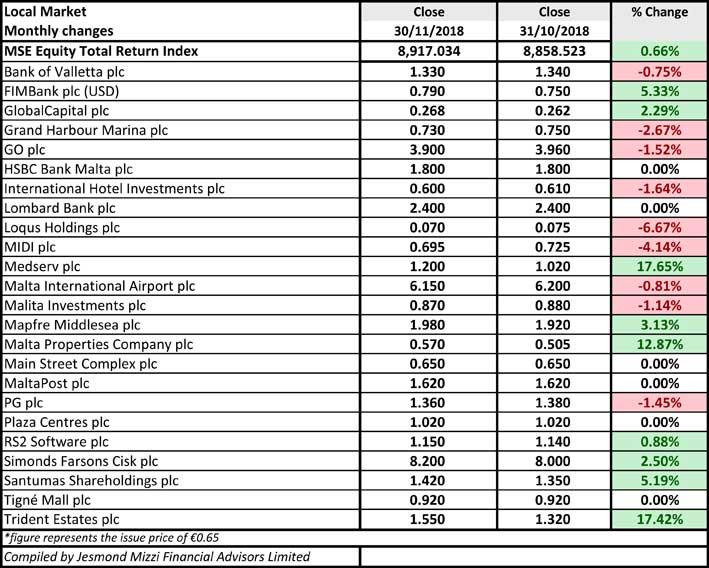

The MSE Equity Total Return Index closed in positive territory for the third consecutive month, having advanced by 0.661%, closing at 8,917.034 points - up by 2.86% as at year-to-date. Turnover amounted to €6.5 million spread across 24 equities, of which gainers and losers tallied at nine.

Medserv plc shares registered the best performance, having rallied by 17.7% to €1.20, as 67 trades of 632,705 shares were executed. The company announced that following an international tendering process, Medserv International Limited has been awarded a shore base contract valued at $30.6 million in a new geographical market in Guyana, South America. The contract is for a period of 15 months, starting from the beginning of 2019. Medserv shall provide integrated logistics support services to a nearshore drilling campaign of Staatsolie Maatschappij Suriname N.V. (Staatsolie) together with shore base business partner Kuldipsingh Port Facility N.V. and marine services provider Trinity Lift Boat Services Ltd.

The group is expecting that this contract be serviced through its internal resources, since it will not require any major capital expenditure. The company claimed that this award, together with already contracted business, further underpins the projected revenue growth forecast for the next two years.

Trident Estates plc shares followed suit, having appreciated by 17.4% or €0.23, over 19 transactions of 68,750 shares, to close at €1.55. Meanwhile, Malta Properties Company plc shares advanced by 12.9%, as 30 deals of 285,892 shares were negotiated, closing €0.065 higher at €0.57.

In the same sector, MIDI plc shares fell by 4.1%, as 782,866 shares changed ownership over 48 trades, to close at €0.695 - up by a significant 98.6% on a year-to-date basis. Reports in the local media suggested that a preliminary deal between MIDI and Tumas Group has been struck, in which the latter shall be taking over the Manoel Island Project, by purchasing at least 60% shareholding of a new company to be set up with MIDI as a joint venture. The company responded by informing the market that no preliminary agreement has been entered into and insisted that although discussions are ongoing, these may or may not result in a transaction. Any material updates will be communicated in accordance with regulatory requirements.

Tigne' Mall plc (Tigne') announced that further to the announcement made on September 11, 2018, relating to the promise of sale and purchase agreement dated September 10, 2018 with MIDI.

On November 28, 2018 it entered into an agreement with MIDI to extend the promise of sale and purchase agreement in respect of the Property to December 15, 2018. In terms of the said promise of sale and purchase agreement, MIDI promised to sell and transfer to the company, which promised to acquire the temporary utile dominium of the remaining period of the original period of ninety nine (99) years, which commenced on the fifteenth day of June of the year two thousand (15/6/2000), by virtue of the emphyteutical grant signed between MIDI and the Government of Malta, relating to the Garage Complex, known as the T1 Car Park, which comprises 132 car parking spaces over three underground levels. .

Tigne' shares were executed across nine deals of 100,000 shares, closing unchanged at €0.92 - down by 15.5% as at year-to-date.

The special purpose vehicle, Malita Investments plc shares, declined by 1.1% over 22 trades of 259,160 shares, closing at €0.87.

