Soft landing after growth peaking in 2015

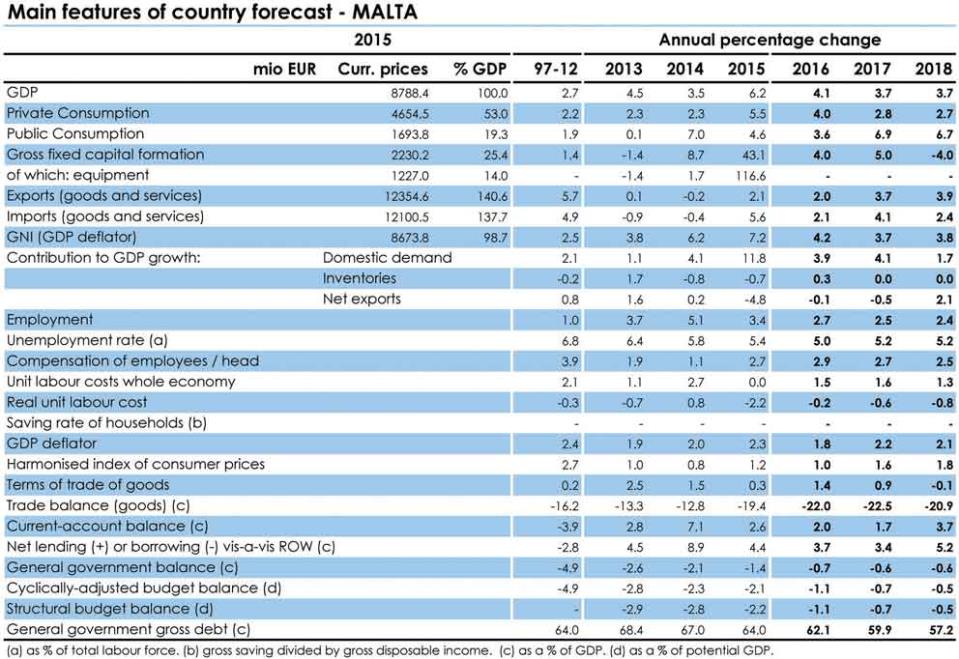

After climbing to 6.2% in 2015, GDP growth is projected to glide down to 4.1% this year and 3.7% in 2017 and 2018, still among the fastest growing in the euro area. Growth is to continue to be based on strong labour market fundamentals - robust job creation and low unemployment. Fiscal consolidation is set to continue, bringing down the government debt below 60% of GDP.

Moderating growth and closing output gap

The Maltese economy continues to perform strongly. After peaking in 2015, real GDP growth moderated in the first half of 2016 to 4.1%, still higher than most peers. With economic sentiment still above the long-term average, the pace of growth is projected to remain unchanged in the second half of the year, coming in at 4.1% for 2016 as a whole. Thereafter, growth is forecast to decline somewhat, but to remain robust at 3.7% in 2017 and 2018. As a result, the positive output gap is expected to close rapidly.

Domestic demand still going strong

Domestic demand is projected to remain the main driver of growth in 2016 and 2017. Private consumption is seen to be the main contributor reflecting rising disposable income, a growing population, and a decreasing saving rate. Following the construction of a new power plant, private investment is projected to remain strong in 2016 and 2017 boosted by newly-emerging activities in the transport sector as well as a number of large projects. As the investment cycle moderates, gross fixed capital formation is seen to contract in 2018 on a high base.

Services, in particular transport, are projected to be the main driver of exports over the forecast horizon, despite a projected decrease in demand from the United Kingdom. The government's citizenship programme also positively affects services exports. Meanwhile, goods exports are forecast to contract in 2016 and to embark on a gradual recovery thereafter, particularly driven by the chemical and pharmaceutical industry. The high import content of investment is projected to lead to a slightly negative contribution of net exports to growth in this and next year. By contrast, with domestic demand slowing down in 2018, net exports are projected to make a significant contribution to GDP growth.

The launching of additional investment projects could pose an upside risk to these projections. The ability of the tourism sector to quickly counterbalance a slowdown in demand from the United Kingdom represents an additional upside risk. A protracted weakness in goods exports, linked with lower demand from emerging markets, could result in weaker-than-expected economic growth.

Low unemployment, recovering inflation

The unemployment rate is projected to drop further to 5% in 2016 on the back of sustained strong job creation. Thereafter, unemployment is forecast to increase slightly, in line with moderating GDP and employment growth, but should remain very low by historical standards. Nevertheless, upward pressure on wages is forecast to remain limited as the influx of foreign labour mitigates labour market shortages. Growth in unit labour costs is projected to average 1.4% between 2016 and 2018 - well below the long-term average.

HICP inflation is projected to reach 1.0% in 2016, mainly driven by services and food prices. It is forecast to accelerate to 1.6% in 2017 on the back of rising oil prices and a further acceleration of services inflation. Thereafter, overall HICP inflation is projected to edge up to 1.8% in 2018.

Structural deficit decreases

In 2016, the general government deficit is forecast to decrease to 0.7% of GDP, from 1.4% in 2015. Current tax revenue is expected to grow more than nominal GDP, boosted by the positive outlook for the labour market and consumer demand as well as the rise in excise duties and the proceeds from the citizenship programme. Current expenditure is expected to continue growing, mainly driven by public sector wages and intermediate consumption related also to costs associated with the country's upcoming EU presidency. Debt servicing costs, by contrast, is estimated to decrease. As a result, current expenditure is expected to decrease by 0.4pps. of GDP. The sharp decline in the absorption of EU funds due to the beginning of a new programming period and the lower capital injection into the national airline is more than compensated by a higher reliance on national funds. As a result, net capital expenditure is expected to increase by 0.3 pps. of GDP.

In 2017, the deficit is expected to decline marginally to 0.6% of GDP. Lower proceeds from the citizenship scheme are projected to result in a decline of current revenue (-0.7 pps. of GDP) despite tax revenue being boosted by the introduction of new excise duties and the concessions on stamp duty for business inheritance. These measures are partly offset by an income tax rebate for pensioners and incentives for businesses. Despite the introduction of several measures aimed at increasing social spending and expenditure on intermediate consumption and other current expenditure in the 2017 budget, current expenditure is expected to decrease due to lower interest expenditure. As reliance on national funds decreases due to an increase in the absorption of EU funds, net public investment is anticipated to decrease by 0.3 pps. of GDP. In 2018, under a no-policy-change assumption, the deficit is expected remain stable due also to a decline in revenue linked to the citizenship programme. Potential expenditure overruns could come from the renewal of the public sector wage agreement.

The structural deficit is projected to be on a declining path, decreasing by more than 1 pp. of GDP in 2016, by ½ pps. of GDP in 2017 and by ¼ pps. of GDP in 2018, thanks to a swift closure of the positive output gap. From 64% in 2015, the debt-to-GDP ratio is projected to fall below 60% in 2017 and to reach 57.2% by 2018.