Reactions to the presentation of the budget have been made by constituted bodies, unions and other organisations.

Malta Chamber of Commerce, Enterprise and Industry

The Malta Chamber of Commerce, Enterprise and Industry noted the underlying priorities of the 2017 Budget Speech, namely, fiscal consolidation, strong economic growth and better living standards for all.

These priorities are similar to the objectives the Chamber itself proposed during its active participation in this year’s Budget consultation process. Here, in fact, it advocated further progress in fiscal consolidation and national competitiveness.

It is noted that this year’s budget continues to build on previous year’s efforts in a number of other areas including income support for low and middle-income earners and pensioners, further investment in human resources, environmental initiatives and transport infrastructure. It is also noted that, save for certain excise tax measures, the budget speech has spared major surprises and shocks on private economic operators.

The Chamber is encouraged by the remarkable rate of economic expansion over the past quarters and the manner in which this is supporting public finance consolidation. Indeed, the 0.7% deficit to GDP ratio for 2016 and 0.5% ratio for 2017 is encouraging, but as credit rating agencies have consistently remarked, the country must not allow for any complacency and must at all costs ensure that there are no slippages in at least three areas: namely,

Public Finances including funds allocated for sectoral restructuring and the formation of new initiatives

Continued reform programmes in pensions and healthcare

The successful setting up of partnerships with the private sector

In this regard, it is understandable that society reaps a just benefit from economic prosperity through the redistributive role of Government and the annual Budget. Nevertheless, this redistributive exercise must be made in full recognition of the private sector and its wealth generation role in the economy. In this light, the Chamber commends the tax incentives granted on voluntary second-pillar pensions as it had itself recommended prior to the Budget.

Competitive-Enhancing Measures

The Chamber welcomes the efforts being made in the area of competitiveness, in particular:

Access to finance via the seed-capital for setting up of the Development Bank

Tax incentives on dividends from companies listed on the Malta Stock Exchange

Tax deductions Employer-schemes for transport of workers

Tax incentives on transfer of family businesses (for 2017)

The attraction of an international accelerator for local start-up companies

A proposal to support companies to facilitate the research and commercialisation of innovative products and services

Various Malta Enterprise administered schemes for business

The introduction of permitting (planning) fees applicable to industry

Simplification of licencing and start-up procedures for business.

On the other hand, in terms of competitiveness, the Chamber believes that the following measures could be detrimental to the private sector. These are related to COLA, Energy Rates for business and proposed sick leave for parents with sick children as detailed hereunder.

COLA

The Chamber noted the announced figure for COLA next year. Generally speaking, €1.75 is not an unaffordable figure for employers but it departs from that which would have applied using the standard mechanism in that it includes an anticipated payment. With a view to avoid similar arrangements which could be burdensome on competitiveness, the Chamber renews its call for adjustments to the COLA mechanism in terms of the formula used and an updating of the Retail Price Index through a revised Household Budgetary Survey.

Energy

The Malta Chamber is disappointed to note that that there were no measures to address the further lowering of energy tariffs for business, which was the Chamber’s prime recommendation prior to this year’s Budget. It is feared that this fact may support further erosion in Malta’s competitive position in cost-sensitive sectors relative to other regions and states.

According to official statistics for Industrial Energy Rates for the second half of 2015 - as reproduced by Eurostat last August - electricity prices for industrial consumers including all taxes and levies in the EU28 averaged marginally lower than those available for Maltese industrial consumers. Moreover, Malta’s average industrial rate as quoted by Eurostat is 36 per cent higher than the average rate available in countries competing for foreign direct investment, namely Bulgaria, Czech Republic, Estonia, Croatia, Lithuania, Hungary, Poland, Romania and Slovenia. In addition, it is worth noting that Malta is the only EU Member State where commercial rates are higher than domestic. This difference stands at 12 percent. On average, commercial rates in the EU28 are 43 per cent cheaper than domestic rates. It is clear that the current structure of energy rates in Malta runs counter to the principle that wealth is first to be created before distributed and does not bode well for continued economic expansion and wealth creation in the country.

