to Malta from Italy or Sicily by ferry or catamaran. “Is anyone taking note of all the cars coming in? I don’t think so.”

Information tabled recently in Parliament showed that there are over 26,000 untaxed vehicles in the Maltese Islands, 8,000 of which have not been taxed for over ten years.