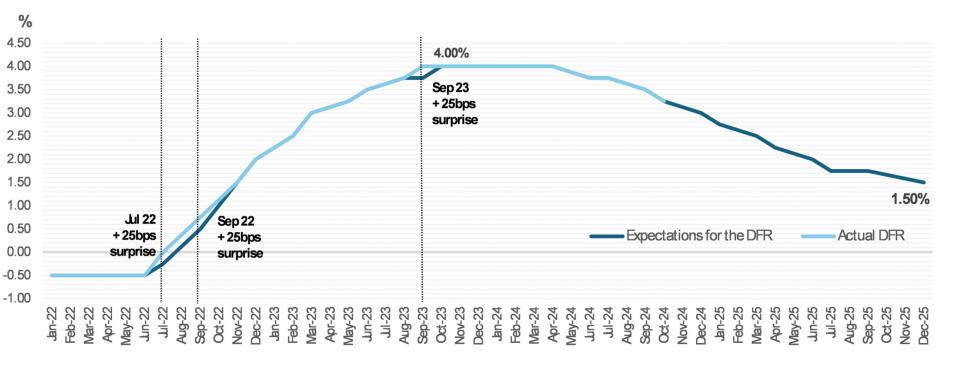

Chart 3: ECB DFR expectations vs actual monetary policy decisions

Source: ECB, ECB Survey of Monetary Analysts

Monetary policy expectations play a pivotal role in shaping market behaviour. These expectations are based on what investors and businesses anticipate central banks will do to guide the economy. One key factor that often mirrors these expectations are government bond yields, providing a snapshot of how markets view future interest rates and economic conditions.

This article focuses on the period between January 2022 and December 2024. It studies the expectations surrounding monetary policy and compares them with the actual decisions made by two of the most influential central banks: the Federal Reserve (Fed) of the US and the European Central Bank (ECB).

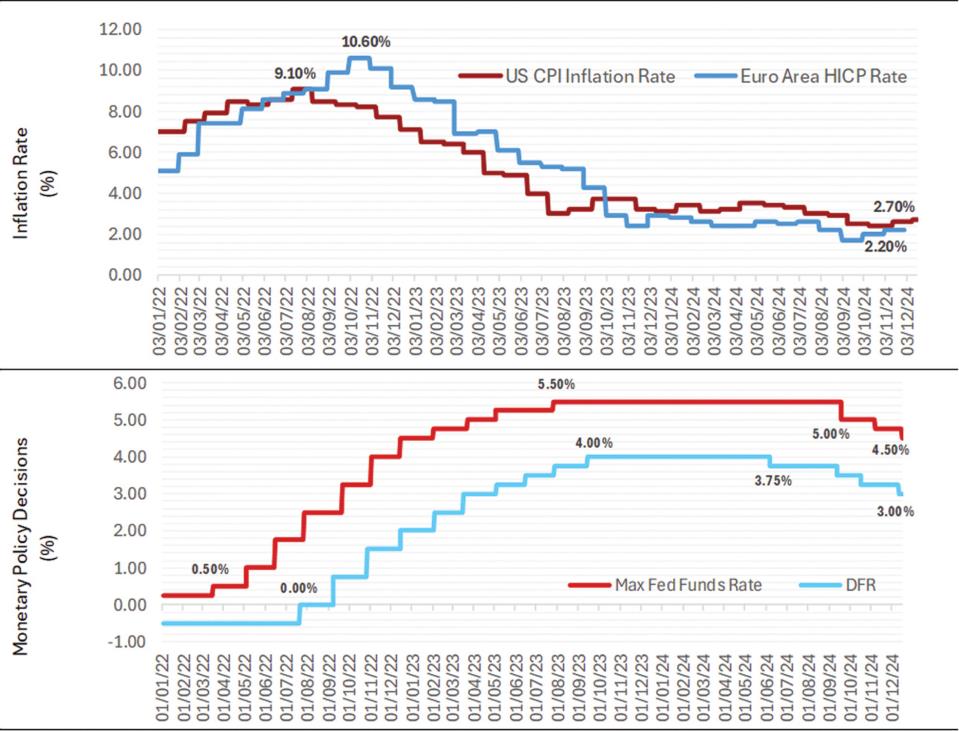

As illustrated in Chart 1, inflation rates in the US and the euro area peaked in late 2022, largely driven by supply shocks in the aftermath of the COVID-19 pandemic and rising food and energy prices following the invasion of Russia in Ukraine. Both the Fed and ECB tightened their monetary policies in 2022 and 2023. As inflation started to moderate towards the end of 2023 and central banks paused their rate hikes, market expectations were then reflected in a decline in bond yields within the same period.

