Throughout the past couple of years Malta has been experiencing a construction boom, having an effect on numerous sectors such as the environment, traffic and especially the affordability of rent. As more and more construction sites pop up around the island, one begins to ask whether the increasing number of construction sites mirrors the same demand in property.

ARQ Economic & Business Intelligence, an economic advisory firm part of local professional services company ARQ Group, have been working on Malta's first house rental index. Economist and Managing Director JP Fabri has recently presented some of the initial findings of the index which will be refined further in the coming weeks and months. The index is based on data collected from over 5,300 transactions of contracts over the years 2015 till the second quarter of 2018. Properties used for the study included apartments, penthouses, and maisonettes with one, two and three bedrooms. The amounts are actual contract value, as opposed to advertised as is in other property indices, with a rental period not exceeding 12 months. The Index is mainly focused on answering questions relating to the rental market in Malta; to determine which types of properties are seeing a fast increase in rent; the regions which were mostly effected and whether there is an issue of rent affordability.

Rent increase most pronounced in the North & Western regions

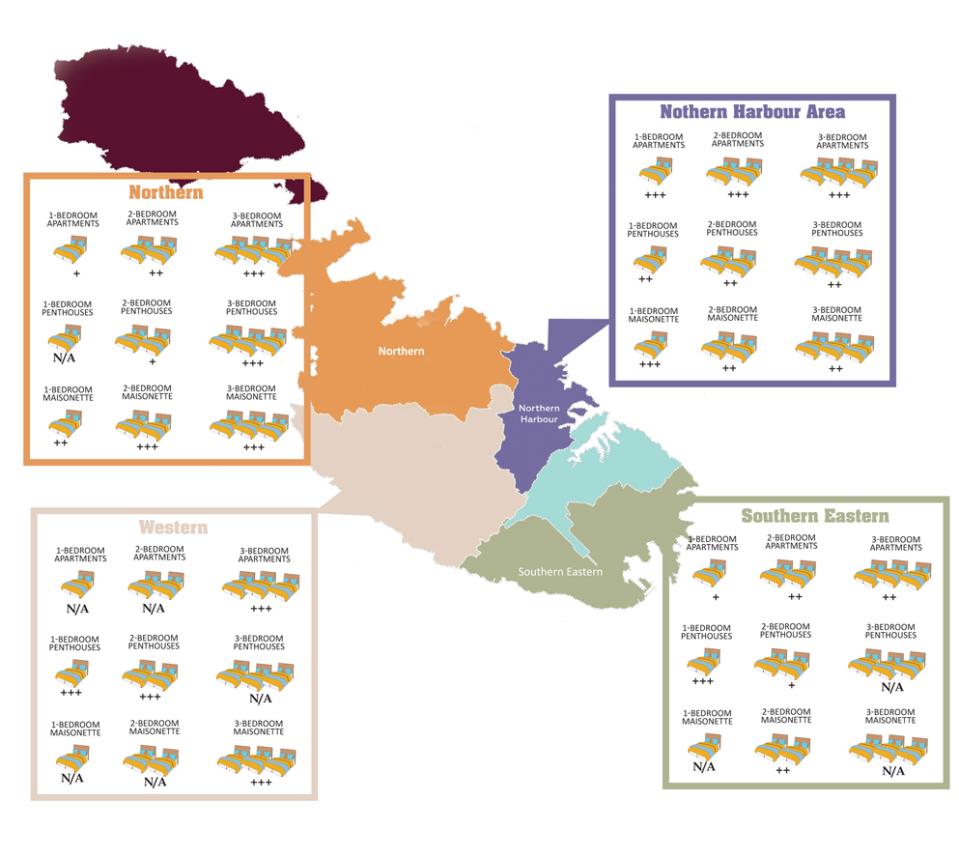

The properties were also analysed on a regional basis as defined by the National statistics Office. Regions analysed were the Southern Harbour, Northern Harbour, South Eastern, Western and Northern whilst Gozo was not included due to data constraints. Initial findings show that the regions that suffered the largest increase in prices are the Northern Harbour (Birkirkara, Gzira, Ħal Qormi; Ħamrun; Msida; Pembroke; San Ġwann; Santa Venera; St Julian's; Swieqi; Ta' Xbiex; Tal -Pietà; Tas - Sliema) and Northern region (Ħal Għargħur; Mellieħa; Mġarr; Mosta; Naxxar; St Paul's Bay). The Western region also displayed a fast increase in rent and includes locality such as Attard, Lija, Balzan and Gharghur.

