The Electrogas Delimara power station transaction is riddled with multiple conflicts of interest, some of which are of a serious nature, The Malta Independent on Sunday can reveal today.

This conclusion follows on the evidence published by this newspaper last Sunday, which showed that Mossack Fonseca, the Panama-based law firm at the epicentre of Panama Papers, handled both Electrogas consortium partner Gasol plc’s parent company through the Mossack Fonseca Seychelles office, as well as the affairs of Health and Energy Minister Konrad Mizzi and the Prime Minister’s Chief of Staff Keith Schembri through numerous other offices around the globe, including one in Malta.

There are a number of other conflicts of interest in the deal and project that have been identified by this newspaper, and which are being published today.

Conflicts of interest in a transaction of this magnitude, which was subject to public bidding, undermines the transparency and accountability under which the transaction was supposed to have been conducted, a circumstance which is bound to result in questions and suspicions that can only be quelled if the government subjects itself to full scrutiny, including the publication of all documentation related to the deal.

Conflicts of interest in such transactions arises when one or more of the parties involved in the deal – or one or more of their agents or advisors – have interests on both sides of the deal at the time of the bidding process, negotiation or even execution of the transaction.

A huge and complex transaction

The Electrogas transaction essentially consists of an 18-year power and gas purchase agreement between government-owned Enemalta and the privately-owned Electrogas consortium, which, following the exit of Gasol plc in July 2015, is now comprised of Socar, Siemens and the Maltese consortium GEM Holdings, each holding a 33 per cent stake.

The contract, which the government has refused to publish despite repeated calls from the media and the Opposition, is believed to be worth several billion euros in turnover over its entire period, and is likely to have a fair value of several hundred millions.

The Electrogas deal involves an unprecedented taxpayers’ guarantee of €360 million – which substantially covers the entire development cost of the project – in favour of a private company. The guarantee represents 80 per cent of a total loan of €450 million granted to the consortium mainly by Maltese banks.

Complicating matters further, the deal depends on the finalisation of a “draft” security of supply agreement which is currently being examined by the European Commission in terms of its State Aid Rules. Moreover, the Opposition had asked the Auditor General to investigate the Electrogas contract.

Main conflicts of interest relate to Nexia BT’s and Mossack Fonseca’s different roles with all the deal’s parties

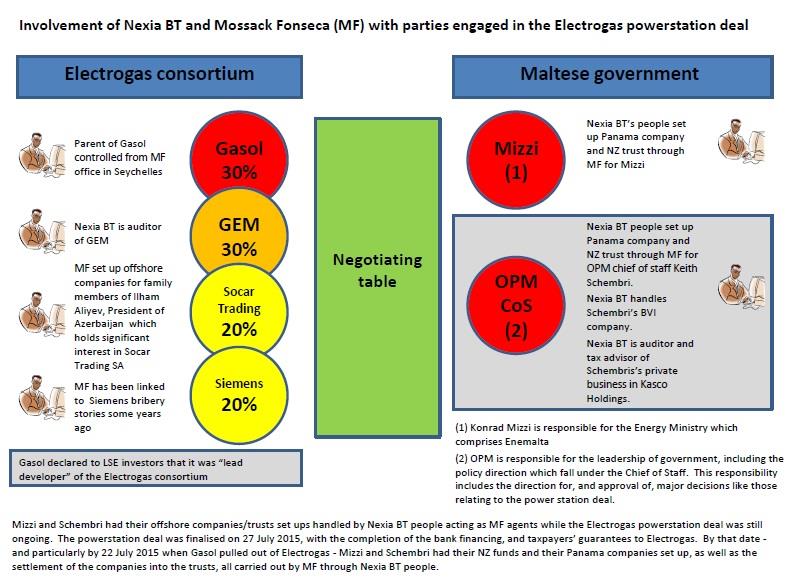

It is the association of Maltese company Nexia BT with the beleaguered Mossack Fonseca, and the different roles taken on by each of them with respect to the parties involved in the power and gas deal while the negotiations were ongoing that give rise to several conflicts of interest.

This newspaper has summarised the different involvements of Nexia BT and Mossack Fonseca with the parties which had influence in the deal in one diagram shown, based on our understanding of the facts in hand and publicly available information.

Another section of the Maltese media had recently reported that Nexia BT has been awarded numerous direct orders and tenders by the government running into hundreds of thousands of euros since the government was elected. However, the Office of the Prime Minister and the Ministry for Energy and Health refused to provide a list of all payments made to Nexia BT by the government since March 2013. One direct order revealed relates to a study of a public private partnership for the management of public conveniences in the central part of Malta. It is not clear if Nexia BT was an adviser to the government specifically on the power and gas deal, but if it was then this would make the conflicts of interest even more serious.