Sick Leave

The Chamber understands the purpose for Government’s proposal to extend sick leave to workers with sick children. This may serve to encourage further labour market participation. However, the Chamber wishes to point out that this measure needs to be designed and implemented carefully as it may lead to further abuse of sick leave. Employers will be contributing to the consultation process leading to this measure.

Towards Ensuring A Level Playing Field

The Chamber welcomed the announced setting up of a new unit to target tax evasion through a joint effort between Inland Revenue, the VAT Department and Customs. The Malta Chamber has been extremely vociferous in the past on this subject, as it consistently argued that tax evasion, deprived the state of substantial funds that could be used better, and it placed honest businesses at a disadvantage. It has always called for a competitive and liberalised environment, fairly and equitably regulated through market surveillance. Ultimately, the Chamber argued, this would result in upholding a competitive level playing field for all the business community. The Chamber welcomes this development and offers Government all the help at its disposal for the successful implementation of this measure.

Malta Developers Association

The Malta Developers Association welcomes with satisfaction a number of measures announced in the Budget Speech, measures which the Government intends to implement to continue to maintain the good pace of economic development in the country in recent years.

Among these measures there are several that the MDA indicated to the government during consultation meetings held with the authorities, among which:

- the extension of the scheme through which first time buyers are exempt from paying stamp duty on the first €150,000;

- the concession for those who are passing on their business to their children where stamp duty on transferred property will be of 1.5% instead of 5%;

- a fiscal incentive for those who rent for not less than seven years so that the tenant will be reassured that he has a reasonable period in which he will not lose the lease;

- the lowering of stamp duty on those who buy property in Gozo from 5% to 2%;

- the removal of the anomaly that exists when parts of structures that are made abroad have an advantage on those made in Malta because of the excise duty on cement;

- fiscal incentives for those who develop car parks;

- the renewal of temporary leases where government is the owner; and

- financial assistance schemes for products that are energy saving, like heat pumps.

The MDA also understands that in a situation where the construction sector is doing well, those involved in this sector have to contribute to society so that there is more social justice. However, it feels that the introduction of excise duty on imported construction materials will negatively affect the small consumer who is acquiring his first home.

General Workers Union

The General Workers Union said the budget targets the needs of society, as more people in the lower income bracket continue to be helped. The GWU said it is satisfied that the government took up some of its proposals.

It praised the government for its commitment to help families and individuals at the risk of poverty. It welcomed the proposal regarding medical leave.

Front Favur il-Mina

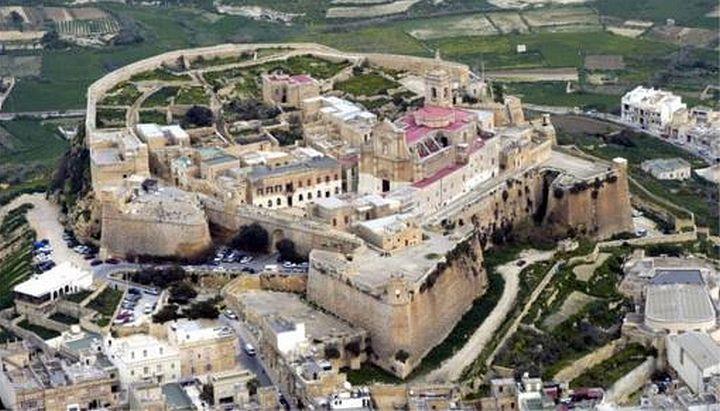

Front Favur Il-Mina acknowledges the progress that has been achieved over the past years with respect to the Malta-Gozo accessibility. Firstly, the Front agrees with the government’s proposition for issuing a call for submissions of proposals for a fast ferry service between the islands. Nonetheless, this must all be done without any further delays. Moreover, when this service is eventually introduced, it must be able to cater for the increasing demand.

As remarked several times, the Front wholly agrees with the necessity of geological studies mainly on the geology of the Channel between the islands. The Front backs the agreement that was reached between Transport Malta and the University of Malta, where the latter shall be responsible to conduct geological and geophysical investigations. Moreover, we concur with the University rector Prof Alfred Vella that the University should play a key role in projects of national importance such as the sub-sea tunnel between Malta and Gozo, which will be both of a social and economic benefit for the whole country.