Chart 1: Inflation & Monetary Policy Decisions Source: ECB, Eurostat, NY Fed

Chart 1: Inflation & Monetary Policy Decisions Source: ECB, Eurostat, NY Fed

The ECB raised rates by 450 basis points (bps) between March 2022 and September 2023, with the Deposit Facility Rate (DFR) peaking at 4.00% and remaining there until June 2024. Similarly, the Fed raised the Fed Funds rate by 525bps from March 2022 to July 2023, reaching 5.25%-5.50%, which was maintained until September 2024. Both central banks' actions were guided by data, including inflation, labour market, and economic activity indicators in their respective regions.

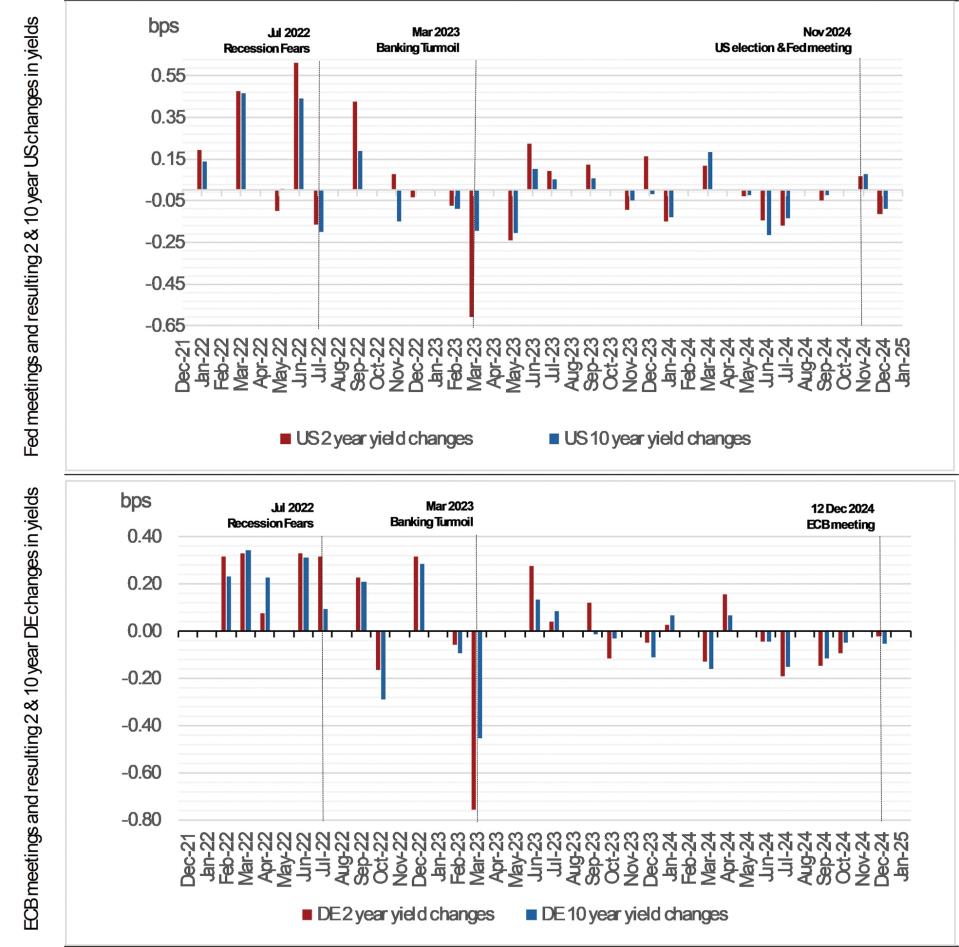

As the market expected central banks to ease monetary policy in 2024, changes in yields were negative from May until September for the US and June to October for the euro area. In November 2024, changes in yields turned positive for the 2- and 10- year US yields possibly due to the US election and its effects on bond markets. In the euro area, yields declined in late November and early December due to a combination of factors, including expectations of a more dovish ECB, weaker economic data and political uncertainty in France. Yields in the US also followed a downward trend due to the expectation of a dovish Fed, weak economic data and geopolitical developments.

Chart 2: ECB & Fed meetings & changes in 2- & 10-year yields. Source: Reuters, Authors' Calculations

Are ECB monetary policy decisions in line with market expectations?

According to the ECB's Survey of Monetary Analysts (SMA), between July 2022 and September 2023, interest rate expectations were frequently revised primarily due to a rapid surge in inflation. Market expectations largely aligned with the ECB's decisions, as shown in Chart 3, which compares market expectations with the actual DFR from January 2022 to December 2025. However, the ECB surprised the market with 25bps higher rate hikes than the market expectations in July 2022, September 2022, and September 2023. In July 2022, the ECB raised rates by 50bps, citing inflation risks. In September 2022, a 75bps hike followed, after inflation hit 9.1% in August. The September 2023 hike was driven by an upward revision in inflation projections.

