Keith Schembri is a shareholder in the Cypriot company allegedly used by Pierre Sladden to move €900,000 to his BVI company, The Malta Independent can reveal following investigations carried out in Cyprus. Mr. Sladden continues to deny details emerging from the Panama Papers, however did not produce any documents to contradict these revelations.

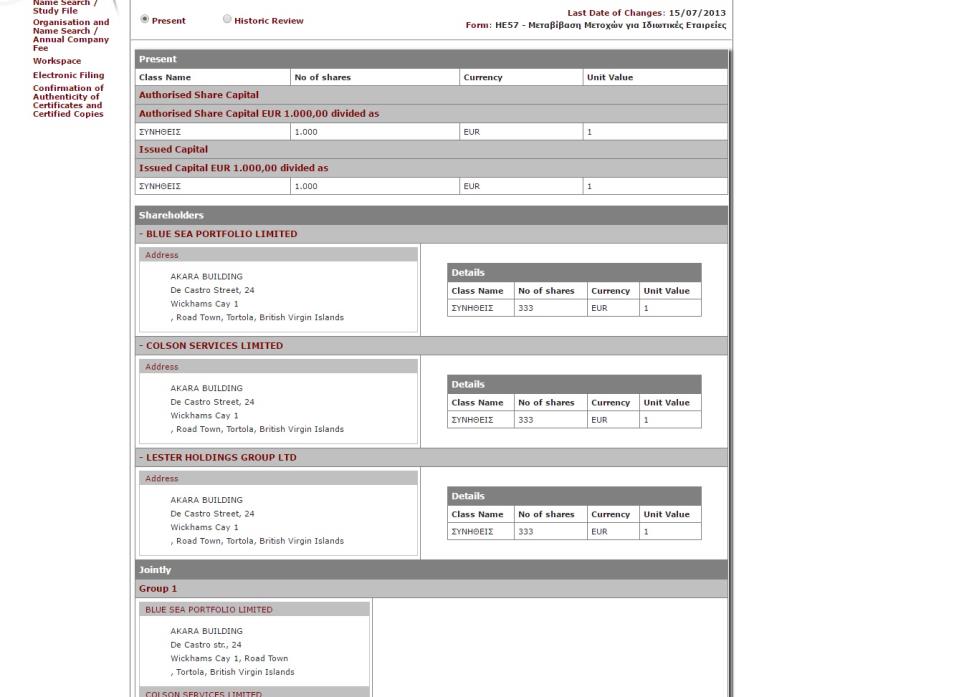

The Cypriot company, A2Z Consulta, is owned jointly by three British Virgin Island offshore companies owned by Mr Schembri, Pierre Sladden and Adrian Hillman respectively.

According to the Department of Registrar of Companies and Official Receiver in Cyprus, the last transfer of shares in A2Z occurred on 15 July, 2013, meaning that Keith Schembri's company was appointed shareholder after he was appointed as the prime Minister's Chief of Staff.

The directors of A2Z are a company called Bestservus (Nominees) Ltd.

The Malta Independent is an official partner of the International Consortium of Investigative Journalists and the German newspaper Suddeutsche Zeitung and gained full access to the entire set of Panama Papers.

A2Z shareholders

It was previously reported that the Maltese authorities have reportedly launched a tax compliance investigation into Mr Sladden, while Mr Hillman resigned from his positions at the Allied Group, publishers of The Times of Malta, pending an internal inquiry in the wake of allegations that he had been receiving kickbacks from Mr Schembri after blogger Daphne Caruana Galizia exposed their companies in the BVI.

While Mr Sladden's involvement in the Cypriot company, A2Z Consulta, had emerged weeks ago through the Panama Papers leaks, further investigation in Cyprus by this newsroom have now shown that Mr Sladden was but one of the three shareholders, along with Mr Schembri and Mr Hillman through their BVI companies.

The Cypriot company owned by Mr Schembri, Mr Sladden and Mr Hillman had allegedly been used on one occasion to move funds from Malta to Cyprus and then on to Mr Sladden's company in the British Virgin Islands, Blue Sea Portfolio. Mr Schembri and Mr Hillman also own British Virgin Islands companies named respectively Colson Services Ltd and Lester Holdings Group Ltd.

A local newspaper in April reported that a tax evasion probe had been launched into Mr Sladden, in the wake of published information that his Maltese company assigned invoices amounting to €900,000 to his British Virgin Islands company, of which he says were reversed..

According to the Panama Papers, Mr Sladden's Maltese company, Redmap, subcontracted A2Z Consulta (owned by Mr Sladden, Mr Schembri and Mr Hillman) which in turn sub-contracted Blue Sea Portfolio Ltd, a company owned by Mr Sladden.

This newspaper has established that the three shareholders of A2Z Consulta Ltd, based in Cyprus, are Colson Services Limited - the BVI company owned by Keith Schembri, Lester Holdings Group Ltd - the BVI company owned by Adrian Hillman, and Blue Sea Portfolio Limited (BSP), all with equal amounts of shares.

Sladden confirms ownership but denies transfers

While it has not yet been established what business A2Z had conducted with Mr Schembri's Colson Services and Mr Hillman's Lester Group (if any) - both in the British Virgin Islands - information garnered from the Panama papers so far has shed some light on how A2Z was used (or was planned to be used according to Sladden's statement) by Mr Sladden.

