Bank of Valletta, after suffering significant embarrassment over the misuse of an early retirement scheme to accommodate its former legal adviser Michael Falzon when he was named parliamentary secretary in 2014, is now seeking ways to remove employees’ automatic right to benefit from the scheme, The Malta Independent on Sunday can reveal.

Sources within the bank, who have been furnishing confidential information to this newsroom on grounds of alleged weak corporate governance, told us that the 2011 collective agreement, which was meant to have been signed last year, is still being negotiated with the General Workers’ Union due to several bones of contention, among which is the restructuring of the bank’s early retirement scheme.

Under the current collective agreement “employees can opt for early retirement at the age of 58 and receive a lump sum payment equivalent to three years’ salary”. However, the collective agreement goes on to state that “the option to retire will be exclusively in the hands of the employee and the bank will honour the employee’s decision”.

Sources who spoke to this newsroom revealed that in the negotiations with the GWU over the new collective agreement, the bank is proposing the elimination of the early retirement scheme conditions as they are currently defined and instead proposes a long service payment that will be made to all those who retire at the statutory retirement age or later.

But what irked many bank employees is that notwithstanding the fact that the bank was already negotiating the elimination of the early retirement scheme for its staff, thus making them work at the bank till the age of 61 and over, it still found it fit to award Dr Falzon an early retirement package in the region of a quarter of a million euros.

On the one hand, the bank’s chairman John Cassar White is claiming internally that the elimination of the early retirement scheme is in line with the government’s active ageing policy, aimed at encouraging workers to retire later rather than earlier, on the other he had no problem defending the decision to award the lump sum to Dr Falzon, whose eligibility is questionable due to his age at the time he left the bank.

Dr Falzon has also been granted the possibility to return to work at the bank should he not be elected in the next general election.

It is now being envisaged that starting from 2016 early retirement will be considered at the sole discretion of the bank and only in particular circumstances, which include humanitarian grounds, when the bank feels that an employee is no longer capable of contributing to the bank’s success and when a bank employee is called to perform senior executive duties at a national level either in the public or voluntary sector.

As such, instead of the automatic right for early retirement at the age of 58, bank employees will have to submit their application to the same board which awarded the ‘questionable’ early retirement package to Dr Falzon.

CEO will not be eligible for a retirement package unless…

The outgoing bank’s CEO, Charles Borg, may miss the opportunity for an early retirement package of the likes awarded to Dr Falzon – notwithstanding the fact that they are the same age and have spent nearly the same time working for the bank.

The differences, according to insiders, are clear. Dr Falzon was appointed parliamentary secretary in the government, which holds a 25 per cent shareholding in the bank and the right to appoint the bank’s chairman, and received a golden handshake of a quarter of a million euros. Charles Borg, meanwhile, is being pushed out of the CEO’s seat with no golden handshake in sight.

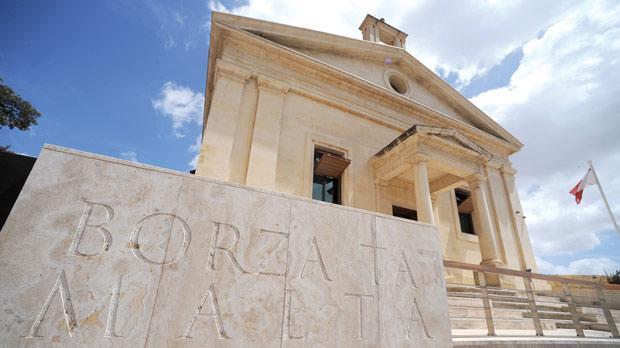

Mr Borg’s contract expires at the end of the year but the bank has gone out of its way to make it clear that it doesn’t intend extending his tenure. In an unprecedented move in the financial sector, the bank announced in a company announcement on the Malta Stock Exchange that it intends to recruit a new CEO.

“Usually the bank would make such an announcement when it actually recruits a new CEO, and not before issuing a call for applications,” sources in the financial sector claimed.

Early last week, the bank’s chairman called an extraordinary Board of Directors meeting, not to update the board on the meetings held with the European Central Bank as revealed by our sister daily newspaper, but rather to inform them of his intentions to announce a call for applications for a new CEO.

Ironically, according to our sources, the bank’s CEO, Mr Borg, was not invited to the meeting and only learned of the subject discussed when the announcement was made.

Come January 2016, Mr Borg will either go back to his former post at the bank, reporting to the new CEO about to replace him, or potentially ask REMCO, the three-man internal board that approved Dr Falzon’s contentious early retirement package, to award him a similar one.