Chart 3: ECB DFR expectations vs actual monetary policy decisions. Source: ECB, ECB Survey of Monetary Analysts

Chart 3: ECB DFR expectations vs actual monetary policy decisions. Source: ECB, ECB Survey of Monetary Analysts

In early 2024, lower inflation and growth led markets to expect nearly six rate cuts in the Eurozone. As inflation cooled, the ECB implemented a 25bps rate cut in June 2024, followed by additional cuts in September and October. In a recent article by Bloomberg, the ECB is shown focusing on issues of slowing growth and weak Purchasing Managers Index (PMI) figures. The HCOB Flash Eurozone Composite PMI Output Index dropped to 48.1 in November, from 50.0 in October. Reduced business activity could prompt market participants to anticipate more rate cuts. Most recent projections published by the SMA sees the DFR to decrease by 175bps by the end of 2025.

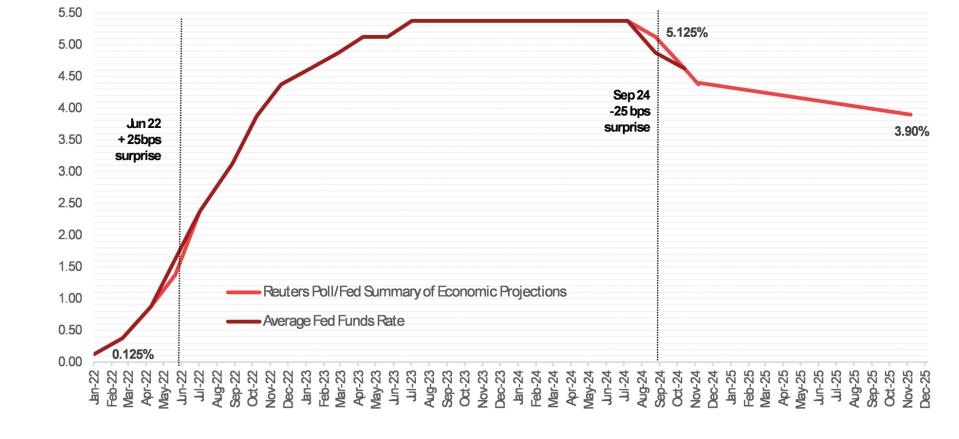

The Fed: A surprising shift in policy

Data from the Chicago Mercantile Exchange (CME) Group in 2022 showed traders initially expected gradual rate increases, whilst assuming a stable inflation outlook, which later changed rapidly as inflation surged. By June 2023, the Fed Funds rate had reached 5.25%, much higher than initially forecasted.

In March 2024, the Fed indicated plans for three rate cuts during the year. After its July meeting, where rates were held steady, Fed Chair Jerome Powell suggested that a rate cut in September was "on the table." The Fed followed through and began easing its policy with a 50bp cut on its Fed Funds rate, exceeding market expectations by 25bps.

Chart 4: Fed Funds Rate expectations vs actual Fed policy decisions. Source: Reuters Poll, Fed, Fed Summary of Economic Projections, December 18, 2024

Chart 4: Fed Funds Rate expectations vs actual Fed policy decisions. Source: Reuters Poll, Fed, Fed Summary of Economic Projections, December 18, 2024

Chart 4 compares the actual Fed Funds rate from January 2022 to December 2025 with market expectations, as polled by Reuters until December 2024, and projected median rates from the Fed's Summary of Economic Projections (December 2024). The chart shows that there were only two instances where the Fed's policy rate trajectory surprised the market.

As expected, in its December meeting, the Fed lowered its benchmark rates by 25bps and added a cautionary tone with future rate hikes now dependent on lowering stubborn high inflation. As per Chart 4 below, the Fed is expected to lower the Fed Funds rate by 50bps until December 2025.

Looking ahead

The election of Donald Trump as the new US President is expected to bring looser fiscal policy, stronger demand, and higher consumer prices, in part due to import tariffs. Some potential spill overs on the Eurozone could be expected, together with other risk factors to consider, including the prolonging of the war between Russia and Ukraine and recent political uncertainty in Germany and France. Looking ahead, much will depend on economic data results from both regions and how the uncertainties surrounding global trade pan out. The market will continue to remain on the lookout to anticipate central banks' response to political and economic news.

Maria Micallef is a Senior Analyst at the Monetary Operations & Government Securities Office.

Kimberly Agius is an Assistant Executive at the Monetary Operations & Government Securities Office.