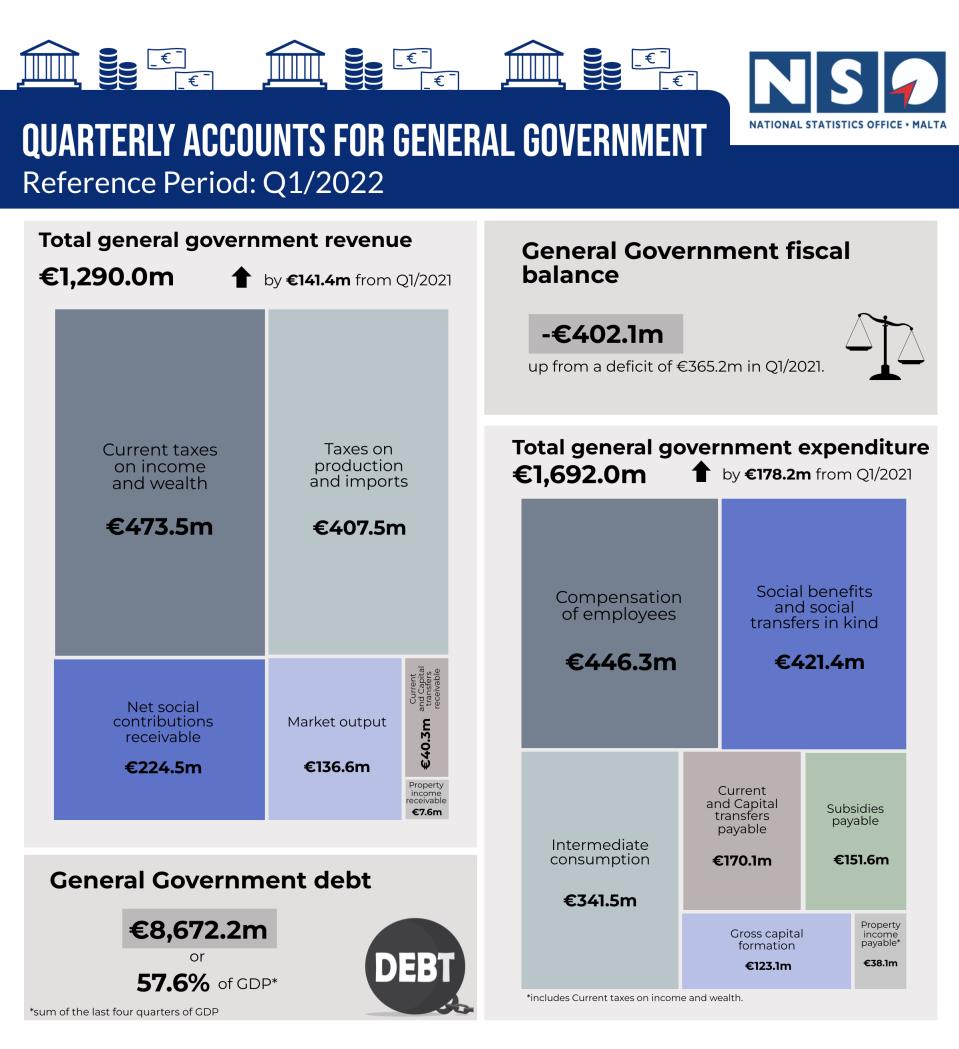

At the end of March, General Government debt stood at €8,672.2 million, or 57.6% of Gross Domestic Product (GDP), the National Statistics Office said.

This equates to an increase of €1.17 billion over the corresponding quarter in 2021, largely reflected in Central Government Debt, which amounted to €8,669.9 million.

Currency and deposits stood at €567.3 million, an increase of €98 million over March of 2021. This includes euro coins issued in the name of the Treasury, considered a liability of Central Government, and the 62+ Malta Government Savings Bond, the latter amounting to €376.7 million.

Long-term debt securities and Long-term loans increased by €863.2 million and €186.0 million, respectively. Short-term debt securities increased by €27.2 million, while Short-term loans increased by €0.5 million.

Local Government debt stood at €2.3 million.

General Government guaranteed debt amounted to €1,151.3 million at the end of March 2022, equivalent to 8.0 per cent of GDP. There was a decrease of €33.4 million when compared to the first quarter of 2021.

Revenue

During the period January to March 2022, total revenue stood at €1,290.0 million, an increase of €141.4 million when compared to the corresponding quarter in 2021.

Almost all components of General Government revenue recorded an increase, with Current taxes on income and wealth registering an increase of €86.1 million over the same period in 2021.

This was followed by Taxes on production and imports (€63.8 million), Market output (€31.9 million), Net social contributions receivable (€20.3 million), and Current transfers receivable (€0.7 million).

In contrast, Capital transfers receivable and Property income receivable decreased by €54.8 million and €6.6 million, respectively.

Total expenditure in the first quarter of 2022 amounted to €1,692.0 million, an increase of €178.2 million over the corresponding quarter in 2021.

The largest increase was recorded in Social benefits and social transfers in kind (€71.8 million), followed by Current transfers payable (€51.9 million) and Intermediate consumption (€45.8 million).

Other increases were registered in Capital transfers payable (€8.1 million), Compensation of employees (€5.2 million) and Subsidies payable (€2.0 million). These increases were partially offset by decreases in Gross capital formation (€3.5 million) and Property income payable (€3.1 million).