IFRS 9

The International Financial Reporting Standard (IFRS) 9 Financial Instruments brought about a new set of accounting rules for financial instruments replacing IAS 39 Financial Instruments: Recognition and Measurement. IFRS 9 was released in three phases:

Phase 1: Classification and Measurement;

Phase 2: Impairment; and

Phase 3: Hedge accounting.

IFRS 9 came into force for financial reporting periods beginning on or after 1 January 2018.

Locally, most banks have released the pre-transition disclosure in their annual financial statements, with the large banks also publishing their interim reports under IFRS 9. We have set out below interesting observations that emerged during our review of these disclosures.

Classification and Measurement

Phase 1: Classification and Measurement introduced new requirements on how the Banks should classify and measure financial assets. As expected, the changes in classification did not result in a significant financial impact on retained earnings and reserves on most local banks. Having said that, the impact highly depends on the business models applied by the Banks and the complexity of the Banks' products and services.

As stated in the pre-transition disclosures, banks do not envisage any changes in the measurement basis for loans and advances to banks and to customers that were classified as Loans and Receivables under IAS 39. The majority of these loans will continue to be measured at amortised cost (AC) in the Balance Sheet. Most financial assets that were classified as Available-for-sale (AFS) under IAS 39 are likely to continue being measured at FVOCI, although reclassifications have been made to AC for assets that form part of high quality liquid portfolios due to insignificant sales. We observed changes in measurement category for certain debt instruments that were voluntarily designated as at FVTPL prior to the adoption of IFRS 9. The change in measurement is a result of the outcome of the business model assessment.

In limited cases, financial assets previously classified as held-to-maturity were not considered to have SPPI cash flows and have accordingly been measured at FVTPL. From the reviews performed, leverage-type feature is the common trigger for SPPI failure. Overall, the implementation of the SPPI testing presented significant challenges for banks that hold contracts with non-standardised and complex terms where individual, rigorous assessment is required.

In terms of the business model assessment, a question often asked is: how should we interpret 'infrequent-significant or frequent-insignificant sales'? For sales out of a Hold-to-Collect (HTC) portfolio, IFRS 9 does not define the terms or lay down any thresholds. Therefore it is an area were judgement will be applied.

However, the industry seems to be pitching this threshold to between 5% - 10% of sales out of the HTC portfolio over the life of the portfolio for sales which are infrequent-significant or frequent-insignificant.

One other issue making the current debate is the accounting for equity instruments under the new FVOCI election. It's interesting to observe that banks still elected to measure equity instruments at FVOCI despite the prohibition on recycling gains and losses in profit or loss.

We believe that banks are now in a better position to understand that the classification and measurement requirements cannot be overlooked. Moreover, classification of financial assets is the first step to identify portfolios subject to the expected credit loss model.

Impairment

The impairment requirements under IFRS 9 have resulted in banks witnessing a paradigm shift from an incurred-loss model to a forward-looking expected credit loss (ECL) model. While it is still crucial to consider historical and current information, IFRS 9 requires bankers to incorporate forward-looking economic scenarios:

Past Events

One of the main elements used by banks in determining their ECL relates to past events, as historical losses incurred by customers may be reflective of the same customers' behaviours in the future. The more granularities the banks' information systems have in place, the more reliable the data is in determining the ECL, as it enables them to incorporate jurisdictional-specific, industry-specific, and customer-specific information in their models. For instance, in determining customer-specific future credit risk, such level of data granularity has enabled several banks to incorporate customers' historical patterns of days past due, defaults, losses and recoveries over a number of past years.

Current conditions

In the absence of available internal historical data, a number of banks have established an internal scale that would determine internal ratings to their counterparties based on past and current events. Such internal ratings are eventually mapped to external ratings provided by reputable international credit rating agencies, hence deriving a probability of default for each exposure.

In determining their ratings, banks shall look beyond historical events and consider any current events that might alter the expected credit risks associated to customers, and implement manual overlays so as to have the ECL reflect any current triggers.

"By way of example, a retail bank issues a home loan to a customer, who five years down the line loses his/her employment and finds it difficult to find an alternative job due to a mismatch in the labour market. Consequently, ECL associated to such customer are likely to increase. As soon as the customer relationship manager becomes aware of such situation, the credit risk team is to be informed so that on top of historical behavioural patterns, a manual adjustment will reflect the current situation."

