Nothing has been decided in the Vitals Global Healthcare – Montenegro healthcare deal, VGH Director Ram Tumuluri and CEO Armin Ernst told The Malta Independent in a meeting.

Recent Maltese media reports read that Vitals Global Healthcare was to sign a 30-year contract in Montenegro for the running of state hospitals.

Mr Tumuluri said that VGH delivered a presentation there. “We have done our due diligence on Montenegro, and we felt the country requires investment in healthcare, which is no secret. We are targeting countries with a population of 5 million or less. We do not want to go to a continent too far from our existing operation, and when we looked at the Balkans, Montenegro seems like the right next step as it has a population of around 650,000. We can’t go from a country with half a million to one with 20 million”.

Main picture: Sri Ram Tumuluri. Picture above: Armin Ernst

“It is still just an evaluation of an opportunity. If you read newspapers in Montenegro, we delivered a presentation saying that given the opportunity, we would like to present this to the Montenegro government. They told us that if they choose to go forward they would need to go through the process and procedures. We said we would be very happy to participate, like we did here. It’s basically opportunity assessment and fact finding at the moment,” Mr Tumuluri added.

“We are keeping our eyes open for countries in our proximity. Our focus is central and eastern European markets,” he said. He added that VGH is not targeting African countries as today, it is not geared to deliver healthcare in Africa.

Konrad Mizzi

Asked about VGH representatives having met Minister Konrad Mizzi, prior to the Maltese call for proposals being issued back in March 2015, the VGH Director reiterated what he has previously said.

“We were approached as investors by Malta Enterprise. ME’s responsibility is to seek foreign direct investment. We met them in New York, where they were delivering a presentation. We were invited, and came here. We conducted our due diligence and delivered a presentation based on our fact findings, on what we would be interested with regards to healthcare in Malta”.

St Luke's and Karin Grech hospitals

He said the presentation was arranged by ME who also invited the Health Ministry. “I never met Minister Mizzi prior to that as we had no relationship. We met at the presentation. This was before the request for proposals, and they declined our proposal, saying this was not what they wanted, and that if they had something we would be welcome to participate. They declined our proposal as we proposed 600 beds in Gozo for a large medical tourism hub. We had no intentions as regards Karen Grech Hospital or St Luke’s Hospital or any of those pieces. Government said this was not feasible and declined”. He said that the presentation with the Ministry of Health was in January 2015.

“It’s the same as Montenegro, we submitted what we can do. They can accept or decline, or look into it”.

Further explaining CEO of the Oxley Group Mark Pawley’s involvement, Mr Tumuluri stressed that it is actually Mr Pawley who is the Ultimate Beneficial Owner of Vitals Global Healthcare.

Mr Pawley is also a shareholder of Oxley, they said, adding that other Oxley shareholders are not part of VGH.

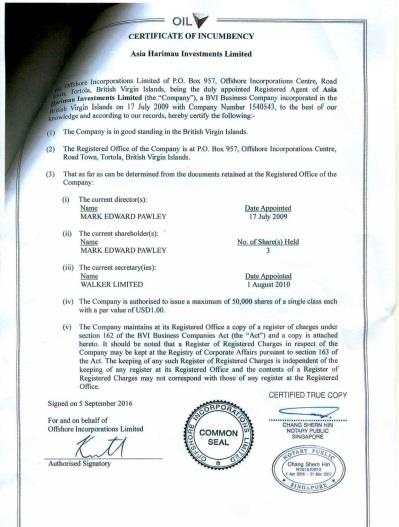

Presenting documents to this newsroom in the form of Certificates of Incumbency, Mr Tumuluri explained that Bluestone Investments Malta Ltd is 100% owned by Bluestone Special Situation 4 Ltd (a BVI company), which in turn is 100% owned by Asia Harimau Investments Ltd (another BVI company), which is 100% owned by Mark Edward Pawley. That is where it stops”.

Asia Harimau Investments Ltd has a single shareholder listed, Mark Edward Pawley, and Mr Tumuluri said that this is the top of the VGH chain. Mr Pawley is also the director of this company and has been since 17 July 2009.

He said that Mr Pawley has access to funds from Oxley as well as two other regulated entities, which are regulated companies - fund managers, “so Oxley is where the funds are coming from. Because it’s institutional funding, when the banks put into funds saying they would commit x amount, then Mark Pawley takes responsibility for that amount and he invests into companies he deems suitable in order to do the sustainable business. VGH is one business he feels is a great long-term investment to put in”.

“So far we invested €25 million all coming from Mark with Oxley Groups’ funds. There is no external investor so far. As we grow as a company in other countries there will be other investors asked to come in. It is our obligation to government to disclose who these will be”.