|

|

North Harbour

|

Northern

|

Southern Eastern

|

Southern Harbour

|

Western

|

|

A1 B

|

+++

|

+

|

+

|

+

|

N/A

|

|

A2B

|

+++

|

++

|

++

|

+

|

N/A

|

|

A3B

|

+++

|

+++

|

++

|

++

|

+++

|

|

PH1B

|

++

|

N/A

|

+++

|

N/A

|

+++

|

|

PH2B

|

++

|

+

|

+

|

N/A

|

+++

|

|

PH3B

|

++

|

+++

|

N/A

|

N/A

|

N/A

|

|

M1B

|

+++

|

++

|

N/A

|

+++

|

N/A

|

|

M2B

|

++

|

+++

|

++

|

+++

|

N/A

|

|

M3B

|

++

|

+++

|

N/A

|

N/A

|

+++

|

The regional differences highlight the pull factors that some localities have in relation to whom is seeking rent. Foreign workers primarily look at the Northern Harbour and Northern regions due to them being commercial and entertainment hubs which also house a large percentage of offices too. On the other hand, the Western zone continues to be an attractive region for families looking for rental opportunities. There has been a rapid increase in prices from 2015, especially in regard to one and two bedroom apartments.

Rent affordability is becoming a challenge

The study also looked at the ratio of house rent to the median earnings, which sheds light on the affordability of rent. If the ratio increases, it means that rent payments are rising faster than wages and thus might pose a burden on wage earners. The findings show that the ratio is on an upward trend meaning that housing rental is becoming less affordable. Mr Fabri said that this can also be an effect of foreign workers who are not only increasing the demand for rents but are also contributing to keeping wages rom rising faster than they currently are.

Cyclical pattern in house prices

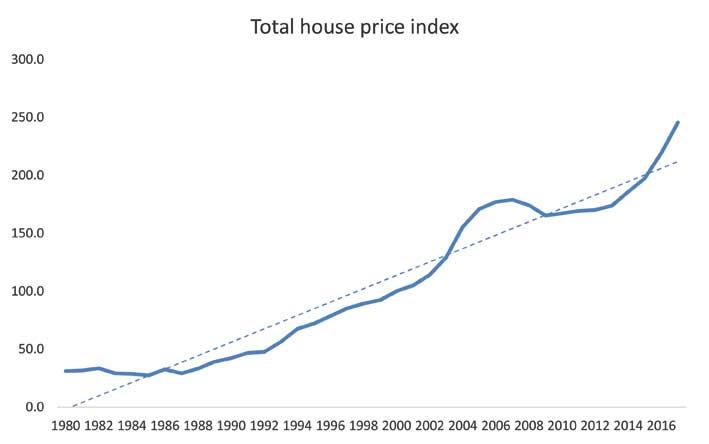

Rental is only one side of the property market and one of the key determinants of rental value is the land value. The property index compiled by the Central Bank of Malta is a good indicator for the movement in selling process of property, even though the Index is compiled on the basis of advertised prices. When looking at the trend from 1980 onwards, although there is a general upward trend in price levels, there are visible different periods of growth which also reflect the different economic realities.

Between 1980 and 1988 there was a general economic stagnation which reflected in the property market too. However, this was reversed in the 90s were the Maltese economy was liberalised and an economic boom took on, also reflecting into an increase in property prices. This continued well into the late nineties which was then followed by a very rapid rise in property prices in the run-up to the European Union. The prices rose at a very rapid rate on account of EU membership, tun-up to the euro and various amnesty schemes which encouraged the return of capital. This rise was reversed between 2007 and 2012 when the price-level corrected itself as the property market stagnated. This also happened against the backdrop of the global recession. However, this negative trend was once again reversed in 2012 were the property market took off again and there is a very sharp increase in advertised prices. This latest increase in the value of land has also been reflected in the rental market.

What's causing this?

The study lists a number of causes which have led to this increase in property prices and in rental prices. These will be tackled separately. However, looking ahead, it is hard to determine what is going to happen however the sustainability of such a fast-growing period is rightly questioned. A more focused analysis of the economic determinants will be presented in the coming weeks.