Therefore, some banks have implemented credit-risk monitoring systems that allows the implementation of managerial overlays, so as to incorporate significant events into the model and have an ECL that realistically reflects the customers' current credit-risk.

Forward-looking economic conditions

The third element to be considered by banks relates to forward-looking economic variables that help preparers determine the impact of such variables on the customers' credit risk. In doing so, banks shall use reliable independent sources so as to obtain forecasts of relevant variables.

"For example, if the preparer is a retail bank providing home mortgages, the housing price index is an important element to consider. Likewise, if the bank issues a commercial loan to a customer who is coming from the construction industry, the housing price index is also crucial as this is likely to affect the customer's economic standing. In addition, preparers shall also calibrate their model by incorporating relevant forecasts of macroeconomic variables of the jurisdiction / region in which the customer is operating - such as GDP growth, inflation and unemployment."

It is empirical for banks to have a robust model in place that facilitates continuous re-calibration - hence enabling them to incorporate fresh data and implement the necessary alterations as deemed relevant.

Multiple scenarios

In reaching an ECL estimate, IFRS 9 also requires preparers to consider a number of scenarios in which, ECL will vary (for example baseline, upside and downside). Therefore, banks shall use multiple scenarios and apply a sensitivity analysis in order to derive a weighted-average ECL.

The following relates to the weights assigned to multiple forward-looking scenarios by seven different banks in Europe:

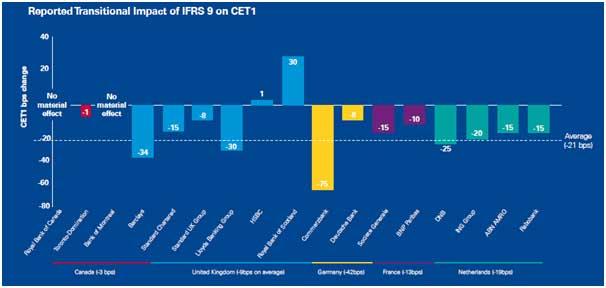

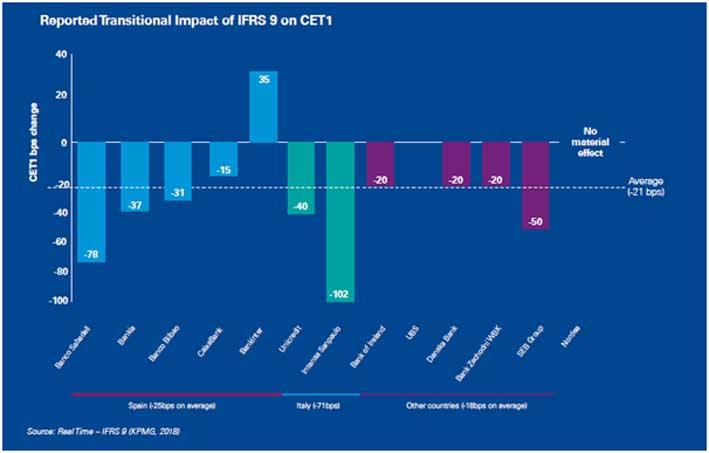

European banks that have disclosed their IFRS 9 transitional impact and that were included in the European Banking Authority (EBA) assessment will have an average negative impact of 21 basis points (bps). Therefore, IFRS 9 will also have an impact on CET1. The following illustrations represent the reported transitional impact of IFRS 9 on CET1:

Most of the banks have just finalised the implementation of the standard. However, the truth is that the IFRS 9 journey is not over yet. We expect the standard to evolve as auditors, banks and regulators gain more experience. An illustration to this is the concerns raised on the treatment of investments in equity instruments which are carried at FVOCI. The European Commission is seeking advice on the possibility of introducing recycling and as a consequence developing a new impairment model for equity instruments.

Discussions are still underway.

The new IFRS 9 requirements and the new ECL model explained above have led to a change in the provision for doubtful debts in the financial reports of several banks, as well as CET1. Going forward, banks are required to incorporate an ongoing maintenance structure in their ECL models. As the macroeconomic context changes, banks need to re-calibrate the model and incorporate fresh data.