The ECB has played an important role in averting risks

As you will all be aware, many of the member states of the euro area are going through fundamental reforms that would over time promote sustainable growth. This can occur only with the support of a healthy financial sector, including a banking system that provides the needed volume of credit at interest rates that reflect the European Central Bank’s provision of ample and low-cost liquidity.

Over the course of the crisis the ECB has launched various measures to avert the risk of more severe ramifications of the financial crisis. In July, the ECB introduced forward guidance, assuring the financial markets that its policy stance will remain accommodative and interest rates low for as long as necessary. As a matter of fact, the recent cut was consistent with this forward guidance.

Throughout the crisis, the ECB has played an important role in ensuring, within its price stability mandate, the proper financing of the euro area economy in a context of subdued credit dynamics. A series of measures were introduced to ensure that banks can pass on low policy rates to the real economy, in particular where they are needed the most. These measures include providing ample liquidity to euro area banks, reviewing the collateral framework, lengthening the maturity of operations to three years, and reducing redenomination risk in financial markets through the announcement of Outright Monetary Transactions.

Over the longer term, further decisive steps are needed for the establishment of a genuine banking union, so as to further enhance the resilience of the banking sector, reduce financial fragmentation and strengthen the institutional framework of the euro area. Certainly, in various euro area countries these measures need to be complemented by efforts to correct past excesses in both the public and private sectors. And these reforms need to be undertaken against the backdrop of a weak and fragile economic recovery, making the whole process more challenging.

The first signs of recovery are now visible

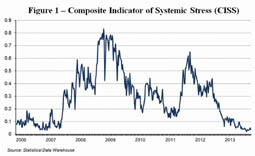

The first signs of recovery are now visible. Figure 1 shows the level of systemic risk across the euro area, as gauged by the Composite Indicator of Systemic Stress. This index has reached the lowest levels since the euro area sovereign debt crisis started.

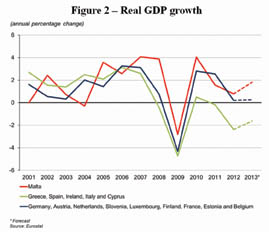

From the macroeconomic perspective, following a contraction that spanned over six quarters, the euro area’s real GDP rose marginally in the second and third quarters of 2013. Although projections still see real GDP shrinking marginally in 2013 as a whole, a modest but positive growth rate of around 1% is expected for 2014. Despite these positive developments, the risks around the outlook for the euro area remain tilted to the downside. Moreover, unemployment in the euro area remains excessively high, especially in the stressed countries.

Heterogeneity in the euro area is evident both in terms of economic performance…

An underlying characteristic that is observed in the euro area is the uneven performance across countries and the emergence of increased heterogeneity. As can be seen in Figure 2, the uneven pace of economic recovery is evident: countries such as Greece, Italy and Portugal are registering a contraction of their economies, while Germany, Austria and Malta are among the countries that have recorded modestly positive growth rates. Figure 3 shows that unemployment rates vary between less than 5% in the Netherlands, Austria and Luxembourg to over 25% in Greece and Spain.

…and in terms of monetary policy transmission

Even on the monetary side, the transmission of accommodative monetary policy measures across the euro area remains weak and uneven. Loans to the private sector have been declining and the pace of contraction has actually accelerated in recent quarters, particularly in the stressed countries. Although on the demand side subdued loan dynamics in the weaker economies can largely be explained by the slow pace of economic activity, the supply of credit is also constrained by the banks’ efforts to repair their balance sheets and strengthen their capital position. For all these reasons, it will perhaps take a while for the ECB’s monetary policy to be reflected in credit creation in the weaker economies.

Though Malta is positioned with the stronger economies…

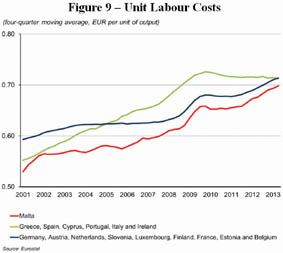

Various indicators place Malta with the stronger performers. Figure 2 shows a growth rate for Malta that generally exceeds the corresponding rates for both categories of countries. A similar conclusion can be drawn from Figure 3, which deals with the unemployment rate. Similarly the level of unit labour costs is lower in Malta than in both the weaker and stronger groups, as will be discussed later. It is important that the public debate and the formulation of policy focus more closely on what is needed for Malta to remain aligned with the better performers.

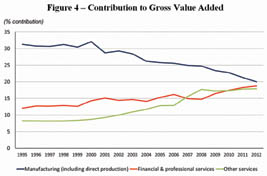

In the first two quarters of 2013, Malta’s GDP growth rate stood at 2.7%. Net exports have been the main source of expansion. The outlook is for stronger growth in 2014 as Malta continues to benefit from its competitiveness. The economy continues to diversify, creating high value added job opportunities. While some sectors have had to downsize, there has been a compensating expansion in other sectors, such as financial and other services. This is shown in Figure 4.

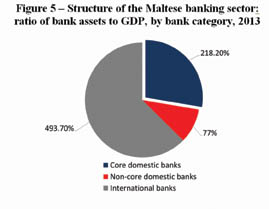

An aspect that may go unnoticed is the role of the financial sector in the resilience of the Maltese economy and its alignment with the stronger group of countries. Financial soundness indicators confirm that Malta has a sound and robust banking sector. A three-way split of the banking sector distinguishes between the core domestic banks that are closely integrated with the domestic economy at one end and the international banks that conduct all their business abroad at the other end, along with a relatively small sector, the non-core domestic banks, in between as shown in Figure 5.

