Economist and Managing Director JP Fabri noted that when discussing economic phenomena, such as increases in prices for rent, one needs to have a holistic view. Markets happen within nested environments and are affected not only by demand and supply forces but also to socio-cultural and demographic factors. When looking at the demand side, a number of factors can be identified which include the current and projected state of economic growth, the population and labour supply changes, the capital environment within the country whilst the supply side reflects on the number of properties on the market.

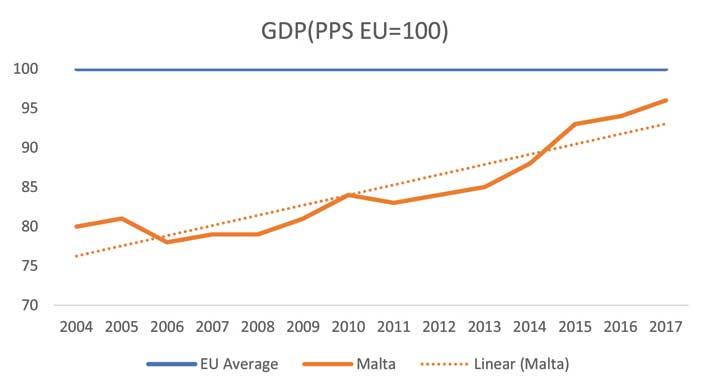

Fast convergence to EU average

Mr Fabri noted that one of the main aims of European Union membership in 2004 was to converge to EU averages in terms of standard of living, calculated by GDP per capita. Membership was seen as a key element of improving Malta's economic standing and this convergence was the main driver for Malta's large cohesion fund budgets. AT membership in 2004, Malta's GDP stood at around 80% of EU average. Fast-forward to 2017 its at 95%. This fast-convergence, particularly after the 2008 global recession has been propelled by a booming economy over the period since 2012. Malta has consistently outperformed EU member states and today we have a very growth-oriented economic model which necessarily means that previously low rents had to reflect the economic activity happening.

Over the past 7 years, growth has averaged 8.5% however Fabri notes that it is interesting to see what has contributed to such growth in order to understand the make-up of Malta's economy and its economic direction.

Over the past 7 years, growth has averaged 8.5% however Fabri notes that it is interesting to see what has contributed to such growth in order to understand the make-up of Malta's economy and its economic direction.

From the graph, it is very obvious that the economy is mainly driven by services even though all sectors, including manufacturing have contributed to the hast economic growth. Professional services, reflecting the financial services, has been important contributor together with gaming which has accounted for around 18% of such growth. Tourism and retail sector has also been an important contributor to this economic boom. The construction sector, although visibly on a boom, has not been a significant contributor and begs the question whether a good proportion of this sector is still misrepresented in national accounts and economic data.

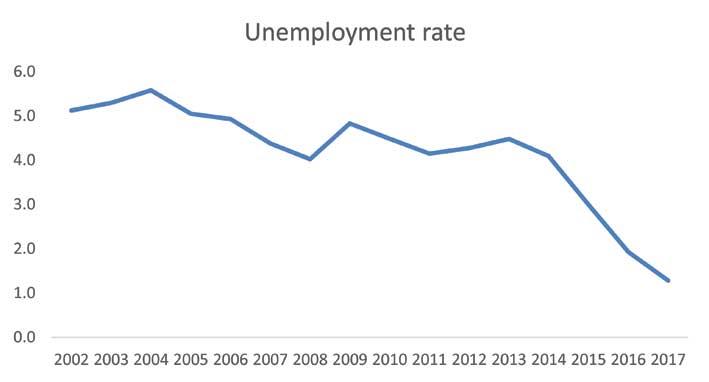

Unemployment plunges to lowest levels

Fabri noted that such economic growth, necessitates labour resources in order to sustain it. In fact, Malta's unemployment rate has been at historically low and close to what economists would define as the natural rate of unemployment, that is close to full-employment. In fact, such an increased demand for human resources has meant that many economic sectors both service-based, construction-based and also tourism and hospitality have been important drivers for a surge in foreign workers. Economically, Fabri said that although that foreign workers have had an important contribution to sustain such growth, they also had a dampening impact on wages that would otherwise have been experienced in a fast-converging economy. In relation to the rental debate, this has important ramifications since an increase in demand was also matched by a dampening effect on wages, thus impacting it on affordability since rents would have increased at a faster rate than earnings. However, an analysis of the labour market will be provided in another more detailed feature.