Plaza Centres plc shares closed unchanged at €1.02, as 12 transactions of 77,795 shares were negotiated. Meanwhile, Main Street Complex plc shares closed unchanged at €0.65, having recovered from a monthly low of €0.60. The shopping mall owner's shares were active on six trades of 232,429 shares.

Bank of Valletta plc shares closed in the red for the sixth consecutive month, having decreased by 0.8%. The banking equity was negotiated across 186 deals of 712,051 shares, closing at €1.33. Amalgamated Investments SICAV plc announced that the preliminary agreement entered into with UniCredit Spa for the acquisition of the latter's shareholding in BOV has been automatically terminated. The reason given by the investment company was that conditions in the said agreement were not satisfied by the predetermined deadline of October 31, 2018.

HSBC Bank Malta plc shares oscillated between a monthly low of €1.73 and a high of €1.80 - at which they closed. The equity witnessed 42 trades of 281,534 shares. HSBC published its Interim Directors' statement in which it reported the bank's performance for the first nine months of 2018. In line with the interim results, profit before tax for the period declined compared to the previous year. Revenue for the period was lower as a result of the persisting low interest rate environment, a reduction in the corporate loan book, and the various risk management actions taken during 2017. Meanwhile, operating expenses were higher due to investments in regulatory programmes combatting financial crime and business growth. The bank reported that its liquidity position remained exceptionally strong and the regulatory capital ratios continue to exceed regulatory capital requirements.

The bank's CEO, Mr. Andrew Beane, said that the quarter's results are in line with expectations and the bank's improved risk management is now enabling greater focus on growth.

FIMBank plc shares advanced by $0.04, or 5.3%, across 30 transactions of 620,027 shares, closing at $0.79. The trade finance bank has registered an increase in its share price for the fifth consecutive month and has rallied by 14.5% since the beginning of this year . The bank announced that on November 21, 2018, United Gulf Holding Company B.S.C. (UGH) acquired over 19 million FIMBank shares from Burgan Bank K.P.S.C. Following this transaction, UGH shareholding in the bank has now increased from 74.89% to 78.66%, while Burgan Bank's holding has gone down from 12.27% to 8.5%.

Lombard Bank Malta plc shares traded flat at €2.40 on two deals of 3,100 shares. The bank announced that further to its previous announcements, it has been notified by the National Development and Social Fund (NDSF) of Malta of its firm intention to dispose of all or part of its shareholding in the bank and to commence the process for the disposal in an orderly manner. The NDSF informed the bank that the completion of the disposal shall be conditional and dependent on market conditions, regulatory approvals and other conditions that are currently being evaluated by the NDSF. The NDSF holds 21,651,746 ordinary shares in the issued share capital of the bank representing 49.01% of the total issued share capital of the bank.

Malta International Airport plc (MIA) shares slipped by €0.05, or 0.8%, over 49 trades of 117,632 shares, closing at €6.15. The local airport operator published the traffic results for the month of October, registering a total of 646,559 passenger movements, translating to an 8.4% increase over the same month last year.

This shows that the airport is on track to reaching its forecasted 6.8 million passenger movements by the end of 2018, as it is currently just short of the 6 million mark.The summer period, spanning from April to October, concluded with a 12.2% overall growth in passenger numbers. This was in line with a 13.4% increase in aircraft movements and a 13.7% increase in seat capacity, as a result of a significantly enhanced summer schedule.

The top drivers for passenger traffic were the United Kingdom, Italy, Germany and France, while Spain recorded an impressive 44.5% growth, following the launch of three new summer routes.

Furthermore, MIA issued an Interim Directors' Statement providing an update on the company's performance since the last update provided in July. The company announced that, during this period, no material events or transactions had taken place that would have an impact on the solid financial position of the company.

The turnover for the first nine months of 2018 was €70.8 million, translating to a 12.2% increase over the corresponding period last year. Expenditure also increased, at a slower pace, as it was 10.9% higher, ultimately resulting in a 16.5% growth in profit for the 9-month period, to €24.9m.

The company remains positive with respect to its traffic projections, and thus it expects the last quarter to follow the positive trend registered so far, and in line with the financial targets set out earlier this year.

The investments and insurance services provider, GlobalCapital plc, registered a 2.3% increase in its share price. The equity was negotiated over one trade of 1,940 shares and closed at €0.268. In the same sector, Mapfre Middlesea plc shares advanced by 3.1% across eight deals of 13,078 shares, closing €0.06 higher at €1.98.

Loqus Holdings plc shares extended their negative streak, having declined by 6.7%, to close at €0.07 - recording a 60% decline as at year-to-date. The I.T. equity was negotiated across 11 deals of 281,459 shares.