The publication of a call for proposals for the design and development of the sub-seabed Malta-Gozo tunnel is another step forward.

All the measures proposed are positive developments. Nonetheless, it is essential that deadlines for all these measures are kept, paired with the fact that the necessary studies should be carried out and decisions should be taken wisely, so that all predicted results are achieved. One essential measure which has been omitted from the budget document is that regarding the Cargo-ferry service that used to operate between Mgarr and Sa Maison. Nonetheless, no solutions have been proposed in the budget document to alleviate the current situation.

Gozo Business Chamber

The Gozo Business Chamber said it is pleased to hear a confirmation from the Minister for Finance that Government is continuing to push to bring under control the deficit to 0.5% and the public debt of the country to 60% of GDP.

On the measures for Gozo, the GBC, is pleased to see that Government has taken heed of the request of the Chamber to have the stamp duty on purchase of residential property in Gozo lowered to a 2%. However, it feels that this measure should be put into immediate effect and include all pending promises of sale and not put in action from the beginning of next year for obvious reasons.

The GBC praised the commitment of Euro 16M to increase space at the Xewkija Industrial Estate. The commitment of Euro 3.2M for the second fiber optic cable between the two islands is also very positive. However, if certain incentives were introduced it would have the desired effect on companies setting up in Gozo. The Chamber is also pleased to see that after the issue of the tender for the geological studies between the islands government has announced that next year it will be issuing out an international tender for the design, building and operation of the tunnel between the two islands. The Chamber also hopes that government will continue to invest more in the infrastructure needed on the island especially on the roads and other projects which will make Gozo an upmarket destination.

Malta Hotels and Restaurants Association

This Budget focuses measures on lower income earners and pensioners, which is in line with our pre-budget theme of “Creating Shared Value”. Indeed, MHRA is pleased with various positive measures which have been announced in the Budget Speech which directly support the tourism sector such as: investment to further support the sustainable growth of the cruise-line business; the commencement of works on the new Institute of Tourism Studies; infrastructural investment including projects related to public parks, various embellishment initiatives and improvement in the road network across a number of localities including Gozo.

MHRA welcomes the tax credit schemes for renovations in hotels and restaurants aimed at the continued improvement of the tourism product. However MHRA was expecting specific votes for the immediate upkeep of core tourism areas, such as Bugibba and Qawra, which are in urgent need of serious investment.

MHRA positively notes that the energy efficiency scheme it proposed for Hotels and Restaurants will be implemented next year.

MHRA is encouraged by the 2016 deficit estimate which is set to be below one per cent and is expected to further improve next year. MHRA is also pleased to note that the national debt as a percentage of the GDP is on the decrease and getting closer to the 60 per cent allowed by Euro zone targets.

Alternattiva Demokratika

Alternattiva Demokratika called on the government to stop wasting money on studies for a tunnel connecting Malta and Gozo and instead invest in incentives that would reduce the use of vehicles.

AD chairman Prof. Cassola praised the increase in work benefits but called for a revision of the minimum wage package. He said that what was proposed does not reflect the current government’s rhetoric of a booming economy, stressing that it should reflect the “quality of life that we aspire to”.

AD welcomed the introduction of incentives in the rental market for low-income families but also said that there were not enough, and the suggestions that were proposed may be ineffective.

The introduction of a tax on construction materials would also allow the industry to give back to the community, according to Cassola, but stressed that AD would much rather see a “moratorium” on large scale developments.

He also criticized the reduction in stamp duty on property in Gozo, fearing that it would induce over-development and have a detrimental effect on Gozitan life.

With regards to the transport sector, Cassola welcomed the introduction of initiatives in public transport, however he said that this is not a solution to the traffic problem and pollution.

Cassola also expressed regret that the government once again forgot about the introduction of incentives for bicycle and their electric counterparts.

Malta Chamber of SMEs

The positive growth being experienced by our economy has produced wealth giving rise to the possibility of spreading economic benefits across sectors. Nevertheless continuous tangible incentives and measures are necessary in the implementation phase to ensure that the positive economic results are not only achieved but sustained.