Looking more closely at the external dimension, an important characteristic that distinguishes us from other models, such as the one in Cyprus, is the fact that the international banking sector in Malta is only lightly linked to the domestic economy and the remainder of the Maltese banking system. Meanwhile, unlike the situation in other countries, the core domestic banks have very low reliance on non-resident deposits. They operate along traditional lines, applying a prudent business model and, like the rest of the banking sector, carrying minimal exposure to securities issued in the distressed economies. The core domestic banks are highly capitalised, profitable and liquid, and the other categories of the banking sector are similarly robust.

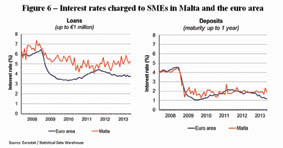

…in terms of interest rates, Malta needs to further align with its peers

Although various indicators place Malta with the stronger performing group, there is room for further improvement. Interest rates on loans to businesses are currently around 2% to 3% higher in Malta as compared to Germany, Netherlands, Finland, Austria and Luxembourg. In contrast deposit rates offered by Maltese banks are broadly in line with those across the euro area as shown in Figure 6. As a result, bank interest margins are higher in Malta as shown in Figure 7. A closer alignment of margins with those of our peers appears to be warranted. The recently proposed Budget measure to conduct a review of bank charges to businesses makes sense. The benefits of having a robust banking sector would then be passed more fully to the rest of the economy.

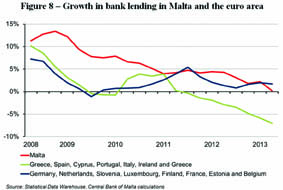

This would be reflected in faster growth in the volume of credit, which recently has been trending downwards, although it should also be pointed out that credit growth in Malta continues to outpace that in the euro area as can be seen in Figure 8. The expected setting-up of the Development Bank will also contribute to fill a funding gap that currently exists in the financial sector in Malta, which could provide relief to the cost and difficulty of access to finance, particularly for SMEs and may serve to complement the core banks in the funding of larger projects.

Preparations for the banking union are underway

We are now entering the first phase of the banking union, where major financial institutions will be supervised directly by the ECB under the SSM. At a second stage, all other institutions will be adopting the single rulebook. This requires preparation for the new challenges ahead.

In the local context, an important step in the preparation for the Single Supervisory Mechanism was the establishment of the Joint Financial Stability Board, set up jointly by the Central Bank and the MFSA, and now part of the Central Bank of Malta Act.

Among the issues that are being discussed by the Joint Financial Stability Board, there is the proposed revision of the Banking Rule BR/09/2008. This revision is currently out for consultation with the financial sector. The rule deals with provisioning for NPLs, taking into account the duration of the NPLs, and also calls for a specific buffer linked to the gap between provisions and NPLs.

Safeguarding fiscal stability by expanding growth… competitiveness is key

Economic and financial stability also require fiscal consolidation, so that the deficit progressively declines towards the Fiscal Compact target. The debt-to-GDP ratio is expected to reach a plateau and then start declining, as planned by the government. Budget figures project the debt-to-GDP ratio at 73% in 2013, along with a deficit ratio of 2.7%. An exit from the Excessive Deficit Procedure is essential.

Indeed, the Fiscal Compact involves strict budgetary commitments and places limits on the government’s deficit. Moreover, even in the absence of the obligations under the Fiscal Compact, public debt cannot be allowed to accumulate persistently as this could lead to unsustainable debt dynamics.

GDP growth reduces the debt ratio first by automatically raising revenues and reducing spending. Secondly, it expands the denominator of the debt-to-GDP ratio. Obviously, resolving fiscal excess through an expanding GDP is less painful.

To sustain economic growth, the economy needs to offer products with high value added and at competitive prices. The alignment of wages and productivity is crucial for competitiveness, particularly at a time when neighbouring economies are undergoing an internal devaluation. Because of this correction, unit labour costs in the stressed economies have plateaued and are now converging with those in the better performing countries (refer to Figure 4). While unit labour costs in Malta have been lower than in other euro area countries, it is crucial to ensure that higher productivity supports wage growth, thereby safeguarding the country’s competitiveness.

Conclusion – Malta as a regional hub

In the recent past, our economy was able to attract sectors and niche markets, such as financial and business services, and the aviation maintenance sector. Further investment promotion calls for continued efforts to identify new areas of growth, and to develop a labour force with the necessary skills and qualifications.

The financial and other services sectors have been crucial for economic stability and growth. Recent expansion in the financial services sector can serve as a springboard for further development in view of new opportunities in the Mediterranean region. Further diversification of the range of financial and other services will provide opportunities for Malta to develop further as a regional hub for various activities. Proficiency in the English language, a sound legal system, the high standards of the legal and accounting professions and the mantle of EU membership offer fertile ground for those who would want to do business here.

Certainly, a growing financial sector needs to be supported and protected with the appropriate legislative and supervisory framework in order to ensure that potential risks are minimised. Malta has managed to host a relatively large financial sector without exposing itself to excessive risks. Yet this has not been the case in other countries. We need to be on the lookout for potential threats to our system in order to reap the benefits of the financial sector without exposure to excessive risk. In the past year we have been under the spotlight and operators need to ensure that the appropriate regulations are carefully followed.

Malta should look optimistically to the future, not only because it has managed to ride the downturn quite well, but also because it has the ingredients for further growth and prosperity. A concerted and unified effort is essential to achieve our potential growth.