The Malta Financial Services Authority is still to answer questions concerning Julie Meyer, while a number of sources have detailed the highly unethical work practices of the American entrepreneur's MFSA-regulated company Ariadne Capital Group and despite the mounting evidence against her as indicated by a number of official court documents involving a trail of unpaid employees and unpaid creditors.

Parliamentary Secretary within the Office of the Prime Minister Silvio Schembri has told this newspaper that he has never met Julie Meyer, and that he gives only political direction to the MFSA and FinanceMalta in terms of policy, and does not get involved in the day-to-day running operations.

He also pointed out that when the he "receives information of any wrongdoings the matter is forwarded to the respective competent authorities".

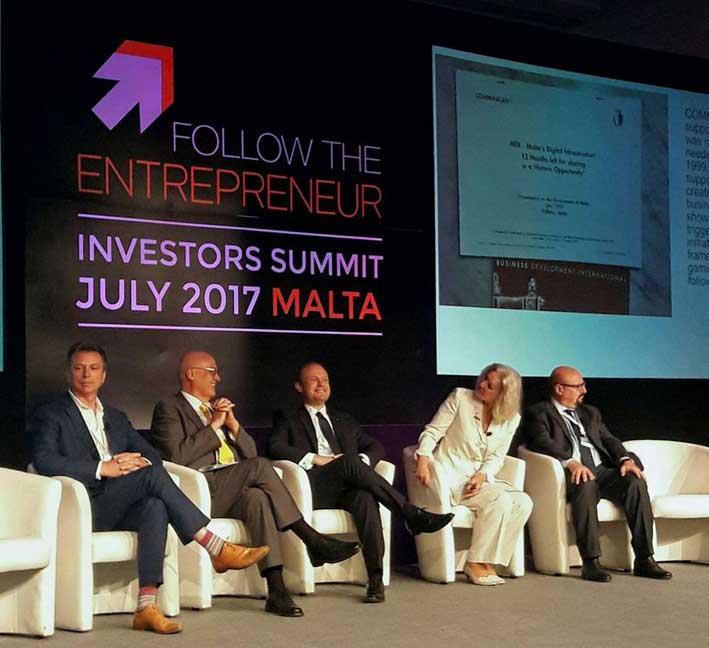

Meyer organises the Follow the Entrepreneur Investor Summit, where both Prime Minister Joseph Muscat and Economy Minister Chris Cardona have been speakers. The event had 50,000 people watching live, 15,000 website visitors and 470 registered investors.

Speaking to The Malta Independent on Sunday, one of Meyer's victims explained that that her offer of a challenging project yielding extremely high profits easily lures in individuals and that a combination of minor monthly repayments at the beginning of the working relationship and a confident demeanour allows trust to develop.

It was only once Meyer was being pursued regarding invoices would she suddenly turn aggressive and try to use legal measures to scare the individual from pursuing the matter further.

Since the earlier reports, Meyer has attacked both the media, and the two directors who resigned from her MFSA-regulated company within the Ariadne Capital Group amid serious concerns over the company's mismanagement following a recent spate of legal cases in Malta.

In the last couple of months, a court has issued a garnishee order against Ms Meyer following a claim for over €59,600 by a Naxxar firm that provides website design and development and a former employee's judicial letter to recover outstanding wages amounting to more than €22,000, a copy of which has been provided to the newsroom.

However, as has been shown across the globe, many of those who decide to take on Meyer and Ariadne Capital in a court of law come out victorious; the only question that remains is exactly how Meyer and her companies have been able to operate both in the UK and, more recently, in Malta despite a proven history of misconduct.

Mounting legal battles over unpaid work for Ariadne Capital

According to UK court documents, as recently as 7 March 2017 Ariadne Capital failed to appear in court and thus lost a case over unpaid wages amounting to £16,627 in respect of Charles Shodijo, the company's former Corporate Finance and Strategy Manager.

Shodijo appeared on the company's website until the publication of an article in last Thursday's The Malta Business Weekly detailing how two of the company's directors had resigned in the last few months.

Another lawsuit providing an example of Meyer's behaviour involved British PR company Lansons PR. American website Business Insider initially reported that Ariadne Capital had claimed damages of £100,000 from Lansons over a 'botched attempt to improve a Wikipedia entry in a campaign that did its reputation more harm than good'.

However, after counter-suing her for £70,000 owed in unpaid invoices, Meyer withdrew her legal action and paid an undisclosed amount to the London-based company.

Lansons CEO Tony Langham would tell trade magazine PR Week that Ariadne stopped paying its £6,000-a-month retainer when it believed that the agency 'was not doing any discernible work' and failed to generate sufficient press coverage.

Scathing anonymous reviews from employees who are believed to have sign non-disclosure agreements

It was also revealed to this newsroom that Ariadne Capital forced employees to sign non-disclosure agreements with the company, as evidenced by the scathing reviews on a website that publishes former employees' anonymous reviews of companies and their management.

"This company is a con, it makes no money, and has no cash, and anyone with basic financial training will know that if you have no cash, you're INSOLVENT. If you work there, YOU WILL NOT BE PAID. Once you leave, you will be owed pay (on average about 3-4 months, but I've known of up to 9 months) which you will have to pursue through legal action to retrieve," one reviewer wrote.

"Once when a supplier came to the office demanding payment, she snuck out down the fire escape so to not have to see this person - this is the action of a heroin or crack addict, and not a 'successful business person.

"Julie claims to have sold First Tuesday (I've been told she was not actually an equity owner); she claims to be a Doctor of Laws/a Lawyer (she is not); claims to have an MBE (as a foreigner she cannot use this designation); claims an MBA (there are a lot of stories around this), and to have invested/backed "seven game-changing companies" including Skype, Zopa, Lastminute.com and many others (all lies - a passing conversation isn't the same as having invested in the company for instance)," the person continued.

"They sell sweet stories to employees and clients and then don't deliver on what they promise, make you work really long hours, don't pay salaries on time (I had to wait max. 3 months) with no explanation, make you lie to clients and partners. I am highly convinced some of the things they do are illegal but it will surface sooner or later!"