Serious conflict of interest

Of all conflicts of interest identified by this newspaper, the most serious arises because while the power and gas transaction was still being negotiated, Energy Minister Konrad Mizzi used the services of Nexia BT, which was already an established representative of Mossack Fonseca in Malta, to acquire a Panama company called Hearnville Inc., to set up a New Zealand trust called the Rotorua Trust, and to settle the company into the trust in which he is the settlor.

Mossack Fonseca offices in Malta, Panama and New Zealand were engaged in the setting up of Dr Mizzi’s international financial structure.

At the same time, the Mossack Fonseca office in the Seychelles was the registered office of the affairs of African Gas Development Corporation Limited, which at the time of the deal’s negotiation held effective control of Gasol, the company which owned a 30 per cent shareholding, and hence a significant stake, in Electrogas and was the consortium’s project leader.

The involvement of Mossack Fonseca with two main parties to the deal means that the deal was tainted with a conflict of interest.

The fact that Dr Mizzi involved Mossack Fonseca in his personal financial matters while the firm was involved also in the running of Gasol’s parent company point, at best, to a very serious failure on the part of the minister.

The negotiation with Gasol-led Electrogas started soon after an announcement by Dr Mizzi, on 13 October 2013, that Electrogas was the preferred bidder for the power station project. The call for bids had been issued on 11 April 2013 – one month after the last general elections. There were two short-listing processes before the final decision, which was taken on 13 October.

The substance of the power and gas deal was completed on 27 July 2015, when the bank loan agreement of €450 million and the correlated taxpayers’ guarantee of €360 million and other commitments were finalised. The power and gas supply agreements had been finalised at an earlier date.

It has now been revealed that the Prime Minister’s chief of staff Keith Schembri also used the services of Nexia BT and Mossack Fonseca to set up an “international structure” identical to that of Dr Mizzi, with a similar timeline and dates. Mr Schembri’s company is called Tillgate Inc. and his trust is named the Haast Trust. The same Mossack Fonseca offices were used for their establishment.

Although Mr Schembri may or may not have been involved directly in the negotiations with Electrogas, his role as Chief of Staff at the Office of the Prime Minister means that he was responsible for leadership of government, including the direction for and approval of major decisions like those relating to the power and gas deal.

It is a well-known fact that the Labour Party’s power plan was crucial in propelling Labour to power, and Mr Schembri had been chairman of a Labour Party energy working group when Dr Muscat was Leader of the Opposition.

According to reports in the Australian Financial Review by Neil Chenoweth, who has full access to the International Consortium for Investigative Journalism’s Panama Papers, the process for the registration of the companies acquired by Dr Mizzi and Mr Schembri started five days after Labour was elected, an assertion that both Dr Mizzi and Mr Schembri deny.

The process to set up the New Zealand trusts commenced in late 2014 and both Dr Mizzi and Mr Schembri confirmed that on 22 July 2015 they settled their respective Panama companies in their respective New Zealand trusts.

Nexia BT’s other roles with Electrogas parties

Meanwhile, Nexia BT has been engaged in the audit of the annual report of GEM Holdings Limited for the year ended 31 December 2014, which they signed off on 20 July 2015, while Nexia BT’s associates Mossack Fonseca were serving as the office from which Gasol, GEM’s partners in the Electrogas deal, was controlled and majority owned.

The involvement of Nexia BT with GEM while it was also engaged on the personal affairs of Dr Mizzi, who was on the other side of the power and gas deal in which GEM had a significant interest, points to yet another serious conflict of interest.

The Panama Papers have also revealed that Mossack Fonseca helped the family of the Azerbaijan President Ilham Aliyev – whose dictatorial government controls at least a significant interest in Socar Trading SA – with hiding shares in mining companies and London property through Panama.

A Mossack Fonseca link has also been established with a corruption scandal some years ago involving Siemens senior management. Former Siemens executive Hans-Joachim Kohlsdorf, who left Siemens after a series of corruption scandals had been revealed, was found to have had an account in the Bahamas branch of Société Générale, which received a deposit in gold valued at about US$500 million in November 2013, Suddeutsche Zeitung, the media house associated with Panama Papers, reported earlier this month.

The connection between Nexia BT and Mossack Fonseca

This newspaper has summarised the structure of Nexia BT and of its main partners Brian Tonna, Karl Cini and Manuel Castagna, as well as its connection with Mossack Fonseca as can be established from information published on the Malta Financial Services Authority companies register, based on our understanding and the facts in hand.