According to the Panama Papers, a sub-contracting and working agreement between A2Z Consulta and Blue Sea Portfolio Limited was drawn up, and dated 4 October, 2012.

The agreement reads that A2Z was engaged by Redmap Limited (a company owned by Pierre Sladden in Malta) for the provision of services consisting in quality checks and negotiation with the suppliers of Redmap in connection with the business activities of Redmap.

Agreement to assign a receivable

The engagement is dated 3 October 2012, and is valid for a period of 10 years, unless terminated earlier. It also does not prohibit A2Z from subcontracting the engagement to third parties, "and has identified Blue Sea Portfolio as a competent person for the provision of the services forming the scope of this engagement". It read that BSP is willing to provide the services to Redmap in the capacity of sub-contractor of A2Z Consulta.

The agreement between A2Z and BSP shows that it would be valid for three years with the possibility of renewal for further periods.

"In consideration of the due performance of the services provided by BSP, A2Z Consulta shall pay BSP €250,000 yearly, payable upon the raising of an invoice by BSP".

Here, the Cyprus company was planned to charge the Malta company, and the BVI company would charge the Cyprus company.

Agreement to assign a debt

A financial advisor speaking with this newsroom explained that the revenue minus the cost of services (which would include the subcontracted agreement) would be the amount taxed in that country, thus meaning that the funds owed to the Cyprus company might not be taxed in Malta. The same could occur in relation to the net profits of the Cyprus company after the deduction of the charges from the BVI company. The BVI is a tax haven.

A second document (agreement to assign a receivable) dated 31 December 2014 was also uncovered. Here, A2Z Consulta was meant to register a receivable of €900,000 from Redmap Ltd based on the above sub-contracting Redmap - A2Z agreement. It also states that A2Z Consulta appears as a debtor of Blue Sea Portfolio in the amount of $978,250 (roughly €800,000 at the time). A2Z Consulta however limited the amount assigned to the BSP to €750,000.

Another document - an agreement to assign debt - also dated 31 December 2014 was also found in the papers. In this agreement, Redmap owes A2Z Consulta €750,000, "and subsequently due to Blue Sea Portfolio Ltd.

The agreement to assign debt and agreement to assign a receivable were sent by a Nexia BT executive to a Mossack Fonseca representative, asking to have them both signed by the BVI company.

However instead of Redmap owing this sum, essentially, to BSP, the agreement sees the debt transferred to P.S. & sons ltd, another Pierre Sladden company here in Malta. Thus meaning that P.S. & Sons would owe the funds to A2Z, who would owe the funds to BSP.

"The assignee (P.S. & Sons) shall, by virtue of the said assignment, pay forth €750,000 directly to Blue Sea Portfolio".

While the documents found by this newsroom were drawn up and were used in email exchanges between Nexia BT representatives and Mossack Fonseca representatives with requests for signatures, they bear no signatures.

Mr Sladden, while confirming that he has a partial business interest in A2Z Consulta, denied that the agreement ever materialised. "A2Z Consulta was engaged in 2012 by Redmap to provide various services including quality checks of the business carried out by Redmap. However the business relationship never materialized and hence no payment was ever effected. Therefore as per my previous statement, no funds or monies were ever transferred".

"All income made by Redmap is declared with the tax authorities".

"I also confirm that A2Z Consulta never traded nor generated any income and is in process of being wound-up," said Mr Sladden.

He was asked about P.S. & Sons, and in response said "The same applies to PS & Sons. No money was transfered to A2Z Consulta".

But the Panama Papers also include a number of invoices, issued by Blue Sea Portfolio Ltd to A2Z Consulta Ltd. One dated January 2013 for the amount of $329,850, one dated December 2013 for the amount of $344,775 and one dated 31 December 2014, for the amount of $303,525.

Mr Sladden said the following about the invoices: "The invoices issued by Blue Sea were reversed and never honoured as A2Z Consulta did not operate or commence its activities as explained in my previous email".

Schembri says neither he, nor his companies, ever received or transferred funds from A2Z Consulta

A number of questions were also sent to Mr Schembri, asking why he did not come forward as an owner of A2Z when it was first mentioned, what he has used the company for, how much funds he placed in the company, whether he will publish the full accounts and transaction list of the company, and whether he is under investigation. In response, Mr Schembri said: "I or any of my companies, local or otherwise, have never received or otherwise transferred any funds from or through A2Z Consulta. Neither have I or any of my companies placed any funds into A2Z Consulta".

Hillman declines to comment

Mr Hillman was asked what he used A2Z Consulta for, whether funds from his companies were sent to or were moved through A2Z Consulta and why he did not come forward as a part-shareholder in the company when it was first mentioned. In response, he said: "As you may be aware I have refrained from discussing any matters which could be the subject of the enquiry conducted by my employers. On the advice of my lawyers I will retain this position, save to say that I never benefitted, in any way, from A2Z Consulta".

Documentation in the Panama Papers continues to show how the Prime Minister's Chief of Staff is the beneficiary in secret companies in the British Virgin Islands set up by OPM's consultant Brian Tonna of Nexia BT. The Prime Minister is still refusing to take political action as regards Keith Schembri. Questions sent to the acting Police Commissioner whether an investigation into the secret companies of the Prime Minister's Chief of Staff in the BVI have remained unanswered.