WIDESPREAD FISCAL BENEFITS

GRTU sees that direct fiscal measures targeted at wider sectors such as pensioners and those on minimum wage are expected to increase disposable income to generate economic benefit across the board.

TRAFFIC AND TRANSPORT

GRTU’s calls and proposals for immediate solutions to the traffic crisis have led to a number of commitments and measures in this Budget. Private collective transport is being incentivised by tax deductions to employers that organise free transport for their employees and large government entities are to provide transport for their own. The urgent need to give a full focus on the Kappara Junction Project to increase the rate of work drastically in order to reduce the negative impact of the length of the project seems to have been heard with a renewed commitment. Incentives to increase parking areas through Projects Malta and Planning Authority proposals to attract public car parks also echo GRTU proposals to solve the traffic crisis. Measures addressing organised school transport which are key for imminent improvement have unfortunately been left out.

ENERGY

GRTU fails to understand how yet for another year, possible savings to business by reduction of energy bills has not been transcended to boost the economy. Following last year’s call by GRTU to decrease utility tariffs, one of GRTU’s main proposals was that of opening up the energy market to more operators in a bid to increase competition and reducing cost to businesses.

Renewable energy initiatives such as the PV Farm project have always been advocated by the GRTU and is once again welcomed as it is being committed to in the Budget. It is however the second year to see this proposal in the Budget and now GRTU awaits immediate implementation.

BUREAUCRACY

It is welcoming to note that GRTU’s proposal on removing senseless compulsory audits for micro-SMEs has partially been taken up by introducing this option for the first two years for start-ups. This is the very first time this concept has been introduced in Malta. This incentive is however only tied to post-graduate start-ups and should definitely be extended to all start-ups if we want all youths to feel empowered on an equal level and not discriminate between business ideas based on educational attainment.

GRTU constantly advocates for the reduction of bureaucracy and therefore welcomes the announcement of removal of trading licenses.

HUMAN RESOURCES

The positive results of decreasing unemployment rates have led to human resources evidently becoming more of a key growing concern to employers across the majority of sectors. GRTU expected to see tangible aggressive measures to address the imminent situation with solutions to a problem that can no longer wait to be tackled.

PENSIONS

GRTU’s proposal for a mandatory pension for self-employed with voluntary opt-outs has resulted in voluntary pension incentives for employers and their employees. In GRTU’s opinion this is a positive step yet the take-up is expected to be weaker than that of the original GRTU proposal.

EXTENSION OF THE VALLETTA SHOP SCHEME

GRTU is pleased to note that the successful 45-year emphytheusis scheme for businesses operating in rented publically-owned premises, negotiated by GRTU in the case of Valletta shops, is now being extended beyond Valletta.

FAMILY BUSINESS TRANSFER

The measure for family business transfer stamp duty to be reduced from 5% to 1.5% from parent to child is a tangible implementation of the Family Business Act concept. GRTU however asks why this is only being launched for 12 months where such timeframe does not allow for planning and execution.

JOINT ENFORCEMENT TASK FORCE (UNFAIR COMPETITION)

GRTU sees initiatives under a new name which are once again supposedly targeted at addressing unfair competition. GRTU hopes that the launch of the Joint Enforcement Task Force would be a tangible initiative this time round as this is a long-awaited essential point to be tackled for SMEs and enterprises that are being driven out of business due to unfair competition.

OPENING HOURS

The flexibility of opening hours according to business needs is another long-awaited commitment by government which has been dragged from one Budget to the other. GRTU asks that after exhaustive consultation and such a long wait, this is implemented by the end of the year.

EXCISE DUTIES

GRTU has noted the increase in specific excise duties such as toiletries, non-alcoholic drinks, glass, iron and tiling, and shall be looking into the expected effect on various sectors. After years of being hindered by eco-contribution tax, these businesses are now being castigated with the introduction of excise duty.

OTHER INCENTIVES

Other incentives noted positively by GRTU include the introduction of the Risk Inventing Scheme for Investment in SME companies which will receive tax incentives of up to Eur250,000 and the stamp duty reduction from 5% to 2% in the case of Gozo.