The shareholding in Mossack Fonseca & Co. (Malta) Limited business is fully and solely owned by BT International Limited, a company that is in turn fully and solely owned by Brian Tonna himself. Mr Tonna told The Malta Independent recently that “our holding of shares in Mossack Fonseca Malta Limited is purely on a fiduciary basis”.

Notwithstanding the complex legal structure, in essence, based on the Panama Papers and the Australian Financial Review revelations, Mossack Fonseca services in Malta are rendered by partners of Nexia BT. Karl Cini’s name was specifically mentioned in the Australian Financial Review reports in the context of email exchanges with Mossack Fonseca Panama offices.

The mysterious exit of Gasol at the conclusion of the negotiations

Gasol exited the Electrogas consortium on 22 July 2015, the same date on which Dr Mizzi’s and Mr Schembri’s Panamanian companies were settled into their New Zealand trusts.

Financial specialists who spoke to The Malta Independent on Sunday on condition of anonymity explained that the value of Gasol’s share transfer in the week when the power and gas deal was substantially completed would have amounted to tens of millions of euros as the deal would have then acquired its equity value.

On exit, Gasol transferred its 30 per cent shareholding to the remaining partners so that they now have a stake of 33 per cent each in Electrogas.

Gasol had acquired its shareholding in Electrogas from Enemalta in 2014 for the sum of €3,000. The difference between the exit value and €3,000 would be registered as a profit due to the shareholders of Gasol, of which African Gas Development Corporation Limited was the majority shareholder.

African Gas Development Corporation Limited is an offshore shell company registered at Suite 13, First Floor, Oliaji Trade Centre, Francis Rachel Street, Victoria, Mahe, the Seychelles, which is the business address of Mossack Fonseca in the Seychelles.

The Seychelles is ranked among the world’s most secretive banking and corporate jurisdictions because, among other matters, it does not require the registration or publication of beneficial owners of shell companies, known as International Business Companies, registered there. According to the Panama Papers, the Seychelles was one of the offshore centres where Mossack Fonseca opened the most companies for its clients outside Panama. The others included the British Virgin Islands (BVI) and the Bahamas.

One publicly available name associated with African Gas Development Corporation Limited is Ethelbert J.L. Cooper, a Liberian “financial engineer” with an unusual past.

He is also closely associated with the setting up of Afren plc, a Nigerian oil company which was listed on the main market of the London Stock Exchange but which went into liquidation on 31 July 2015 as a consequence of a combination of the downturn in the oil market and a one-year long corruption scandal which rocked the company’s board after two directors (one of them a co-founder of the company with Mr Cooper) were found to be receiving “commissions” from one of the company’s trading partners in their secretive BVI accounts.

Recently, Mr Cooper has been involved in the financing of the Ethelbert Cooper Gallery of African and African American Art at the Hutchins Centre at Harvard University.

Contracts relating to Electrogas power and gas deal not made public

Notwithstanding repeated attempts by the media and calls by the Opposition, the government has failed to publish any of the contracts related to the power and gas deal. It is, in fact, not clear what the full list of contracts itself looks like, and it is not clear if the government has publicly announced the existence of all contracts and public commitments undertaken towards the private consortium.

Opposition called for NAO investigation of contract signed with Electrogas

On 30 July 2015, the Opposition filed a formal request, through Parliament’s Standing Orders, calling on the Auditor General at the National Audit Office to investigate the contracts signed by the government with Electrogas on the new power station. The Opposition’s request followed the departure of Gasol from the consortium.

The Opposition asked the NAO to investigate the procedure used leading to Electrogas being chosen as the preferred bidder and to look into the government guarantee.

EU investigating the “draft” security of supply agreement to which deal is subject

A few weeks after the media had revealed, in early June 2015, that the government had issued an €88 million taxpayers’ guarantee to the Electrogas consortium on temporary bank loans, the Energy Minister and the Finance Minister called a joint press conference just before the traditional Santa Marija holiday, on 13 August, to announce that the guarantee had been increased to a whopping €360 million, and that a “draft” security of supply agreement to which the transaction was subject was still being examined by the EU Commission in terms of the EU’s State Aid Rules. The security of supply agreement, which is a deal clincher for the Electrogas consortium, is based on an 18-year monopoly on gas provision.

The examination by the European Commission has now been ongoing for several months.

It is not clear how the Commission may view the deal in its entirety within the context of the new information on the circumstances in which the deal was negotiated, especially after considering the association of Mossack Fonseca with project leader Gasol and with the Energy Minister and his “international structure” involving Panama, which in itself could come under separate EU scrutiny in terms of its other rules.