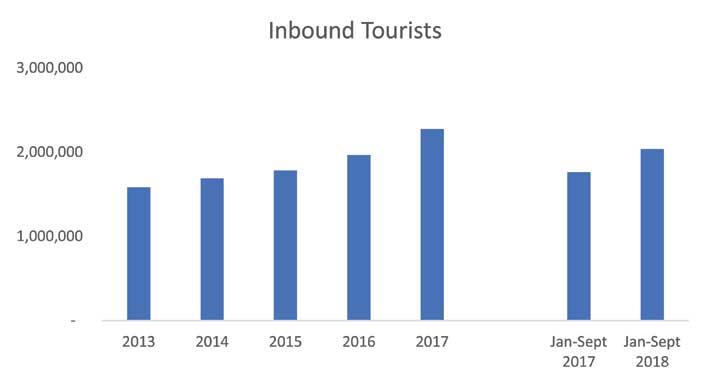

Apart from an increased labour force, driven by foreign workers, Fabri noted that the tourism sector has also expanded rapidly in recent years as shown be the increase in inbound tourists. With the rise of the Airbnb generation and other direct rentals of local accommodation, the house rental market has also been impacted by such a growing market. This growing industry can also be proxied by the increase in property management companies that promise the management of bookings, property cleaning and other ancillary services. However, such a trend has also had an impact on the supply of properties available for rental.

Investments in property increasing land value & suppply

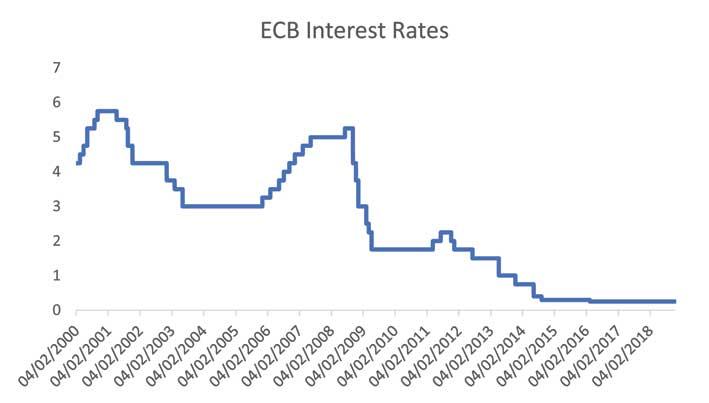

Fabri also noted that the capital environment and dynamics is also an important contributor. Surplus capital will also move to higher yielding returns. With a historically low-level of interest rates, capital has been moving away from bank deposits in other higher interest yielding investments.

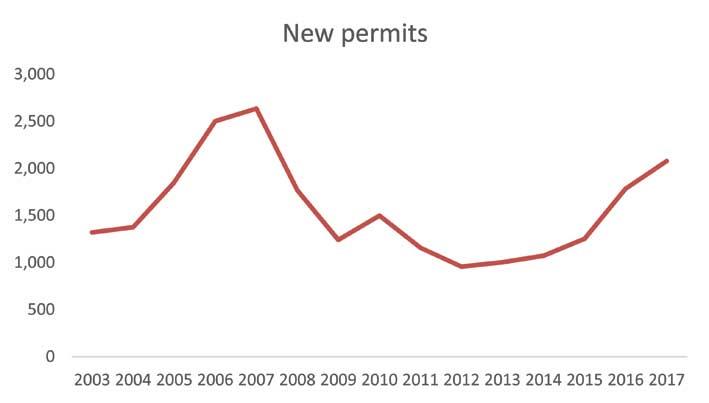

In fact, the fast-growing economy and property boom, has meant that further capital kept moving into real estate and the demand for land and properties has increased. This flight of inward capital has had the impact of increasing the value of land and this has necessarily impacted the rental price given that land has appreciated. This flight into real estate is also seen through the increase in permits given with a faster increase in the number of units coming on stream.

Such an increase in development also begs the question on the role of credit to finance such development. In exploring the risks associated with the property boom on financial stability, Fabri said that latest data reported by the Central Bank notes that although the strong growth in mortgage lending has pushed up household debt, as a share of GDP household debt dropped by 1.4 percentage points to about 50%, below the euro area average. While mortgages are granted at variable rates, creditworthiness of households remained strong supported by their robust financial wealth which exceeded three times the size of their debt. Households' financial wealth is predominantly in cash or quasi-cash assets and buttressed by positive labour market developments. Furthermore, while household indebtedness is skewed towards young age cohorts, which are the lowest income-earners; their rising income prospects (compared to older age groups) mitigate the skewed debt distribution.

Conclusion

Fabri noted that the property prices and rental value is the result of various forces coming together based not only on present circumstances but also on future expectations. Therefore, any discussion needs to be based on facts and statistics and data quality needs to be an important element in policy and reform discussions. Fabri added that rent is becoming an important policy discussion as it also hinges on Malta's attractiveness for foreign labour and in fact this week a gaming lobby group highlighted such concerns. The Independent on Sunday will continue delving into the rental market with an analysis of labour and population changes.