RS2 Software plc shares increased by 0.9%, as 263,534 shares changed ownership over 45 transactions, to close at €1.15 - down by 25.3% as at year-to-date.

GO plc shares fell by €0.06, or 1.5%, as 116,113 shares changed hands across 45 trades, closing at €3.90. The telecommunications services provider announced its intention of an initial public offering of shares in BMIT Technologies plc. The company announced that GO will be seeking to dispose of up to 49% of its shareholding in BMIT, formerly known as GO Data Centre Services Limited. The core business of BMIT is primarily carried out through four companies, enabling it to offer its customers a complete suite of data centre centric services, including hosting and managed services, as well as a range of cloud services. The group also specializes in the design, implementation, support and optimization of ICT solutions for the corporate sector.

The value of gross assets attributable to the group amount to €15.8 million, generating a profit after tax of €4.1 million for 2017. GO is seeking to raise up to €49 million, through the disposal of the shares.

BMIT, which is being valued at €100 million, is the largest data centre operator in Malta, having always functioned separately from GO, in terms of operations.

BMIT plans to develop a new data centre in Zejtun, which would increase the company's capacity by nearly 30%. EBITDA is expected to increase from €7 million back in 2015, to €11.4 million in 2020, while the projected net dividend yields are 4.4% in 2019, and increasing to 4.9% in 2020.

The rationale behind the IPO is to deliver shareholder returns and to raise the profile of the BMIT group, while giving it access to the capital markets. This move will also enhance both companies' management focus and improve their governance. The process of the IPO is expected to be concluded by February 2019.

Grand Harbour Marina plc shares decreased by 2.7% over two deals of 590 shares, closing at €0.73.

The retail and supermarkets owner PG plc registered a 1.5% loss in its share price, having closed the month at €1.36. The equity was active on 30 trades of 335,440 shares. On December 3, 2018 the Board resolved to distribute a net interim dividend of €0.015741 per ordinary share. This interim dividend will be paid on December 10, 2018 to the ordinary shareholders who were on the company's register as at November 30, 2018.

The Board will be convening on December 18, 2018 to approve the Interim Unaudited Financial Statements for the six-month financial period from May 1, 2018 to October 31, 2018. The board also announced that the Zara Shopping Complex located at the Alhambra Centre in Sliema, opened its doors for business on November 28, 2018, following months of extensive construction works that were carried out for the enhancement and extension of this shopping complex.

International Hotel Investments plc shares declined by 1.6% across 41 deals of 388,075 shares, closing at €0.60.

Santumas Shareholdings plc shares appreciated by €0.07 or 5.2%, as 27,265 shares changed ownership over seven trades, to close at €1.42.

The food and beverage supplier, Simonds Farsons Cisk plc, registered a 2.5% increase in its share price. The equity witnessed seven transactions of 35,104 shares, closing €0.20 higher at €8.20.

MaltaPost plc shares traded unchanged at €1.62 over two deals of 3,767 shares.

D Shopping Malls Finance plc announced that the offer of €7,500,000, 5.35% Unsecured Bonds 2028 was fully subscribed. The bonds were admitted to trading on Prospects MTF, and trading on the Malta Stock Exchange commenced on November 13, 2018. D Shopping Malls, is part of Dizz Group which is now the first group to issue a bond on the main market and a bond on the Prospects MTF market.

The proceeds shall be utilised primarily to develop two shopping and commercial centres - D Mall located in Tigne Point, and Center Parc located in Qormi. Through the proceeds, the company will also acquire property located in Laguna Complex, Portomaso as well as an apartment in Qui-si-Sana, Sliema.

In the corporate bond market, 53 issues were active, of which 17 gained ground and 25 fell. Turnover amounted to €11 million. The 4.5% Medserv plc Unsecured € 2026 headed the list of gainers, having advanced by 1.5%, to close at €102.50. Meanwhile, the 4.5% Izola Bank plc € Unsecured 2025 was the worst performer, having declined by 3.8%, closing at €102.

In the sovereign debt market, turnover totalled €28.4 million, spread over 26 issues, of which 19 declined and seven advanced. The 2.1% MGS 2039 (I) registered the best performance and was the most liquid issue, having witnessed a turnover of €9.5 million, as it advanced by 2% to €102.50.

This article, which was compiled by Jesmond Mizzi, Managing Director of Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member Firm of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information, contact Jesmond Mizzi Financial Advisors at 67 Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]